Automotive Transparent Antenna Market By Type (Transparent Conductive Oxides, Nanowire, Conductive Polymer, Nano Carbon), By Application (Commercial Vehicles, Passenger Vehicles), By Component (Amplifiers, Control Module, Power Supply, Transceivers, Electronic Control Unit (ECU), Others), By Location in Vehicle (Front windshield, Backlite, Sidelite, Sunroof, Roof module), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49935

-

Aug 2024

-

136

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

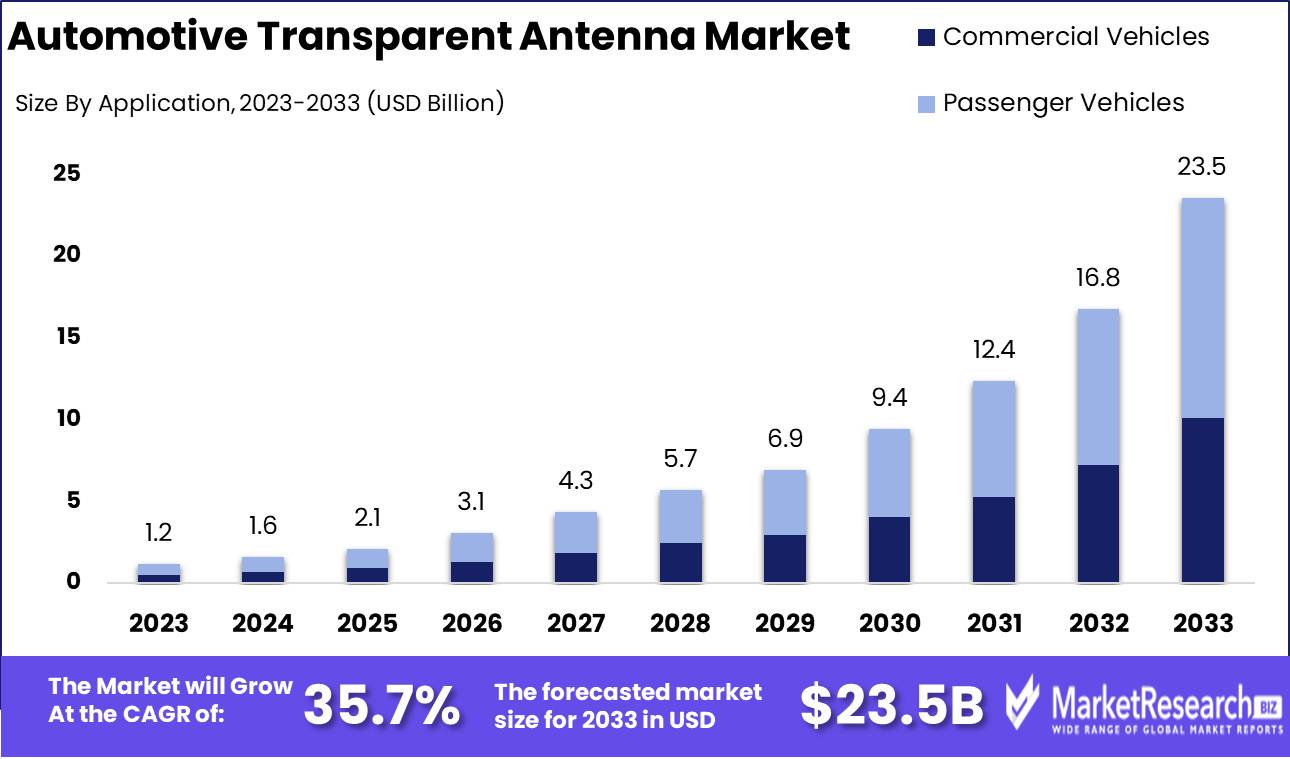

The Global Automotive Transparent Antenna Market was valued at USD 1.2 Bn in 2023. It is expected to reach USD 23.5 Bn by 2033, with a CAGR of 35.7% during the forecast period from 2024 to 2033.

The Automotive Transparent Antenna Market involves the development, production, and integration of optically transparent antennas into vehicles. These antennas, made from advanced materials like NANOWEB®, enable multi-band operation while maintaining high transmission rates and low visual obstructions. They cater to the growing demand for seamless connectivity and multifunctional vehicular technologies, enhancing both aesthetic and functional aspects of automotive design.

The Automotive Transparent Antenna Market is set for significant growth, driven by technological advancements and the increasing demand for seamless, multi-functional vehicular connectivity. Optically transparent antennas (OTAs) represent a breakthrough in automotive design, providing multi-band operation across frequencies like 1.8 GHz, 2.4 GHz, and 3.39–12 GHz. This capability meets the evolving needs of modern vehicles, which require robust communication systems to support navigation, infotainment, and other connected services.

The Automotive Transparent Antenna Market is set for significant growth, driven by technological advancements and the increasing demand for seamless, multi-functional vehicular connectivity. Optically transparent antennas (OTAs) represent a breakthrough in automotive design, providing multi-band operation across frequencies like 1.8 GHz, 2.4 GHz, and 3.39–12 GHz. This capability meets the evolving needs of modern vehicles, which require robust communication systems to support navigation, infotainment, and other connected services.Recent innovations in materials, particularly the development of NANOWEB®, have enhanced the performance of transparent antennas. These materials achieve over 99% transmission rates and exhibit low haze levels, significantly outperforming traditional Indium Tin Oxide (ITO). The superior optical and electrical properties of these advanced materials make them ideal for integration into automotive windshields and windows, where maintaining clarity and minimizing visual disruption are crucial.

The market's growth is further propelled by the automotive industry's shift towards advanced driver-assistance systems (ADAS) and autonomous driving technologies. Transparent antennas play a vital role in ensuring uninterrupted connectivity and communication, which are essential for the functionality and safety of these systems. As vehicles become more technologically advanced, the integration of high-performance transparent antennas is becoming a standard requirement.

The aesthetic benefits of transparent antennas align with the design preferences of modern vehicles, where sleek and unobtrusive elements are highly valued. By providing enhanced functionality without compromising design, transparent antennas offer a competitive edge to automakers looking to differentiate their products.

Key Takeaways

- Market Value: The Global Automotive Transparent Antenna Market was valued at USD 1.2 Bn in 2023. It is expected to reach USD 23.5 Bn by 2033, with a CAGR of 35.7% during the forecast period from 2024 to 2033.

- By Type: Transparent Conductive Oxides hold 40% of the market, essential for creating transparent antennas.

- By Application: Passenger Vehicles dominate with 70%, highlighting the integration of advanced technologies in consumer vehicles.

- By Component: Electronic Control Unit (ECU) constitutes 30%, crucial for managing antenna operations and connectivity.

- By Location in Vehicle: Backlite placement makes up 35%, preferred for its unobtrusive integration into vehicle design.

- Regional Dominance: North America holds a 33% market share, driven by advanced automotive technology adoption.

- Growth Opportunity: Developing multi-functional transparent antennas that support advanced connectivity features can drive innovation and market growth.

Driving factors

Increasing Demand for Advanced Automotive Technologies

The automotive industry is undergoing a significant transformation with the adoption of advanced technologies. Transparent antennas, which can be integrated into windshields and other glass surfaces, are gaining traction as they offer seamless connectivity without compromising the vehicle's aesthetics.

The increasing demand for advanced automotive technologies, such as infotainment systems, vehicle-to-everything (V2X) communication, and advanced driver-assistance systems (ADAS), is propelling the growth of the automotive transparent antenna market. These antennas support high-frequency signals and provide better reception, enhancing the overall driving experience and safety.

Growth in Connected and Autonomous Vehicles

The rise of connected and autonomous vehicles (CAVs) is a major driving force behind the automotive transparent antenna market. CAVs rely heavily on uninterrupted and reliable communication systems for navigation, safety, and infotainment. Transparent antennas are essential in providing the necessary connectivity for these vehicles, as they can be embedded within the vehicle’s structure, maintaining the sleek design while offering robust signal strength.

As the adoption of connected and autonomous vehicles continues to grow, the demand for transparent antennas is expected to surge, further boosting market expansion.

Rising Focus on Vehicle Aesthetics and Design

Modern consumers and automakers place a high emphasis on vehicle aesthetics and design. Transparent antennas offer a significant advantage in this regard, as they can be seamlessly integrated into the vehicle's glass surfaces, eliminating the need for protruding external antennas that can detract from the vehicle's appearance.

This integration not only enhances the aesthetic appeal of vehicles but also improves aerodynamic performance. The rising focus on vehicle aesthetics and design is driving automakers to adopt transparent antennas, contributing to the overall growth of the market.

Restraining Factors

High Development and Implementation Costs

One of the primary restraining factors for the automotive transparent antenna market is the high development and implementation costs. Developing transparent antennas that can be seamlessly integrated into automotive glass surfaces requires significant investment in research and development. Advanced materials and manufacturing processes are needed to ensure these antennas meet performance standards while maintaining transparency and durability.

Implementing these antennas in vehicles involves complex integration processes that add to the overall cost. These high costs can deter automakers, especially in the mid-range and economy segments, from adopting transparent antennas, thereby limiting market growth.

Technical Challenges in Integration

The integration of transparent antennas into vehicles presents several technical challenges. Ensuring that these antennas provide reliable signal reception without interference while being embedded in glass surfaces is a complex task. Factors such as the curvature of the glass, varying thicknesses, and the presence of other electronic components can affect the performance of transparent antennas.

Maintaining the aesthetic quality and structural integrity of the glass while incorporating antennas requires sophisticated engineering solutions. These technical challenges can slow down the adoption rate of transparent antennas, as automakers may be cautious in deploying a technology that poses potential integration issues and performance uncertainties.

By Type Analysis

Transparent Conductive Oxides held a dominant market position in the By Type segment of the Automotive Transparent Antenna Market, capturing 40% share.

In 2023, Transparent Conductive Oxides held a dominant market position in the By Type segment of the Automotive Transparent Antenna Market, capturing 40% share. This dominance is attributed to the superior electrical conductivity and optical transparency of transparent conductive oxides, making them ideal for automotive applications. Materials such as indium tin oxide (ITO) are widely used in automotive transparent antennas for their efficiency in transmitting signals without compromising visibility.

Nanowire materials also play a significant role in the market, offering flexibility and high conductivity. However, their market share is smaller compared to transparent conductive oxides due to higher production costs and ongoing development challenges.

Conductive circular Polymers and Nano Carbon materials are emerging as alternative solutions, providing benefits like flexibility and lightweight properties. Despite their potential, these materials currently hold a smaller market share due to limited commercial availability and higher production costs.

By Application Analysis

Passenger Vehicles held a dominant market position in the By Application segment of the Automotive Transparent Antenna Market, capturing 70% share.

In 2023, Passenger Vehicles held a dominant market position in the By Application segment of the Automotive Transparent Antenna Market, capturing 70% share. The high market share is driven by the increasing adoption of advanced communication and entertainment systems in passenger cars. Transparent antennas are preferred in passenger vehicles due to their aesthetic appeal and ability to integrate seamlessly into vehicle glass without obstructing the driver's view.

Commercial Vehicles also utilize transparent antennas for communication and fleet management purposes. However, their market share is smaller compared to passenger vehicles due to the slower adoption rate of advanced in-vehicle technologies in the commercial vehicle segment.

By Component Analysis

Electronic Control Unit (ECU) held a dominant market position in the By Component segment of the Automotive Transparent Antenna Market, capturing 30% share.

In 2023, Electronic Control Unit (ECU) held a dominant market position in the By Component segment of the Automotive Transparent Antenna Market, capturing 30% share. ECUs are critical for managing the various functions of transparent antennas, including signal processing, connectivity, and integration with other vehicle systems.

Amplifiers, Control Modules, Power Supplies, and optical Transceivers are also essential components in the market. Each plays a vital role in enhancing the performance and functionality of transparent antennas.

Others include various supplementary components that support the overall operation of transparent antenna systems but hold a smaller market share due to their specialized and auxiliary roles.

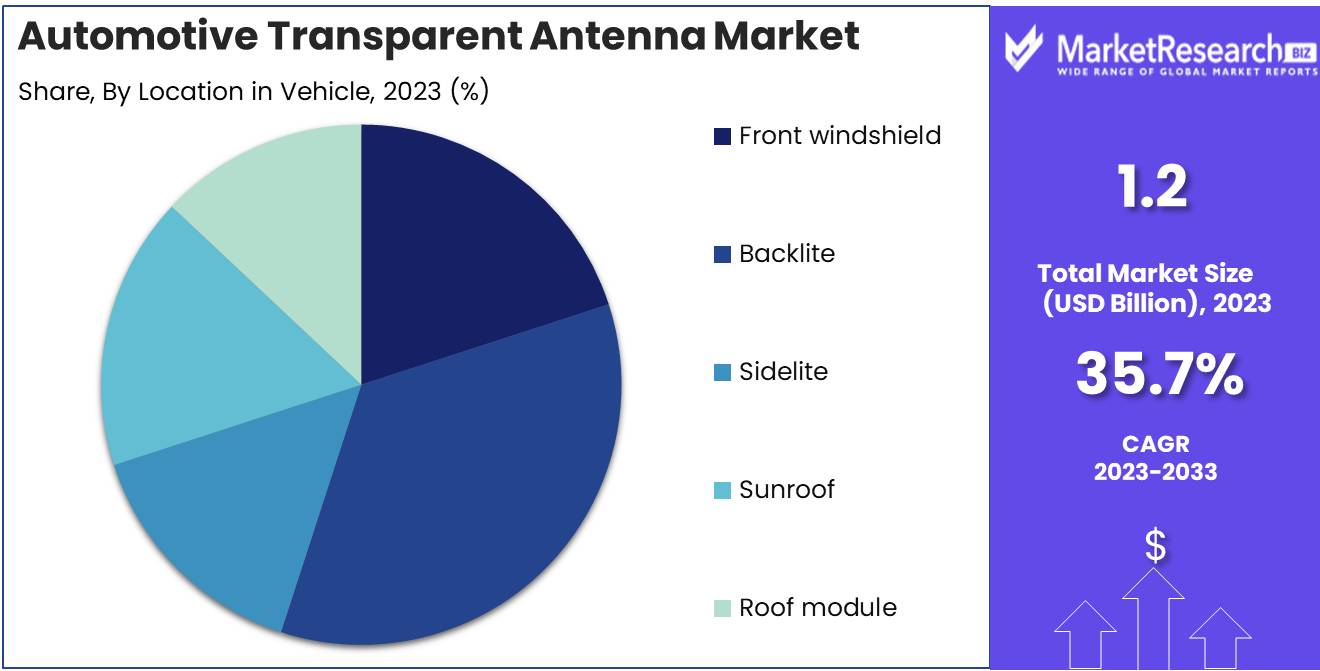

By Location in Vehicle Analysis

Backlite held a dominant market position in the By Location in Vehicle segment of the Automotive Transparent Antenna Market, capturing 35% share.

In 2023, Backlite held a dominant market position in the By Location in Vehicle segment of the Automotive Transparent Antenna Market, capturing 35% share. The backlite, or rear windshield, is a preferred location for transparent antennas due to its large surface area and minimal interference with driver visibility.

Front Windshield, Sidelite, Sunroof, and Roof Module are other common locations for transparent antennas in vehicles. The front windshield is often used for specific applications like toll collection systems and heads-up displays. The market share for these locations is smaller compared to the backlite due to design constraints and potential visibility issues.

The Roof Module and Sunroof locations provide additional options for integrating transparent antennas, especially in vehicles with panoramic sunroofs or advanced roof systems. These locations, while growing in popularity, currently hold a smaller market share due to limited adoption and specific vehicle design requirements.

Key Market Segments

By Type

- Transparent Conductive Oxides

- Nanowire

- Conductive Polymer

- Nano Carbon

By Application

- Commercial Vehicles

- Passenger Vehicles

By Component

- Amplifiers

- Control Module

- Power Supply

- Transceivers

- Electronic Control Unit (ECU)

- Others

By Location in Vehicle

- Front windshield

- Backlite

- Sidelite

- Sunroof

- Roof module

Growth Opportunity

Development of Multifunctional Transparent Antennas

The automotive transparent antenna market is poised for substantial growth in 2024, driven by the development of multifunctional transparent antennas. These advanced antennas not only provide superior connectivity for communication systems but also support additional functionalities such as GPS, satellite radio, broadcast equipment and even vehicle-to-everything (V2X) communication.

This multifunctionality enhances the value proposition of transparent antennas, making them a more attractive option for automakers looking to integrate multiple technologies into a single, sleek solution. The ability to support various communication needs without compromising on design aesthetics positions transparent antennas as a pivotal technology in modern vehicles.

Expansion in Electric and Autonomous Vehicle Segments

The rapid expansion in the electric and autonomous vehicle (EV and AV) segments presents a significant opportunity for the automotive transparent antenna market. Electric vehicles, with their emphasis on advanced technology and streamlined designs, benefit greatly from the integration of transparent antennas. These antennas help maintain the aerodynamic efficiency of EVs while providing the necessary connectivity for navigation, infotainment, and vehicle-to-grid (V2G) communication.

Autonomous vehicles, which rely heavily on robust communication systems for safe operation, also stand to gain from the adoption of transparent antennas. As the EV and AV markets continue to grow, the demand for innovative antenna solutions like transparent antennas is expected to rise, driving market growth.

Latest Trends

Use of Advanced Materials for Better Performance

In 2024, the automotive transparent antenna market is expected to witness significant advancements driven by the use of advanced materials. These materials, such as conductive polymers and nanomaterials, enhance the performance and durability of transparent antennas. They offer superior conductivity, flexibility, and transparency, which are essential for seamless integration into automotive glass surfaces.

The adoption of these materials will lead to antennas that are not only more efficient but also more resilient to environmental factors such as temperature fluctuations and mechanical stress. This trend is anticipated to drive innovation and increase the market penetration of transparent antennas in the automotive sector.

Integration with Vehicle Communication Systems

Another key trend shaping the automotive transparent antenna market in 2024 is the growing integration with vehicle communication systems. As vehicles become increasingly connected, the need for reliable and integrated communication solutions becomes paramount. Transparent antennas are uniquely positioned to meet this need, offering a sleek and unobtrusive way to support various communication protocols such as vehicle-to-everything (V2X), GPS, and cellular connectivity.

This integration enhances the overall functionality of vehicles, enabling real-time data exchange, improved navigation, and better safety features. Automakers are expected to increasingly incorporate transparent antennas into their designs to support these advanced communication systems, driving market growth.

Regional Analysis

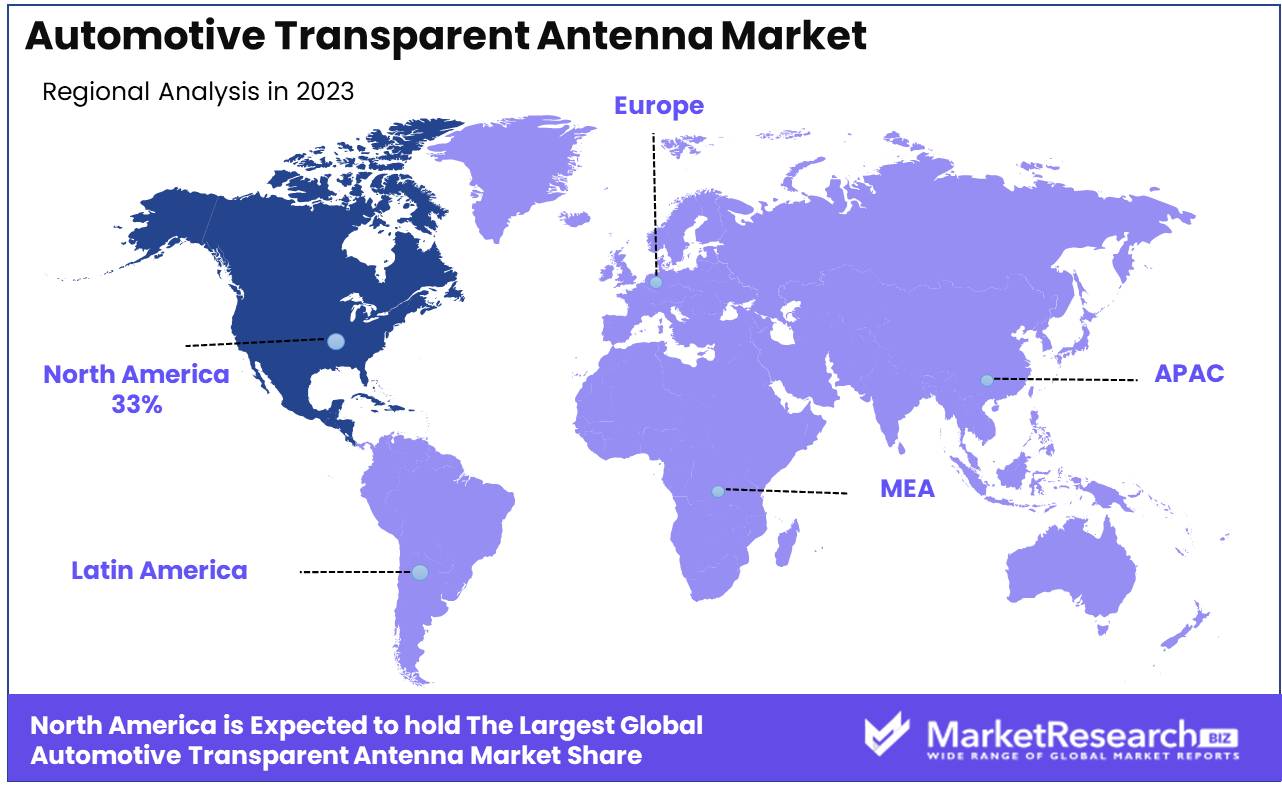

North America held a dominant market position in the Automotive Transparent Antenna Market, capturing more than a 33% share.

The North America region dominated the Automotive Transparent Antenna Market in 2023, capturing more than a 33% share. This dominance is driven by the high demand for advanced automotive technologies, the presence of major automotive manufacturers, and significant investments in research and development. The U.S., in particular, is a major contributor, with numerous innovations in automotive antenna technologies and a strong focus on improving vehicle connectivity and performance.

Europe is also a significant market, with a strong automotive industry and high demand for advanced vehicle technologies. Countries like Germany, the UK, and France are key players, with significant investments in automotive R&D and a focus on integrating transparent antennas into modern vehicles.

The Asia Pacific region is experiencing rapid growth in the automotive transparent antenna market, driven by the expanding automotive sector and increasing consumer demand for advanced in-vehicle technologies.

In the Middle East & Africa, the automotive transparent antenna market is emerging, with growing interest in advanced automotive technologies. The market growth is supported by increasing disposable incomes, rising urbanization, and government initiatives to modernize the automotive sector.

Latin America is experiencing steady growth in the automotive transparent antenna market, driven by rising automotive production and the increasing adoption of advanced vehicle technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

TE Connectivity is a leader in the automotive transparent antenna market, offering innovative and reliable solutions. Its focus on quality and advanced technology positions it as a key market player.

Amphenol’s extensive product range and emphasis on innovation enhance its market presence. Its commitment to quality and reliability makes it a significant player in the automotive transparent antenna market.

HELLA’s advanced antenna solutions cater to the evolving needs of the automotive industry. Its focus on innovation and technology ensures its strong market position.

Laird’s expertise in automotive antenna systems drives its market growth. Its innovative and reliable solutions make it a key player in the automotive transparent antenna market.

Kathrein’s advanced antenna technology enhances vehicle connectivity and performance. Its focus on innovation and quality positions it as a leading market player.

Companies like HARADA INDUSTRY CO., LTD, Schaffner Holding Ltd., Schwarzbeck Mess-E

Market Key Players

- TE Connectivity Ltd.

- Amphenol Corporation

- HELLA

- Laird PLC

- Kathrein

- HARADA INDUSTRY CO., LTD

- Schaffner Holding Ltd.

- Schwarzbeck Mess-Elektronik OHG

- Metamaterial Technologies Inc.

- Nearson Inc.

- Venti Group

Recent Development

- In June 2024, HARADA INDUSTRY CO., LTD secured $40 million in funding to develop next-generation transparent antennas for autonomous vehicles. This investment aims to enhance vehicle connectivity and performance.

- In April 2024, Amphenol Corporation acquired a leading transparent antenna manufacturer to expand its product portfolio. This acquisition is expected to increase their market share by 15%.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Bn Forecast Revenue (2033) USD 23.5 Bn CAGR (2024-2033) 35.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Transparent Conductive Oxides, Nanowire, Conductive Polymer, Nano Carbon), By Application (Commercial Vehicles, Passenger Vehicles), By Component (Amplifiers, Control Module, Power Supply, Transceivers, Electronic Control Unit (ECU), Others), By Location in Vehicle (Front windshield, Backlite, Sidelite, Sunroof, Roof module) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape TE Connectivity Ltd., Amphenol Corporation, HELLA, Laird PLC, Kathrein, HARADA INDUSTRY CO., LTD, Schaffner Holding Ltd., Schwarzbeck Mess-Elektronik OHG, Metamaterial Technologies Inc., Nearson Inc., Venti Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- TE Connectivity Ltd.

- Amphenol Corporation

- HELLA

- Laird PLC

- Kathrein

- HARADA INDUSTRY CO., LTD

- Schaffner Holding Ltd.

- Schwarzbeck Mess-Elektronik OHG

- Metamaterial Technologies Inc.

- Nearson Inc.

- Venti Group