Global Automotive Exhaust Systems Market By Components (Catalytic Converters, Exhaust Manifold, and others), By Fuel Type (Diesel, Gasoline), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

14488

-

Aug 2023

-

152

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

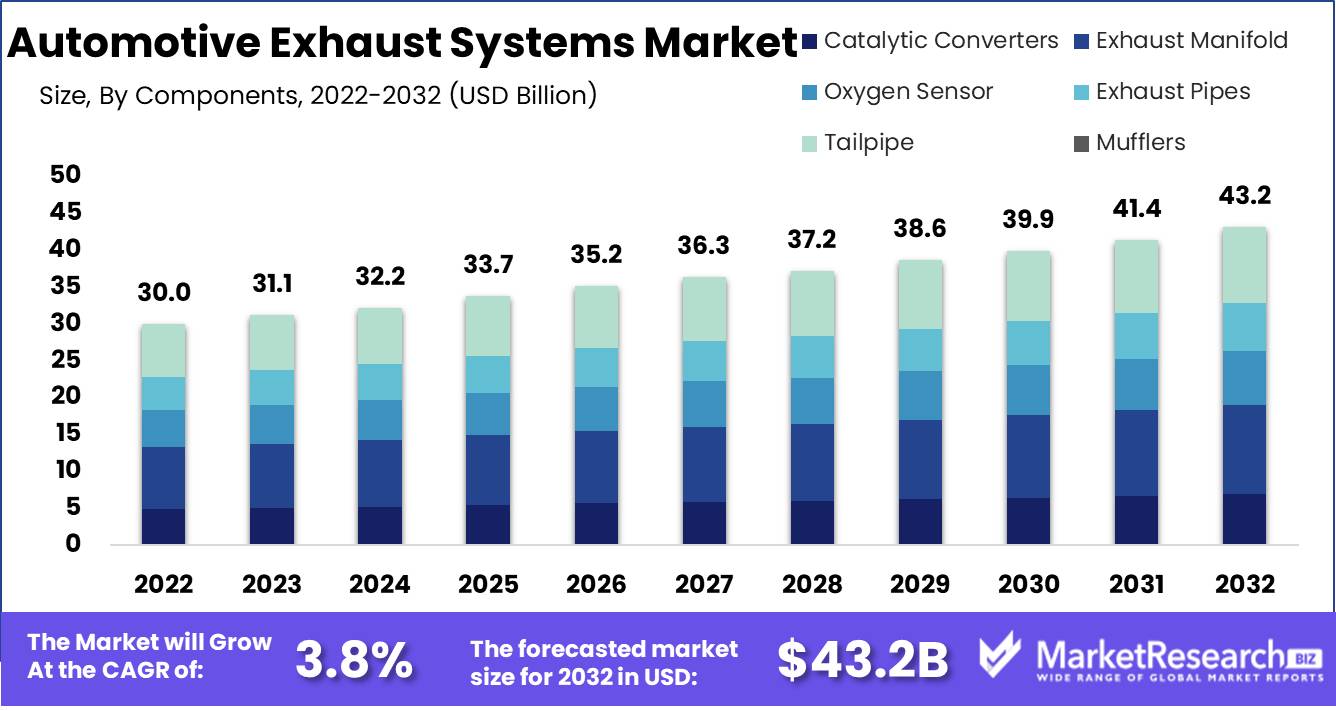

Automotive Exhaust Systems market size is expected to be worth around USD 43.2 Bn by 2032 from USD 30.0 Bn in 2022, growing at a CAGR of 3.8% during the forecast period from 2023 to 2032.

The automotive exhaust systems market resides within the expansive domain of the automotive industry, a vast and intricate network that incorporates the intricate processes of manufacturing, distribution, and sales of a multitude of automotive devices and parts. This market plays a crucial role in determining the performance of a given automobile, ensuring that the resulting emissions are pure and highly efficient by specializing in the specialized discipline of designing and fabricating exhaust systems for vehicles.

The automotive exhaust systems has experienced an escalating rise in its prominence as a result of growing concerns about the pressing need for vehicles that prioritize sanitation and environmental harmony. Its primary objective is to manufacture exhaust systems that scrupulously adhere to the stringent regulations and mandates imposed by federal and state agencies, while also actively attempting to mitigate the pollution caused by automobile emissions. By virtue of having a dependable exhaust system, not only does the output of harmful emissions decrease considerably, but it also increases fuel efficiency, resulting in substantial economic benefits for the owners of these vehicles.

The automotive exhaust systems market offers a wide range of benefits to the automotive industry as a whole, including improved fuel efficiency, reduced emissions, enhanced engine performance, and reduced noise levels. Its unwavering significance lies in its ability to ensure that vehicular entities adhere to stringent environmental regulations while also providing customers with a solution that meets their specific needs and requirements. This industry's manufacturers engage in a perpetual cycle of innovation, constantly attempting to create more effective and environmentally friendly products.

The automotive exhaust systems market is firmly ensconced in a rising demand trend for eco-friendly systems. This market continually expands its borders, thereby assuring a prosperous and limitless future. As an essential component of every vehicle, exhaust systems play a crucial role, making the sustained expansion of this market a prerequisite for the continued success of the broader automotive industry.

Driving factors

Regulations and requirements for emissions that are extremely stringent

It is anticipated that numerous factors that are driving the automotive exhaust systems market will lead to growth in the market in the future years. One of these factors is the strictness of the emission rules and standards that have been enacted by governments all over the world. The growing number of people who are concerned about the environment has led to an increase in the number of governments that are enforcing stringent emission standards for automobiles. This has led to an increase in the demand for exhaust systems that are as effective as possible. The automotive exhaust systems market has benefited from this development.

Increasing numbers of people looking for cars with better gas mileage

The rising need for more fuel-efficient vehicles is another significant aspect that is pushing the market. As a result of the continued increase in the cost of fuel, people are becoming more aware of the importance of fuel economy, and automakers are actively attempting to design vehicles that consume less fuel. As a result, there is a growing need for exhaust systems that are both effective and contribute to the reduction of pollutants; this trend is driving the expansion of the automotive exhaust systems market.

Increases in both production and sales of vehicles across the world

The rise in worldwide vehicle production and sales is another factor that is fueling the expansion of the automotive exhaust systems market. The greater the number of cars and trucks on the road, the greater the need for more effective exhaust systems to be installed in such vehicles. For instance, China, which is currently the largest automotive market in the world, is currently experiencing a spike in vehicle manufacturing, which is fueling the expansion of the automotive exhaust systems market.

Restraining Factors

Price fluctuations for raw materials

Steel, aluminum, and precious metals like platinum, palladium, and rhodium, which are used in the production of automotive exhaust systems, are frequently subject to price fluctuations on the market. As the prices of these basic materials increase, the cost of manufacturing the exhaust system's components rises, making the systems more expensive for purchasers. Moreover, these fluctuations make it difficult for producers to plan their budgets and pricing strategies. The stability of basic material prices is required for the long-term expansion and viability of the market for automotive exhaust systems.

High upfront and installation expenses

Exhaust system installation is a crucial function in automobile manufacturing, and it is frequently a labor-intensive process. Installation requires trained personnel and specialized apparatus, which can increase the product's initial cost. Customers are willing to pay if a product provides value, but high installation costs can deter purchasers searching for more affordable options. In addition, manufacturers must ensure there is sufficient trained personnel available to perform installations efficiently.

Increasing Interest in Electric Vehicles

The world is transitioning to a green economy, and the automotive industry is no exception. The transition to electric vehicles has already begun, with global sales of electric vehicles reaching a record-breaking 3.2 million units in 2020, and this figure is expected to increase. With the introduction of electric vehicles, demand for conventional internal combustion engine-powered vehicles is anticipated to decrease. This transition in demand will inevitably affect the market for automotive exhaust systems, and manufacturers will need to adapt.

Component Analysis

The automotive exhaust systems market is one of the world's most rapidly expanding markets. This market is dominated by the exhaust manifold segment, which has experienced consistent expansion over the years. The exhaust manifold is an essential part of the exhaust system, as it is responsible for directing the engine's exhaust gases to the exhaust pipe. This segment represents the majority of the automotive exhaust systems market.

The economic growth of emergent economies has been a significant factor in the expansion of the automotive exhaust systems market. Rapid industrialization and urbanization in these economies have increased the demand for vehicles, which has led to a surge in demand for exhaust systems for automobiles. Increasing discretionary incomes of consumers in emerging nations have also significantly contributed to the expansion of this market segment.

Consumer trends and behaviors have a significant impact on the automotive exhaust systems market. With an increased emphasis on sustainability and energy efficiency, consumers are seeking more environmentally responsible vehicle options. This has increased the demand for environmentally beneficial, energy-efficient, and pollution-reducing exhaust systems. Additionally, consumers are willing to pay a premium for products of superior quality, durability, and performance.

Fuel Type Analysis

The gasoline segment dominates the automotive exhaust systems market, accounting for the largest market share. Gasoline engines are extensively used in passenger vehicles and offer significant advantages over diesel engines, including lower ownership costs, greater fuel efficiency, and superior acceleration.

The economic growth of emerging economies has been instrumental in the automotive industry's adaptation of gasoline engines. The rising urbanization, industrialization, and disposable incomes of consumers in these economies have led to an increase in the demand for private vehicles, which has led to an increase in the demand for gasoline motors.

The growth of the petroleum segment of the automotive exhaust systems market has been largely shaped by consumer trends and behaviors. With an increased emphasis on sustainability and eco-friendly solutions, consumers are seeking fuel-efficient and low-emission vehicles. The fuel efficiency and environmental friendliness of gasoline engines make them a popular choice among consumers.

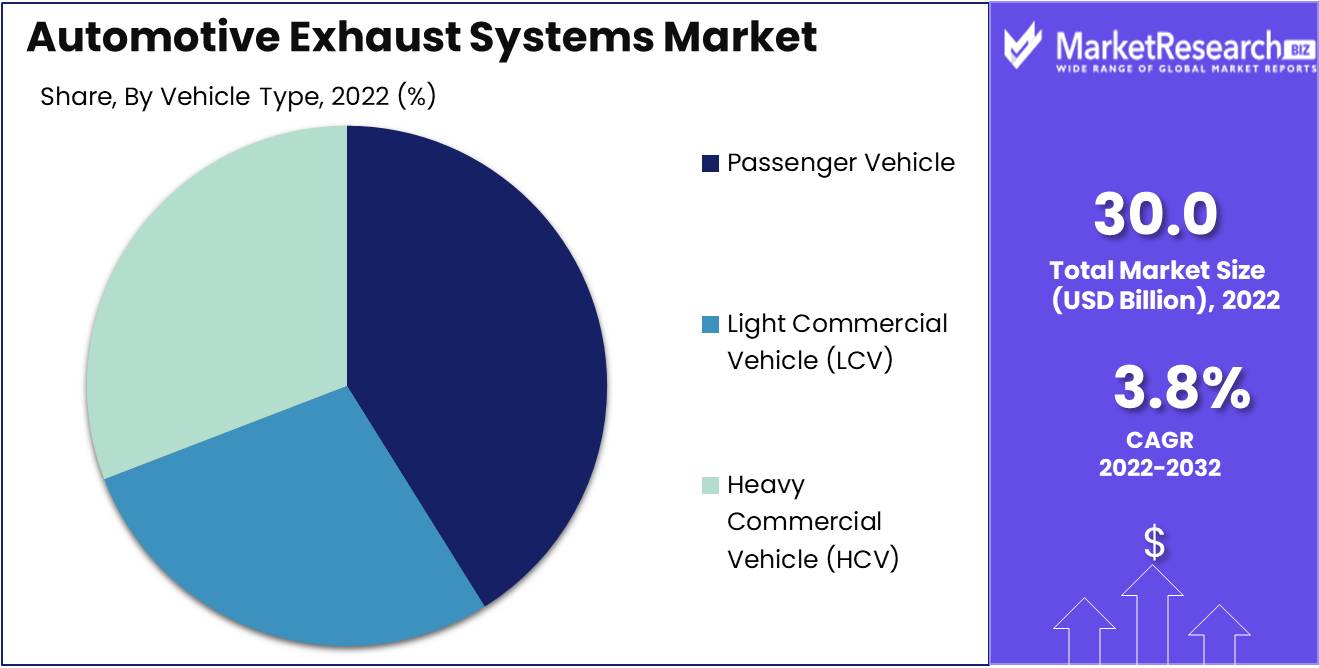

Vehicle Type Analysis

The passenger cars segment dominates the automotive exhaust systems market, accounting for the majority of market share. Passenger automobiles have a number of advantages over other types of vehicles, including convenience, affordability, and comfort, making them popular among consumers.

The economic growth of emergent economies has been instrumental in the automotive industry's adoption of passenger vehicles. The rising disposable incomes of consumers in emergent economies have increased the demand for affordable and comfortable transportation options, resulting in a surge in demand for passenger cars.

The growth of the passenger cars segment of the automotive exhaust systems market is significantly influenced by consumer trends and behaviors. With an increased emphasis on convenience, safety, and eco-friendliness, consumers seek vehicles with high performance, comfort, and low emissions. Passenger vehicles offer these benefits, which contribute to their popularity among consumers.

Key Market Segments

By Components

- Catalytic Converters

- Exhaust Manifold

- Oxygen Sensor

- Exhaust Pipes

- Tailpipe

- Mufflers

By Fuel Type

- Diesel

- Gasoline

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By After-Treatment Devices

- Diesel Oxidation Catalyst

- Diesel Particulate Filter

- Selective Catalytic Reduction

- Gasoline Particulate Filter

Growth Opportunity

Demand for electric and hybrid vehicles is growing.

Several countries have introduced incentives to encourage the purchase of electric and hybrid vehicles, which are gaining popularity among consumers worldwide. The use of electric and hybrid vehicles reduces hazardous emissions significantly, resulting in smaller carbon footprints and cleaner air. Consequently, the demand for exhaust systems for these vehicles is rising rapidly. Manufacturers must develop and produce exhaust systems that are innovative and appropriate for these types of vehicles. This represents a significant growth opportunity in the market for automotive exhaust systems.

Increasing Demand for Lightweight, High-Performance Exhaust Systems

There is a growing preference for lightweight and high-performance exhaust systems as fuel economy and emission reduction become increasingly important. Advanced materials such as titanium, stainless steel, and aluminum can be used to create exhaust systems that can withstand high temperatures while remaining lightweight. These materials are more lightweight, durable, and resistant to corrosion than conventional materials. Consequently, a number of manufacturers are introducing new lightweight exhaust systems to the market, driving their demand.

Increasing Tendency to Downsize Engines

Manufacturers are increasingly adopting the trend of engine downsizing in an effort to reduce carbon emissions without sacrificing engine capacity. Downsizing an engine, in which a smaller engine replaces a larger one, necessitates innovative exhaust systems that are capable of discharging harmful exhaust gases while maintaining performance. This is due to the fact that smaller engines produce more exhaust emissions than larger engines. As the market for downsized engines expands, so does the demand for innovative and energy-efficient exhaust systems.

Latest Trends

Influential Market Trends on Automotive Exhaust Systems

The automotive exhaust systems market has experienced significant growth over the past several years, propelled by factors such as the adoption of advanced manufacturing technologies, the rising popularity of electric turbochargers, and the increasing emphasis on developing eco-friendly exhaust systems. In this article, we will examine some of the most influential market trends that will shape the future of the automotive exhaust systems market.

Implementation of Innovative Manufacturing Technologies

The automotive industry is continually implementing new and innovative manufacturing technologies that enhance the overall production efficiency. Utilizing advanced manufacturing technologies such as 3D printing and automation technology, this pattern has also been observed in the automotive exhaust systems market. Not only have these technologies helped reduce production time, but they have also enhanced the quality of the final product.

Increasing Emphasis on Eco-Friendly Exhaust Systems

The issue of vehicular air pollution has been a significant concern for governments around the globe. To combat this problem, the automotive industry has been devising environmentally friendly exhaust systems that reduce the emissions of harmful pollutants such as carbon monoxide, nitrogen oxides, and particulate matter. Exhaust systems that utilize alternative fuels such as hydrogen and ethanol, as well as techniques such as exhaust gas recirculation, have undergone a significant shift in development.

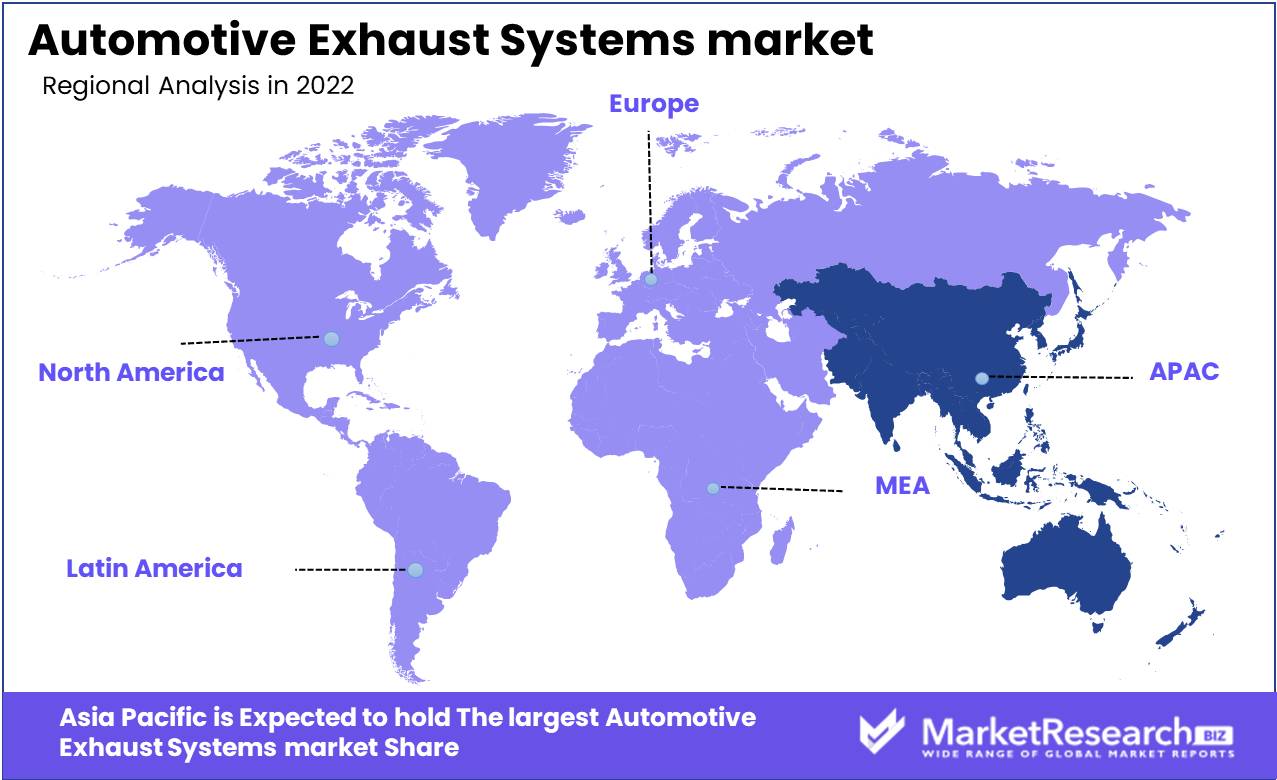

Regional Analysis

Asia-Pacific will be the fastest-growing automotive exhaust system market. The region's growing auto industry and need for fuel-efficient cars are to blame. The automotive exhaust system market in this region is also benefiting from increased awareness of greenhouse gas emissions and stricter regulations.China, India, and Japan dominate the Asia-Pacific automotive exhaust system market. China dominates the Asia-Pacific automotive exhaust system market due to rising car sales. India and Japan would additionally boost the Asia-Pacific automotive exhaust system market.

The automotive exhaust system market will also rise in North America. Due to strict government emissions standards and rising automobile production in this region. The US drives North American automotive exhaust system market growth.

Europe has the third-largest automotive exhaust system market. The market in this region has grown due to growing awareness of greenhouse gas pollution and strict EU restrictions. Germany drives European automotive exhaust system market growth. Automotive exhaust system manufacturing technology is projected to boost market growth. Advanced materials, lightweight designs, and enhanced durability will improve car performance and fuel efficiency, driving the automotive exhaust system market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Faurecia, Tenneco, Eberspacher, Friedrich Boysen, Sango, Sejong Industrial, Basf Catalysts, Futaba Industrial, Yutaka Giken, Benteler Automotive, Dinex, Katcon Global, and Calsonic Kansei are among the market's major players. Faurecia enjoys a solid reputation on the market for providing cutting-edge exhaust systems and components that improve performance, fuel economy, and emissions.

Tenneco is well-known for manufacturing an extensive selection of exhaust components and systems to meet a variety of consumer requirements. In addition, they employ cutting-edge technologies, such as electronic valve control and selective catalytic reduction (SCR), to increase efficiency and decrease emissions.

Eberspacher is extremely focused on manufacturing exhaust systems and components that meet customer specifications, and they offer a vast selection of products, including mufflers, catalytic converters, and diesel particulate filters.

Friedrich Boysen has an outstanding market reputation for manufacturing high-performance exhaust systems for a variety of vehicles. Their products are distinguished by their extraordinary durability, longevity, and performance excellence. To keep up with the changing regulatory environment, customer preferences, and emerging industry trends, it is anticipated that these key players will continue to drive innovation and technological advances in the automotive exhaust systems market.

Top Key Players in Automotive Exhaust Systems Market

- Tenneco Inc.

- Bosal, Sejong Industrial Co., Ltd.

- Eberspächer

- Futaba Industrial Co. Ltd.

- Benteler International AG

- Sango Co. Ltd.

- Faurecia

- Friedrich Boysen GmbH & Co. Kg.

- Yutaka Giken Co. Ltd.

Recent Development

- In 2022, Bosch is a German multinational engineering and technology company, while Esab is a Swedish welding and cutting equipment manufacturer. The acquisition will allow Bosch to expand its product portfolio and offer a more comprehensive range of exhaust systems to its customers.

- In 2023, Tenneco announced plans to invest $200 million in its exhaust systems business. Tenneco is an American automotive parts manufacturer. The investment will be used to expand production capacity and develop new technologies for exhaust systems.

- In 2022, Faurecia opened a new exhaust systems manufacturing plant in China. Faurecia is a French automotive parts manufacturer. The new plant is located in the city of Changzhou and will produce exhaust systems for passenger cars and commercial vehicles.

- In 2023, BorgWarner launched a new line of lightweight exhaust systems. BorgWarner is an American automotive supplier. The new line of exhaust systems is made from carbon fiber composites, which are lighter and more durable than traditional materials.

Report Scope:

Report Features Description Market Value (2022) USD 30.0 Bn Forecast Revenue (2032) USD 43.2 Bn CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Components(Catalytic Converters, Exhaust Manifold, Oxygen Sensor, Exhaust Pipes, Tailpipe, Mufflers), By Fuel Type (Diesel, Gasoline), By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV)), By After-Treatment Devices (Diesel Oxidation Catalyst, Diesel Particulate Filter, Selective Catalytic Reduction, Gasoline Particulate Filter) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tenneco Inc., Bosal, Sejong Industrial Co., Ltd., Eberspächer, Futaba Industrial Co. Ltd., Benteler International AG, Sango Co. Ltd., Faurecia, Friedrich Boysen GmbH & Co. Kg., Yutaka Giken Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Automotive Exhaust Systems Market Overview

- 2.1. Automotive Exhaust Systems Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Automotive Exhaust Systems Market Dynamics

- 3. Global Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Automotive Exhaust Systems Market Analysis, 2016-2021

- 3.2. Global Automotive Exhaust Systems Market Opportunity and Forecast, 2023-2032

- 3.3. Global Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Components, 2016-2032

- 3.3.1. Global Automotive Exhaust Systems Market Analysis by By Components: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Components, 2016-2032

- 3.3.3. Catalytic Converters

- 3.3.4. Exhaust Manifold

- 3.3.5. Oxygen Sensor

- 3.3.6. Exhaust Pipes

- 3.3.7. Tailpipe

- 3.3.8. Mufflers

- 3.4. Global Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Fuel Type, 2016-2032

- 3.4.1. Global Automotive Exhaust Systems Market Analysis by By Fuel Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fuel Type, 2016-2032

- 3.4.3. Diesel

- 3.4.4. Gasoline

- 3.5. Global Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Vehicle Type, 2016-2032

- 3.5.1. Global Automotive Exhaust Systems Market Analysis by By Vehicle Type: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Vehicle Type, 2016-2032

- 3.5.3. Passenger Vehicle

- 3.5.4. Light Commercial Vehicle (LCV)

- 3.5.5. Heavy Commercial Vehicle (HCV)

- 3.6. Global Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By After-Treatment Devices, 2016-2032

- 3.6.1. Global Automotive Exhaust Systems Market Analysis by By After-Treatment Devices: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By After-Treatment Devices, 2016-2032

- 3.6.3. Diesel Oxidation Catalyst

- 3.6.4. Diesel Particulate Filter

- 3.6.5. Selective Catalytic Reduction

- 3.6.6. Gasoline Particulate Filter

- 4. North America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Automotive Exhaust Systems Market Analysis, 2016-2021

- 4.2. North America Automotive Exhaust Systems Market Opportunity and Forecast, 2023-2032

- 4.3. North America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Components, 2016-2032

- 4.3.1. North America Automotive Exhaust Systems Market Analysis by By Components: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Components, 2016-2032

- 4.3.3. Catalytic Converters

- 4.3.4. Exhaust Manifold

- 4.3.5. Oxygen Sensor

- 4.3.6. Exhaust Pipes

- 4.3.7. Tailpipe

- 4.3.8. Mufflers

- 4.4. North America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Fuel Type, 2016-2032

- 4.4.1. North America Automotive Exhaust Systems Market Analysis by By Fuel Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fuel Type, 2016-2032

- 4.4.3. Diesel

- 4.4.4. Gasoline

- 4.5. North America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Vehicle Type, 2016-2032

- 4.5.1. North America Automotive Exhaust Systems Market Analysis by By Vehicle Type: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Vehicle Type, 2016-2032

- 4.5.3. Passenger Vehicle

- 4.5.4. Light Commercial Vehicle (LCV)

- 4.5.5. Heavy Commercial Vehicle (HCV)

- 4.6. North America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By After-Treatment Devices, 2016-2032

- 4.6.1. North America Automotive Exhaust Systems Market Analysis by By After-Treatment Devices: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By After-Treatment Devices, 2016-2032

- 4.6.3. Diesel Oxidation Catalyst

- 4.6.4. Diesel Particulate Filter

- 4.6.5. Selective Catalytic Reduction

- 4.6.6. Gasoline Particulate Filter

- 4.7. North America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Automotive Exhaust Systems Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Automotive Exhaust Systems Market Analysis, 2016-2021

- 5.2. Western Europe Automotive Exhaust Systems Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Components, 2016-2032

- 5.3.1. Western Europe Automotive Exhaust Systems Market Analysis by By Components: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Components, 2016-2032

- 5.3.3. Catalytic Converters

- 5.3.4. Exhaust Manifold

- 5.3.5. Oxygen Sensor

- 5.3.6. Exhaust Pipes

- 5.3.7. Tailpipe

- 5.3.8. Mufflers

- 5.4. Western Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Fuel Type, 2016-2032

- 5.4.1. Western Europe Automotive Exhaust Systems Market Analysis by By Fuel Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fuel Type, 2016-2032

- 5.4.3. Diesel

- 5.4.4. Gasoline

- 5.5. Western Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Vehicle Type, 2016-2032

- 5.5.1. Western Europe Automotive Exhaust Systems Market Analysis by By Vehicle Type: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Vehicle Type, 2016-2032

- 5.5.3. Passenger Vehicle

- 5.5.4. Light Commercial Vehicle (LCV)

- 5.5.5. Heavy Commercial Vehicle (HCV)

- 5.6. Western Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By After-Treatment Devices, 2016-2032

- 5.6.1. Western Europe Automotive Exhaust Systems Market Analysis by By After-Treatment Devices: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By After-Treatment Devices, 2016-2032

- 5.6.3. Diesel Oxidation Catalyst

- 5.6.4. Diesel Particulate Filter

- 5.6.5. Selective Catalytic Reduction

- 5.6.6. Gasoline Particulate Filter

- 5.7. Western Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Automotive Exhaust Systems Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Automotive Exhaust Systems Market Analysis, 2016-2021

- 6.2. Eastern Europe Automotive Exhaust Systems Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Components, 2016-2032

- 6.3.1. Eastern Europe Automotive Exhaust Systems Market Analysis by By Components: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Components, 2016-2032

- 6.3.3. Catalytic Converters

- 6.3.4. Exhaust Manifold

- 6.3.5. Oxygen Sensor

- 6.3.6. Exhaust Pipes

- 6.3.7. Tailpipe

- 6.3.8. Mufflers

- 6.4. Eastern Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Fuel Type, 2016-2032

- 6.4.1. Eastern Europe Automotive Exhaust Systems Market Analysis by By Fuel Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fuel Type, 2016-2032

- 6.4.3. Diesel

- 6.4.4. Gasoline

- 6.5. Eastern Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Vehicle Type, 2016-2032

- 6.5.1. Eastern Europe Automotive Exhaust Systems Market Analysis by By Vehicle Type: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Vehicle Type, 2016-2032

- 6.5.3. Passenger Vehicle

- 6.5.4. Light Commercial Vehicle (LCV)

- 6.5.5. Heavy Commercial Vehicle (HCV)

- 6.6. Eastern Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By After-Treatment Devices, 2016-2032

- 6.6.1. Eastern Europe Automotive Exhaust Systems Market Analysis by By After-Treatment Devices: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By After-Treatment Devices, 2016-2032

- 6.6.3. Diesel Oxidation Catalyst

- 6.6.4. Diesel Particulate Filter

- 6.6.5. Selective Catalytic Reduction

- 6.6.6. Gasoline Particulate Filter

- 6.7. Eastern Europe Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Automotive Exhaust Systems Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Automotive Exhaust Systems Market Analysis, 2016-2021

- 7.2. APAC Automotive Exhaust Systems Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Components, 2016-2032

- 7.3.1. APAC Automotive Exhaust Systems Market Analysis by By Components: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Components, 2016-2032

- 7.3.3. Catalytic Converters

- 7.3.4. Exhaust Manifold

- 7.3.5. Oxygen Sensor

- 7.3.6. Exhaust Pipes

- 7.3.7. Tailpipe

- 7.3.8. Mufflers

- 7.4. APAC Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Fuel Type, 2016-2032

- 7.4.1. APAC Automotive Exhaust Systems Market Analysis by By Fuel Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fuel Type, 2016-2032

- 7.4.3. Diesel

- 7.4.4. Gasoline

- 7.5. APAC Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Vehicle Type, 2016-2032

- 7.5.1. APAC Automotive Exhaust Systems Market Analysis by By Vehicle Type: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Vehicle Type, 2016-2032

- 7.5.3. Passenger Vehicle

- 7.5.4. Light Commercial Vehicle (LCV)

- 7.5.5. Heavy Commercial Vehicle (HCV)

- 7.6. APAC Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By After-Treatment Devices, 2016-2032

- 7.6.1. APAC Automotive Exhaust Systems Market Analysis by By After-Treatment Devices: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By After-Treatment Devices, 2016-2032

- 7.6.3. Diesel Oxidation Catalyst

- 7.6.4. Diesel Particulate Filter

- 7.6.5. Selective Catalytic Reduction

- 7.6.6. Gasoline Particulate Filter

- 7.7. APAC Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Automotive Exhaust Systems Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Automotive Exhaust Systems Market Analysis, 2016-2021

- 8.2. Latin America Automotive Exhaust Systems Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Components, 2016-2032

- 8.3.1. Latin America Automotive Exhaust Systems Market Analysis by By Components: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Components, 2016-2032

- 8.3.3. Catalytic Converters

- 8.3.4. Exhaust Manifold

- 8.3.5. Oxygen Sensor

- 8.3.6. Exhaust Pipes

- 8.3.7. Tailpipe

- 8.3.8. Mufflers

- 8.4. Latin America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Fuel Type, 2016-2032

- 8.4.1. Latin America Automotive Exhaust Systems Market Analysis by By Fuel Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fuel Type, 2016-2032

- 8.4.3. Diesel

- 8.4.4. Gasoline

- 8.5. Latin America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Vehicle Type, 2016-2032

- 8.5.1. Latin America Automotive Exhaust Systems Market Analysis by By Vehicle Type: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Vehicle Type, 2016-2032

- 8.5.3. Passenger Vehicle

- 8.5.4. Light Commercial Vehicle (LCV)

- 8.5.5. Heavy Commercial Vehicle (HCV)

- 8.6. Latin America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By After-Treatment Devices, 2016-2032

- 8.6.1. Latin America Automotive Exhaust Systems Market Analysis by By After-Treatment Devices: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By After-Treatment Devices, 2016-2032

- 8.6.3. Diesel Oxidation Catalyst

- 8.6.4. Diesel Particulate Filter

- 8.6.5. Selective Catalytic Reduction

- 8.6.6. Gasoline Particulate Filter

- 8.7. Latin America Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Automotive Exhaust Systems Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Automotive Exhaust Systems Market Analysis, 2016-2021

- 9.2. Middle East & Africa Automotive Exhaust Systems Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Components, 2016-2032

- 9.3.1. Middle East & Africa Automotive Exhaust Systems Market Analysis by By Components: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Components, 2016-2032

- 9.3.3. Catalytic Converters

- 9.3.4. Exhaust Manifold

- 9.3.5. Oxygen Sensor

- 9.3.6. Exhaust Pipes

- 9.3.7. Tailpipe

- 9.3.8. Mufflers

- 9.4. Middle East & Africa Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Fuel Type, 2016-2032

- 9.4.1. Middle East & Africa Automotive Exhaust Systems Market Analysis by By Fuel Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Fuel Type, 2016-2032

- 9.4.3. Diesel

- 9.4.4. Gasoline

- 9.5. Middle East & Africa Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By Vehicle Type, 2016-2032

- 9.5.1. Middle East & Africa Automotive Exhaust Systems Market Analysis by By Vehicle Type: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Vehicle Type, 2016-2032

- 9.5.3. Passenger Vehicle

- 9.5.4. Light Commercial Vehicle (LCV)

- 9.5.5. Heavy Commercial Vehicle (HCV)

- 9.6. Middle East & Africa Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By By After-Treatment Devices, 2016-2032

- 9.6.1. Middle East & Africa Automotive Exhaust Systems Market Analysis by By After-Treatment Devices: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By After-Treatment Devices, 2016-2032

- 9.6.3. Diesel Oxidation Catalyst

- 9.6.4. Diesel Particulate Filter

- 9.6.5. Selective Catalytic Reduction

- 9.6.6. Gasoline Particulate Filter

- 9.7. Middle East & Africa Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Automotive Exhaust Systems Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Automotive Exhaust Systems Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Automotive Exhaust Systems Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Automotive Exhaust Systems Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Tenneco Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Bosal, Sejong Industrial Co., Ltd.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Eberspächer

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Futaba Industrial Co. Ltd.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Benteler International AG

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Sango Co. Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Faurecia

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Friedrich Boysen GmbH & Co. Kg.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Yutaka Giken Co. Ltd

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

-

- Figure 1: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Components in 2022

- Figure 2: Global Automotive Exhaust Systems Market Attractiveness Analysis by By Components, 2016-2032

- Figure 3: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Fuel Typein 2022

- Figure 4: Global Automotive Exhaust Systems Market Attractiveness Analysis by By Fuel Type, 2016-2032

- Figure 5: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Vehicle Typein 2022

- Figure 6: Global Automotive Exhaust Systems Market Attractiveness Analysis by By Vehicle Type, 2016-2032

- Figure 7: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By After-Treatment Devicesin 2022

- Figure 8: Global Automotive Exhaust Systems Market Attractiveness Analysis by By After-Treatment Devices, 2016-2032

- Figure 9: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Automotive Exhaust Systems Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Figure 14: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Figure 15: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Figure 16: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Figure 17: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Figure 19: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Figure 20: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Figure 21: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Figure 22: Global Automotive Exhaust Systems Market Share Comparison by Region (2016-2032)

- Figure 23: Global Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Figure 24: Global Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Figure 25: Global Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Figure 26: Global Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Figure 27: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Componentsin 2022

- Figure 28: North America Automotive Exhaust Systems Market Attractiveness Analysis by By Components, 2016-2032

- Figure 29: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Fuel Typein 2022

- Figure 30: North America Automotive Exhaust Systems Market Attractiveness Analysis by By Fuel Type, 2016-2032

- Figure 31: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Vehicle Typein 2022

- Figure 32: North America Automotive Exhaust Systems Market Attractiveness Analysis by By Vehicle Type, 2016-2032

- Figure 33: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By After-Treatment Devicesin 2022

- Figure 34: North America Automotive Exhaust Systems Market Attractiveness Analysis by By After-Treatment Devices, 2016-2032

- Figure 35: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Automotive Exhaust Systems Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Figure 40: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Figure 41: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Figure 42: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Figure 43: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Figure 45: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Figure 46: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Figure 47: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Figure 48: North America Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Figure 49: North America Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Figure 50: North America Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Figure 51: North America Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Figure 52: North America Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Figure 53: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Componentsin 2022

- Figure 54: Western Europe Automotive Exhaust Systems Market Attractiveness Analysis by By Components, 2016-2032

- Figure 55: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Fuel Typein 2022

- Figure 56: Western Europe Automotive Exhaust Systems Market Attractiveness Analysis by By Fuel Type, 2016-2032

- Figure 57: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Vehicle Typein 2022

- Figure 58: Western Europe Automotive Exhaust Systems Market Attractiveness Analysis by By Vehicle Type, 2016-2032

- Figure 59: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By After-Treatment Devicesin 2022

- Figure 60: Western Europe Automotive Exhaust Systems Market Attractiveness Analysis by By After-Treatment Devices, 2016-2032

- Figure 61: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Automotive Exhaust Systems Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Figure 66: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Figure 67: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Figure 68: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Figure 69: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Figure 71: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Figure 72: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Figure 73: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Figure 74: Western Europe Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Figure 76: Western Europe Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Figure 77: Western Europe Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Figure 78: Western Europe Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Figure 79: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Componentsin 2022

- Figure 80: Eastern Europe Automotive Exhaust Systems Market Attractiveness Analysis by By Components, 2016-2032

- Figure 81: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Fuel Typein 2022

- Figure 82: Eastern Europe Automotive Exhaust Systems Market Attractiveness Analysis by By Fuel Type, 2016-2032

- Figure 83: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Vehicle Typein 2022

- Figure 84: Eastern Europe Automotive Exhaust Systems Market Attractiveness Analysis by By Vehicle Type, 2016-2032

- Figure 85: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By After-Treatment Devicesin 2022

- Figure 86: Eastern Europe Automotive Exhaust Systems Market Attractiveness Analysis by By After-Treatment Devices, 2016-2032

- Figure 87: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Automotive Exhaust Systems Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Figure 92: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Figure 93: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Figure 94: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Figure 95: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Figure 97: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Figure 98: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Figure 99: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Figure 100: Eastern Europe Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Figure 102: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Figure 103: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Figure 104: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Figure 105: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Componentsin 2022

- Figure 106: APAC Automotive Exhaust Systems Market Attractiveness Analysis by By Components, 2016-2032

- Figure 107: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Fuel Typein 2022

- Figure 108: APAC Automotive Exhaust Systems Market Attractiveness Analysis by By Fuel Type, 2016-2032

- Figure 109: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Vehicle Typein 2022

- Figure 110: APAC Automotive Exhaust Systems Market Attractiveness Analysis by By Vehicle Type, 2016-2032

- Figure 111: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By After-Treatment Devicesin 2022

- Figure 112: APAC Automotive Exhaust Systems Market Attractiveness Analysis by By After-Treatment Devices, 2016-2032

- Figure 113: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Automotive Exhaust Systems Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Figure 118: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Figure 119: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Figure 120: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Figure 121: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Figure 123: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Figure 124: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Figure 125: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Figure 126: APAC Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Figure 128: APAC Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Figure 129: APAC Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Figure 130: APAC Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Figure 131: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Componentsin 2022

- Figure 132: Latin America Automotive Exhaust Systems Market Attractiveness Analysis by By Components, 2016-2032

- Figure 133: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Fuel Typein 2022

- Figure 134: Latin America Automotive Exhaust Systems Market Attractiveness Analysis by By Fuel Type, 2016-2032

- Figure 135: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Vehicle Typein 2022

- Figure 136: Latin America Automotive Exhaust Systems Market Attractiveness Analysis by By Vehicle Type, 2016-2032

- Figure 137: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By After-Treatment Devicesin 2022

- Figure 138: Latin America Automotive Exhaust Systems Market Attractiveness Analysis by By After-Treatment Devices, 2016-2032

- Figure 139: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Automotive Exhaust Systems Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Figure 144: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Figure 145: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Figure 146: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Figure 147: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Figure 149: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Figure 150: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Figure 151: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Figure 152: Latin America Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Figure 154: Latin America Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Figure 155: Latin America Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Figure 156: Latin America Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Figure 157: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Componentsin 2022

- Figure 158: Middle East & Africa Automotive Exhaust Systems Market Attractiveness Analysis by By Components, 2016-2032

- Figure 159: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Fuel Typein 2022

- Figure 160: Middle East & Africa Automotive Exhaust Systems Market Attractiveness Analysis by By Fuel Type, 2016-2032

- Figure 161: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By Vehicle Typein 2022

- Figure 162: Middle East & Africa Automotive Exhaust Systems Market Attractiveness Analysis by By Vehicle Type, 2016-2032

- Figure 163: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by By After-Treatment Devicesin 2022

- Figure 164: Middle East & Africa Automotive Exhaust Systems Market Attractiveness Analysis by By After-Treatment Devices, 2016-2032

- Figure 165: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Automotive Exhaust Systems Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Figure 170: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Figure 171: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Figure 172: Middle East & Africa Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Figure 173: Middle East & Africa Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Figure 175: Middle East & Africa Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Figure 176: Middle East & Africa Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Figure 177: Middle East & Africa Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Figure 178: Middle East & Africa Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Figure 180: Middle East & Africa Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Figure 181: Middle East & Africa Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Figure 182: Middle East & Africa Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

List of Tables

- Table 1: Global Automotive Exhaust Systems Market Comparison by By Components (2016-2032)

- Table 2: Global Automotive Exhaust Systems Market Comparison by By Fuel Type (2016-2032)

- Table 3: Global Automotive Exhaust Systems Market Comparison by By Vehicle Type (2016-2032)

- Table 4: Global Automotive Exhaust Systems Market Comparison by By After-Treatment Devices (2016-2032)

- Table 5: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Table 9: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Table 10: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Table 11: Global Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Table 12: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Table 14: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Table 15: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Table 16: Global Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Table 17: Global Automotive Exhaust Systems Market Share Comparison by Region (2016-2032)

- Table 18: Global Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Table 19: Global Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Table 20: Global Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Table 21: Global Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Table 22: North America Automotive Exhaust Systems Market Comparison by By Fuel Type (2016-2032)

- Table 23: North America Automotive Exhaust Systems Market Comparison by By Vehicle Type (2016-2032)

- Table 24: North America Automotive Exhaust Systems Market Comparison by By After-Treatment Devices (2016-2032)

- Table 25: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Table 29: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Table 30: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Table 31: North America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Table 32: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Table 34: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Table 35: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Table 36: North America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Table 37: North America Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Table 38: North America Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Table 39: North America Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Table 40: North America Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Table 41: North America Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Table 42: Western Europe Automotive Exhaust Systems Market Comparison by By Components (2016-2032)

- Table 43: Western Europe Automotive Exhaust Systems Market Comparison by By Fuel Type (2016-2032)

- Table 44: Western Europe Automotive Exhaust Systems Market Comparison by By Vehicle Type (2016-2032)

- Table 45: Western Europe Automotive Exhaust Systems Market Comparison by By After-Treatment Devices (2016-2032)

- Table 46: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Table 50: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Table 51: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Table 52: Western Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Table 53: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 54: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Table 55: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Table 56: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Table 57: Western Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Table 58: Western Europe Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Table 59: Western Europe Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Table 60: Western Europe Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Table 61: Western Europe Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Table 62: Western Europe Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Table 63: Eastern Europe Automotive Exhaust Systems Market Comparison by By Components (2016-2032)

- Table 64: Eastern Europe Automotive Exhaust Systems Market Comparison by By Fuel Type (2016-2032)

- Table 65: Eastern Europe Automotive Exhaust Systems Market Comparison by By Vehicle Type (2016-2032)

- Table 66: Eastern Europe Automotive Exhaust Systems Market Comparison by By After-Treatment Devices (2016-2032)

- Table 67: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Table 69: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Table 71: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Table 72: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Table 73: Eastern Europe Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Table 74: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 75: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Table 76: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Table 77: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Table 78: Eastern Europe Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Table 79: Eastern Europe Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Table 80: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Table 81: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Table 82: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Table 83: Eastern Europe Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Table 84: APAC Automotive Exhaust Systems Market Comparison by By Components (2016-2032)

- Table 85: APAC Automotive Exhaust Systems Market Comparison by By Fuel Type (2016-2032)

- Table 86: APAC Automotive Exhaust Systems Market Comparison by By Vehicle Type (2016-2032)

- Table 87: APAC Automotive Exhaust Systems Market Comparison by By After-Treatment Devices (2016-2032)

- Table 88: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Table 90: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Table 92: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Table 93: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Table 94: APAC Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Table 95: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 96: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Table 97: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Table 98: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Table 99: APAC Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Table 100: APAC Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Table 101: APAC Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)

- Table 102: APAC Automotive Exhaust Systems Market Share Comparison by By Fuel Type (2016-2032)

- Table 103: APAC Automotive Exhaust Systems Market Share Comparison by By Vehicle Type (2016-2032)

- Table 104: APAC Automotive Exhaust Systems Market Share Comparison by By After-Treatment Devices (2016-2032)

- Table 105: Latin America Automotive Exhaust Systems Market Comparison by By Components (2016-2032)

- Table 106: Latin America Automotive Exhaust Systems Market Comparison by By Fuel Type (2016-2032)

- Table 107: Latin America Automotive Exhaust Systems Market Comparison by By Vehicle Type (2016-2032)

- Table 108: Latin America Automotive Exhaust Systems Market Comparison by By After-Treatment Devices (2016-2032)

- Table 109: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 110: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) (2016-2032)

- Table 111: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 112: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Components (2016-2032)

- Table 113: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Fuel Type (2016-2032)

- Table 114: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By Vehicle Type (2016-2032)

- Table 115: Latin America Automotive Exhaust Systems Market Revenue (US$ Mn) Comparison by By After-Treatment Devices (2016-2032)

- Table 116: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 117: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Components (2016-2032)

- Table 118: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Fuel Type (2016-2032)

- Table 119: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By Vehicle Type (2016-2032)

- Table 120: Latin America Automotive Exhaust Systems Market Y-o-Y Growth Rate Comparison by By After-Treatment Devices (2016-2032)

- Table 121: Latin America Automotive Exhaust Systems Market Share Comparison by Country (2016-2032)

- Table 122: Latin America Automotive Exhaust Systems Market Share Comparison by By Components (2016-2032)