Atherectomy Devices Market By Product (Directional Atherectomy Devices, Orbital Atherectomy Devices, Rotational Atherectomy Devices, Laser Atherectomy Devices), By Application (Peripheral Vascular Applications, Coronary Applications), By End-User (Hospitals, Ambulatory Surgical Centers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46769

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

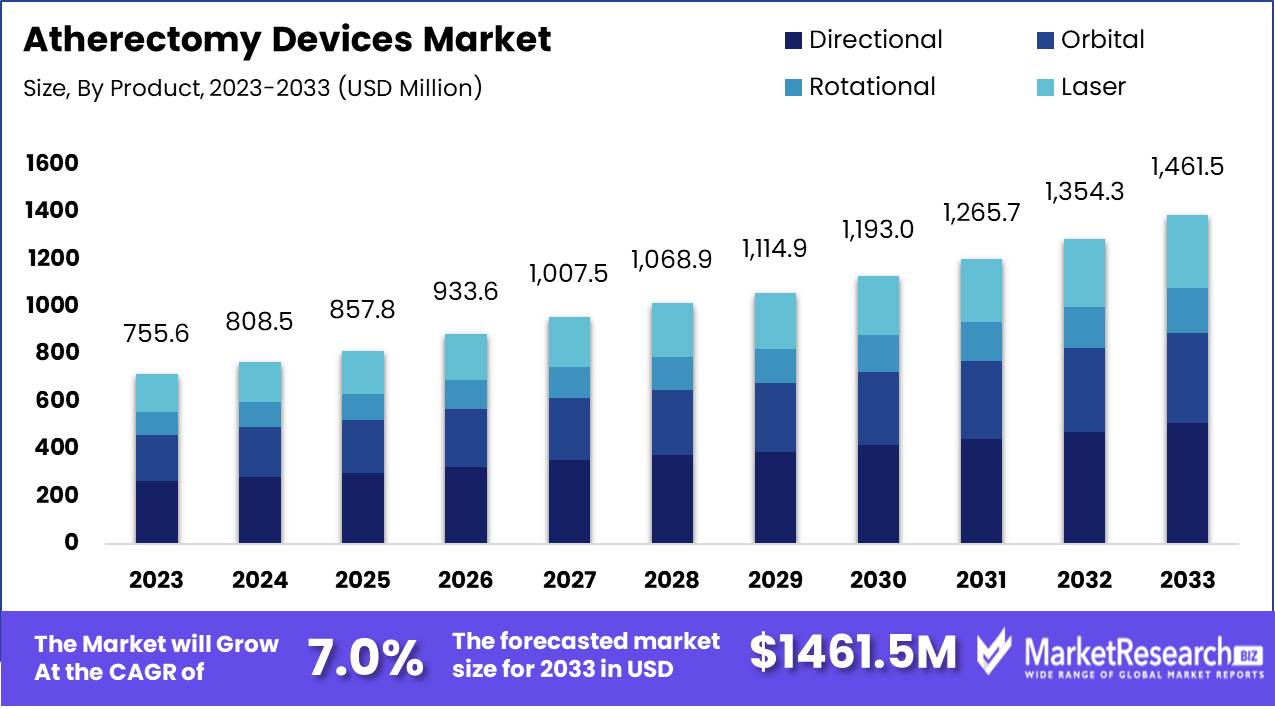

The Atherectomy Devices Market was valued at USD 755.6 Million in 2023. It is expected to reach USD 1461.5 Million by 2033, with a CAGR of 7.0% during the forecast period from 2024 to 2033.

The atherectomy devices market encompasses medical devices used to remove atherosclerotic plaque from blood vessels, particularly in peripheral and coronary arteries. This market is driven by the rising prevalence of cardiovascular diseases, advancements in minimally invasive surgical techniques, and increasing adoption of atherectomy procedures due to their efficacy in improving arterial blood flow.

The atherectomy devices market is poised for significant growth, driven by increasing patient demand for minimally invasive procedures and the impressive success rates associated with these devices. Atherectomy devices, which mechanically remove plaque from blood vessels, have demonstrated a high efficacy rate, with 94.7% of patients experiencing successful outcomes. This robust success rate underscores the clinical effectiveness of atherectomy devices, fostering greater confidence among healthcare providers and patients alike. The trend towards less invasive surgical options is further propelling market growth as patients seek to avoid the complexities and extended recovery times associated with traditional surgical interventions. Consequently, the adoption of atherectomy devices is expanding, supported by technological advancements that enhance their precision and safety.

The competitive landscape of the atherectomy devices market is characterized by low market concentration, indicating a fragmented market with numerous players. This fragmentation suggests significant opportunities for market entrants and smaller companies to innovate and capture market share. Established companies must continually invest in R&D to maintain their competitive edge amidst increasing competition. The combination of a high success rate, patient preference for minimally invasive procedures, and a fragmented market structure creates a fertile ground for growth and innovation.

Moving forward, companies that can leverage these dynamics through strategic partnerships, advanced product development, and robust marketing strategies will likely emerge as leaders in the atherectomy devices market. The confluence of these factors positions the market for sustained expansion, with substantial benefits for patients and providers alike.

Key Takeaways

- Market Growth: The Atherectomy Devices Market was valued at USD 755.6 Million in 2023. It is expected to reach USD 1461.5 Million by 2033, with a CAGR of 7.0% during the forecast period from 2024 to 2033.

- By Product: Orbital Atherectomy Devices dominate with 34% market share in 2023.

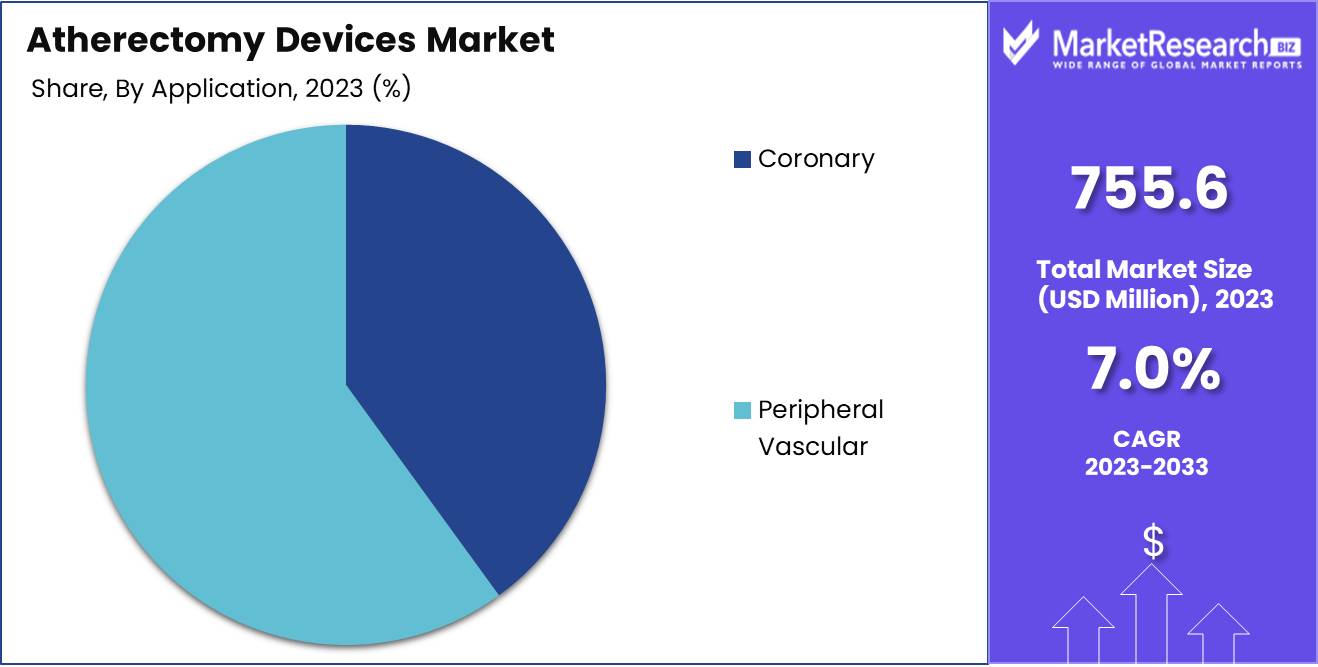

- By Application: Peripheral Vascular Applications dominated with over 52% market share.

- By End-User: Ambulatory Surgical Centers dominated the atherectomy market, capturing over 55% share.

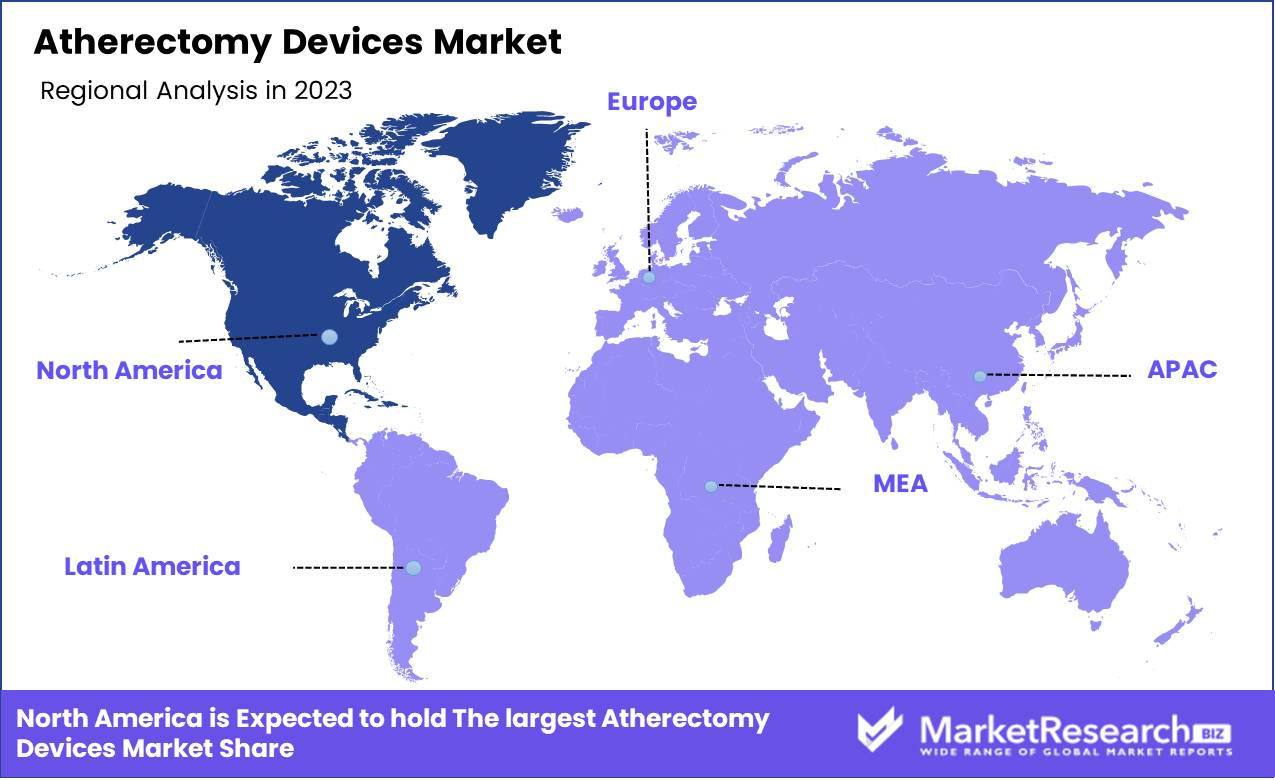

- Regional Dominance: North America leads with a 36% market share in atherectomy devices.

- Growth Opportunity: Rising minimally invasive procedures and robust research drive significant growth in the atherectomy devices market.

Driving factors

Rising Prevalence of Cardiovascular Diseases: Catalyzing Market Expansion

The escalating incidence of cardiovascular diseases (CVDs) significantly fuels the growth of the atherectomy devices market. As the global population ages and lifestyle-related risk factors such as obesity, hypertension, and diabetes become more prevalent, the burden of CVD increases. According to the World Health Organization, cardiovascular diseases are the leading cause of death globally, claiming an estimated 17.9 million lives each year. This high prevalence creates a substantial demand for effective treatment options, including atherectomy devices, which are crucial for managing arterial blockages and improving patient outcomes. The need for these devices is amplified by the rise in peripheral artery disease (PAD), which affects more than 200 million people worldwide.

Preference for Minimally Invasive Procedures: Shaping Patient and Provider Choices

The healthcare industry's shift towards minimally invasive procedures is a pivotal factor in the atherectomy devices market expansion. Patients and healthcare providers increasingly prefer minimally invasive techniques due to their associated benefits, such as reduced hospital stays, lower complication rates, and quicker recovery times. Atherectomy procedures, being less invasive compared to traditional surgical options, align well with these preferences. This trend is supported by advancements in technology that enhance the safety and efficacy of atherectomy devices. For instance, the development of laser and rotational atherectomy devices has improved precision in plaque removal, leading to better patient outcomes.

Increasing Awareness and Diagnostic Capabilities: Enhancing Early Detection and Treatment

Enhanced awareness and diagnostic capabilities play a critical role in the growth of the atherectomy devices market. Public health initiatives and educational campaigns have significantly increased awareness of cardiovascular diseases and their risk factors. This heightened awareness leads to more people seeking medical advice and undergoing diagnostic evaluations. Improved diagnostic technologies, such as advanced imaging techniques and non-invasive tests, facilitate early detection of arterial blockages and other cardiovascular conditions. Early diagnosis is crucial for the timely intervention and management of these conditions using atherectomy devices. The integration of artificial intelligence (AI) and machine learning in diagnostic tools has further revolutionized the detection process, enabling more accurate and faster identification of patients who could benefit from atherectomy procedures.

Restraining Factors

Limited Patient Awareness: A Barrier to Market Expansion

One of the primary restraining factors affecting the growth of the atherectomy devices market is the limited awareness among patients regarding the availability and benefits of these devices. Despite the technological advancements and proven efficacy of atherectomy procedures in managing peripheral artery disease (PAD), many patients remain uninformed about their treatment options. This lack of awareness leads to a lower adoption rate of atherectomy devices, as patients are less likely to seek out or consent to these procedures.

According to industry surveys, a significant portion of the target patient population is either unaware of the minimally invasive nature of atherectomy or lacks understanding of how it can effectively prevent more severe complications like amputation. Educational initiatives aimed at increasing patient knowledge could play a critical role in overcoming this barrier. By enhancing patient education, healthcare providers can drive higher demand for atherectomy devices, thus accelerating market growth.

The dearth of Skilled and Well-Trained Surgeons: Limiting Procedure Adoption

The shortage of skilled and well-trained surgeons is another significant factor restraining the growth of the atherectomy devices market. Performing atherectomy requires specialized training and expertise, which not all vascular surgeons possess. This scarcity of proficient surgeons limits the number of procedures that can be performed, directly impacting the market's expansion.

The complexity of atherectomy procedures demands not only initial training but also ongoing education to keep up with advancements in device technology and procedural techniques. The lack of sufficient training programs and continuous professional development opportunities exacerbates this issue. In regions where skilled surgeons are in short supply, the adoption of atherectomy devices is notably lower, further stalling market growth.

By Product Analysis

Orbital Atherectomy Devices dominate with a 34% market share in 2023.

In 2023, Orbital Atherectomy Devices held a dominant market position in the By Product segment of the Atherectomy Devices Market, capturing more than a 34% share. The segment comprises four key categories: Directional Atherectomy Devices, Orbital Atherectomy Devices, Rotational Atherectomy Devices, and Laser Atherectomy Devices.

Directional Atherectomy Devices, known for their precision in removing atherosclerotic plaque, are preferred in treating specific arterial blockages due to their targeted approach. However, they represent a smaller market share compared to their orbital counterparts. Orbital Atherectomy Devices have gained prominence due to their versatility and efficacy in addressing calcified lesions, which are common in patients with peripheral artery disease. This category's ability to navigate tortuous vessels and provide comprehensive plaque modification has driven its significant market share.

Rotational Atherectomy Devices are designed to ablate hard, calcified plaque using high-speed rotational motion. Despite their effectiveness, their usage is somewhat limited by concerns over vessel trauma and complexity in certain anatomies. Lastly, Laser Atherectomy Devices utilize ultraviolet energy to vaporize plaque. While offering the advantage of minimal thermal damage, their adoption is constrained by higher costs and technical demands.

By Application Analysis

In 2023, Peripheral Vascular Applications dominated with over 52% market share.

In 2023, Peripheral Vascular Applications held a dominant market position in the By Application segment of the Atherectomy Devices Market, capturing more than a 52% share. This significant market share can be attributed to the increasing prevalence of peripheral artery disease (PAD), the rising geriatric population, and the advancements in minimally invasive atherectomy technologies. The demand for these devices is driven by the need for effective treatments that reduce the risk of amputation and improve patient outcomes. Additionally, the growing awareness and screening for PAD have contributed to the expansion of this segment.

Conversely, Coronary Applications, while essential, accounted for a smaller share of the market. The focus in this segment is on the treatment of coronary artery disease (CAD), which remains a leading cause of morbidity and mortality globally. Despite being critical, the growth in this segment is comparatively moderate due to the established nature of alternative interventions such as angioplasty and stenting. However, innovations in atherectomy devices aimed at improving precision and safety continue to foster gradual adoption in coronary procedures, supporting a steady market presence. Overall, these segments underscore the diverse applications and growing adoption of atherectomy devices in cardiovascular care.

By End-User Analysis

Ambulatory Surgical Centers dominated the atherectomy market, capturing over 55% share.

In 2023, Ambulatory Surgical Centers (ASCs) held a dominant market position in the By End-User segment of the Atherectomy Devices Market, capturing more than a 55% share. This prominence is attributed to several factors, including the increasing preference for minimally invasive procedures and the cost-effectiveness of ASCs compared to traditional hospitals. Hospitals, while still significant players in the market, have seen a relative decline in their share, now comprising around 45%. This shift is driven by the growing patient preference for outpatient settings, which offer reduced recovery times and lower risks of hospital-acquired infections.

Furthermore, advancements in atherectomy device technology have enhanced the safety and efficacy of procedures performed in ASCs, making them a more attractive option for both patients and healthcare providers. The higher efficiency and specialized care available at ASCs also contribute to their leading position in this segment, as they are designed to handle a high volume of specific surgical procedures, thereby optimizing operational efficiencies and outcomes.

Key Market Segments

By Product

- Directional Atherectomy Devices

- Orbital Atherectomy Devices

- Rotational Atherectomy Devices

- Laser Atherectomy Devices

By Application

- Peripheral Vascular Applications

- Coronary Applications

By End-User

- Hospitals

- Ambulatory Surgical Centers

Growth Opportunity

Increasing Adoption of Minimally Invasive Procedures

The global atherectomy devices market is poised for significant growth in 2024, driven primarily by the increasing adoption of minimally invasive procedures. These procedures offer numerous benefits, including reduced recovery times, lower risk of complications, and improved patient outcomes. As healthcare systems globally continue to prioritize cost-effectiveness and patient-centric care, the demand for atherectomy devices is expected to surge. In particular, the rising prevalence of peripheral artery disease (PAD) and coronary artery disease (CAD) necessitates advanced, minimally invasive solutions, positioning atherectomy devices as a critical component in modern cardiovascular treatment paradigms.

Growing Research Activities

In addition to the shift towards minimally invasive procedures, the global atherectomy devices market is benefiting from robust research activities. Continuous innovation and technological advancements are propelling the development of next-generation atherectomy devices that offer enhanced efficacy and safety profiles. Key industry players are investing heavily in R&D to create devices that can more precisely target arterial plaques, reduce restenosis rates, and improve long-term patient outcomes. These research efforts are expected to lead to the introduction of new products and technologies, thereby expanding the market's growth potential.

Latest Trends

Advancements in Technology: Driving Precision and Efficiency in Atherectomy Devices

The atherectomy devices market in 2024 is witnessing significant advancements in technology, which are poised to enhance both the precision and efficiency of these devices. Innovations such as laser atherectomy and orbital atherectomy are at the forefront, offering improved plaque removal capabilities with minimal arterial damage. These advancements are particularly crucial for treating complex lesions and calcified arteries, where traditional methods fall short.

Additionally, the integration of artificial intelligence and machine learning into atherectomy procedures is streamlining operations and improving patient outcomes. AI-powered imaging systems are enabling more accurate diagnosis and real-time monitoring, which is critical for optimizing treatment strategies and reducing procedural complications. As technology continues to evolve, the adoption of more sophisticated atherectomy devices is expected to rise, driven by the demand for minimally invasive and highly effective cardiovascular interventions.

Growing Awareness: Enhancing Diagnosis and Treatment of Peripheral Artery Disease

Increasing awareness about peripheral artery disease (PAD) and its severe health implications is another key trend propelling the atherectomy devices market in 2024. Medical professionals and public health initiatives are intensifying efforts to educate both patients and healthcare providers about the benefits of early diagnosis and treatment of PAD. This heightened awareness is translating into greater demand for atherectomy procedures, as patients seek out effective solutions for managing their condition.

Moreover, insurance providers are increasingly recognizing the cost-effectiveness of atherectomy, which is bolstering its adoption. Comprehensive awareness campaigns and educational programs also emphasize the importance of regular screenings and timely medical intervention, which are critical in preventing the progression of PAD and improving overall patient health outcomes. Consequently, the growing awareness is fostering a more proactive approach to cardiovascular health, further driving the market for advanced atherectomy devices.

Regional Analysis

North America leads with a 36% market share in atherectomy devices.

The global atherectomy devices market exhibits significant regional variation, with North America leading with a substantial market share of 36%. This dominance is primarily driven by the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and favorable reimbursement policies. The U.S., in particular, has a high adoption rate of advanced medical technologies, contributing to this region's robust market presence.

Europe holds the second-largest market share, supported by the increasing geriatric population and rising incidence of peripheral artery diseases. Countries such as Germany, France, and the UK are at the forefront due to their well-established healthcare systems and growing investments in medical research and development. The Asia Pacific region is experiencing the fastest growth, propelled by the expanding healthcare sector, rising awareness about minimally invasive procedures, and increasing government initiatives to improve healthcare access. Markets in China, Japan, and India are particularly noteworthy for their rapid adoption of atherectomy devices.

In the Middle East & Africa, market growth is more gradual but steady, driven by improving healthcare infrastructure and increasing investments in healthcare technology, especially in the UAE and South Africa. Latin America shows promising growth potential, particularly in Brazil and Mexico, where rising healthcare expenditure and increasing prevalence of lifestyle-related diseases are creating a favorable market environment.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- The rest of the Middle East & Africa

Key Players Analysis

The global atherectomy devices market in 2024 is characterized by robust competition and significant innovation driven by key players aiming to address the increasing prevalence of peripheral artery disease (PAD) and other vascular conditions. Major companies such as Medtronic plc, Boston Scientific, and Abbott Laboratories are leading the market through their extensive portfolios and continual technological advancements.

Medtronic plc stands out for its comprehensive range of atherectomy devices, including directional, orbital, and rotational systems. The company's strategic acquisitions and strong R&D investments have reinforced its market position, enabling it to offer cutting-edge solutions that cater to a wide spectrum of clinical needs. Boston Scientific leverages its significant expertise in medical devices to provide innovative atherectomy solutions. Its commitment to improving clinical outcomes through minimally invasive procedures has cemented its reputation in the market. Boston Scientific’s integration of advanced imaging technologies enhances precision and safety in atherectomy procedures, setting a high standard for competitors.

Cardiovascular Systems Inc. (CSI) specializes in atherectomy devices designed for complex arterial calcifications. CSI's focus on niche markets and its continuous product enhancements have made it a pivotal player, particularly in the treatment of severe PAD cases. Koninklijke Philips N.V. and Terumo Corporation emphasize comprehensive cardiovascular care solutions. Philips’ integration of imaging and atherectomy devices facilitates precise treatment planning and execution, while Terumo's innovations in catheter-based systems and commitment to user-friendly designs contribute to its growing market share. Abbott Laboratories and AngioDynamics Inc. have made significant strides with their portfolio expansions and strategic partnerships, aiming to enhance patient outcomes through state-of-the-art atherectomy devices.

Meanwhile, Becton, Dickinson and Company, Cardinal Health Inc., Nipro Corporation, and Biomerics LLC leverage their extensive healthcare expertise to innovate and penetrate the atherectomy market, focusing on cost-effective and efficient solutions. Rex Medicals also plays a critical role, particularly in the development of novel atherectomy technologies that promise to further streamline procedures and improve patient recovery times.

Market Key Players

- Medtronic plc

- Avinger

- Boston Scientific

- Cardiovascular Systems Inc

- Koninklijke Philips N.V

- Abbott Laboratories

- AngioDynamics Inc

- Becton

- Dickinson and Company

- Terumo Corporation

- Cardinal Health Inc.

- Nipro Corporation

- Biomerics LLC

- Rex Medicals

Recent Development

- In April 2024, Medtronic introduced the HawkOne Directional Atherectomy System, an updated version of its flagship device with improved cutting efficiency and safety features. This development aims to reduce procedure times and improve patient outcomes in peripheral artery disease (PAD) treatments.

- In March 2024, Boston Scientific announced the launch of its new enhanced laser atherectomy system, the ELAS-4, designed to improve precision in the removal of atherosclerotic plaques. This device incorporates advanced imaging capabilities to enhance procedural outcomes.

- In January 2024, Philips launched the Stellarex™ 0.035 Drug-coated Balloon, which complements their atherectomy devices by providing a treatment option that reduces restenosis rates post-atherectomy. This development signifies Philips' integrated approach to vascular treatment solutions.

Report Scope

Report Features Description Market Value (2023) USD 755.6 Million Forecast Revenue (2033) USD 1461.5 Million CAGR (2024-2032) 7.0% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Directional Atherectomy Devices, Orbital Atherectomy Devices, Rotational Atherectomy Devices, Laser Atherectomy Devices), By Application (Peripheral Vascular Applications, Coronary Applications), By End-User (Hospitals, Ambulatory Surgical Centers) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Medtronic plc, Avinger, Boston Scientific, Cardiovascular Systems Inc, Koninklijke Philips N.V, Abbott Laboratories, AngioDynamics Inc, Becton, Dickinson and Company, Terumo Corporation, Cardinal Health Inc., Nipro Corporation, Biomerics LLC, Rex Medicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Medtronic plc

- Avinger

- Boston Scientific

- Cardiovascular Systems Inc

- Koninklijke Philips N.V

- Abbott Laboratories

- AngioDynamics Inc

- Becton

- Dickinson and Company

- Terumo Corporation

- Cardinal Health Inc.

- Nipro Corporation

- Biomerics LLC

- Rex Medicals