Antistatic Agents Market By Form (Liquid, Powder, Pellets, Microbeads, Others), By Product (Ethoxylated Fatty Acid Amines, Diethanolamides, And Others), By Polymer (Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), And Others), By End-Use (Packaging, Electronics, And Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47990

-

June 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

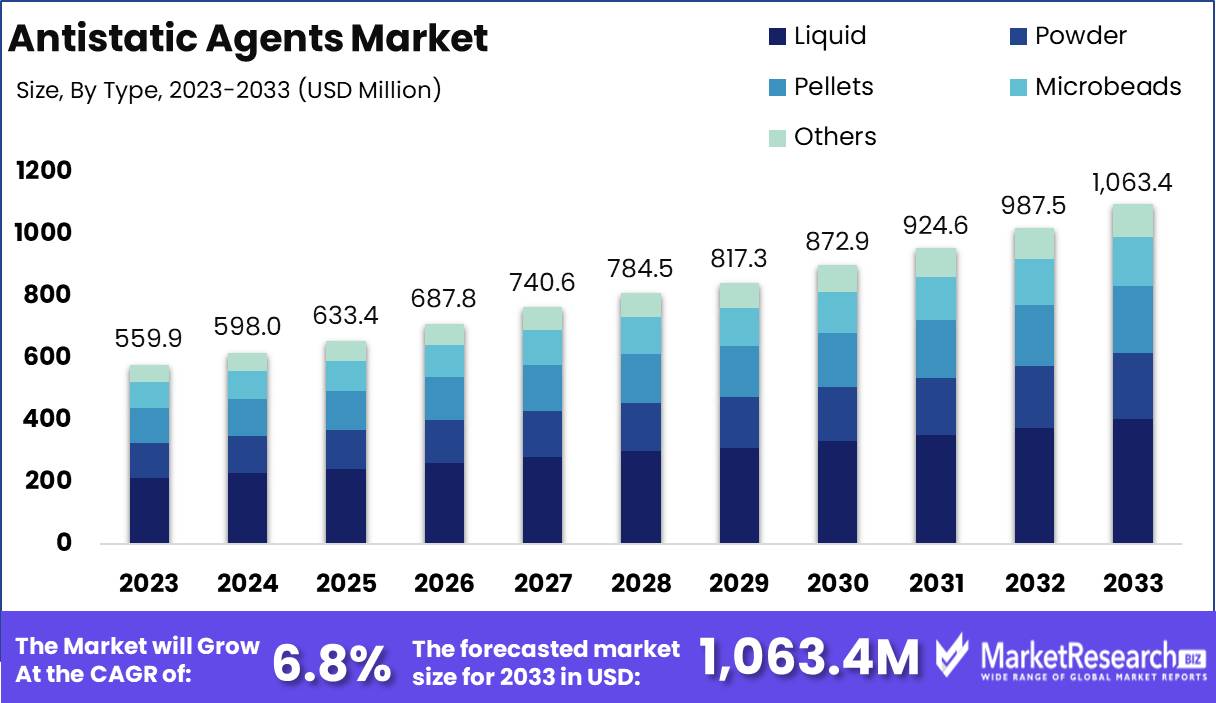

The Global Antistatic Agents Market was valued at USD 559.9 Mn in 2023. It is expected to reach USD 1063.4 Mn by 2033, with a CAGR of 6.8% during the forecast period from 2024 to 2033.

The Antistatic Agents Market encompasses specialized chemical additives designed to mitigate static electricity in various industrial processes and consumer products. These agents function by altering the surface conductivity of materials, preventing the buildup of static charges that can damage electronic components, attract dust, or pose safety risks. Widely used in sectors such as electronics, packaging, textiles, and automotive industries, antistatic agents enhance product performance and longevity while ensuring operational safety and efficiency.

The Antistatic Agents Market plays a crucial role across diverse industries by addressing the pervasive challenge of static electricity. These specialized chemical additives, such as Stadis 450, Stadis 425, and Dorf Ketal's SR 1795, are integral to preventing static charge buildup in jet fuels and distillate fuels, thereby significantly enhancing operational safety. This application highlights the market's essential role in safeguarding critical processes and infrastructures.

The Antistatic Agents Market plays a crucial role across diverse industries by addressing the pervasive challenge of static electricity. These specialized chemical additives, such as Stadis 450, Stadis 425, and Dorf Ketal's SR 1795, are integral to preventing static charge buildup in jet fuels and distillate fuels, thereby significantly enhancing operational safety. This application highlights the market's essential role in safeguarding critical processes and infrastructures.Beyond fuel additives, antistatic agents like alkylamine ethoxylates (ANEOs), including polyoxyethylene(15)tallow amine (POEA), are essential components in glyphosate herbicide formulations. They facilitate optimal dispersion and efficacy of herbicides, ensuring consistent application and weed control in agricultural practices. This dual application spectrum underscores the versatility and indispensability of antistatic agents across both industrial and agricultural sectors.

A growing demand for antistatic agents driven by stringent safety regulations, increasing automation in manufacturing, and rising consumer expectations for product quality and reliability. Industries ranging from electronics and packaging to automotive and agriculture rely on these agents to mitigate risks associated with static discharge, enhance product performance, and maintain operational efficiency.

The Antistatic Agents Market presents opportunities for innovation and collaboration among manufacturers and end-users. Advances in formulation technologies and sustainable additives are poised to reshape market dynamics, offering solutions that not only meet current regulatory standards but also align with global sustainability goals. As businesses navigate these opportunities, strategic investments in research and development will be crucial to capitalize on emerging trends and maintain competitive advantage in the evolving marketplace.

Key Takeaways

- Market Growth: The Global Antistatic Agents Market was valued at USD 559.9 Mn in 2023. It is expected to reach USD 1063.4 Mn by 2033, with a CAGR of 6.8% during the forecast period from 2024 to 2033.

- By Form: Liquid: Liquid antistatic agents hold a significant market share of about 38%, valued for their ease of application and versatility across industries.

- By Product: Quaternary ammonium compounds dominate the antistatic agent market with a share of around 33%, renowned for their effective surface resistivity reduction.

- By Polymer: Polypropylene (PP) likely holds a substantial market share of around 28%, driven by its widespread use in packaging, textiles, and automotive industries.

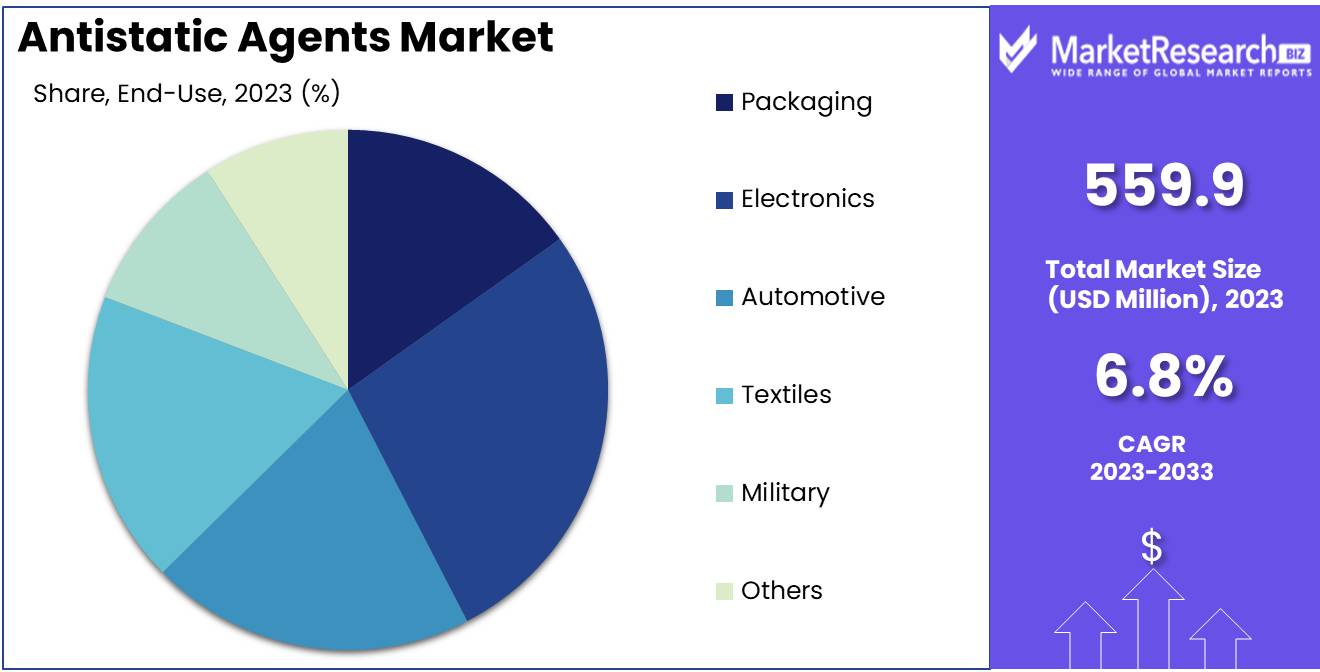

- By End-Use: Electronics sector holds a significant share of approximately 27% in the antistatic agent market, crucial for protecting electronic components from electrostatic discharge (ESD).

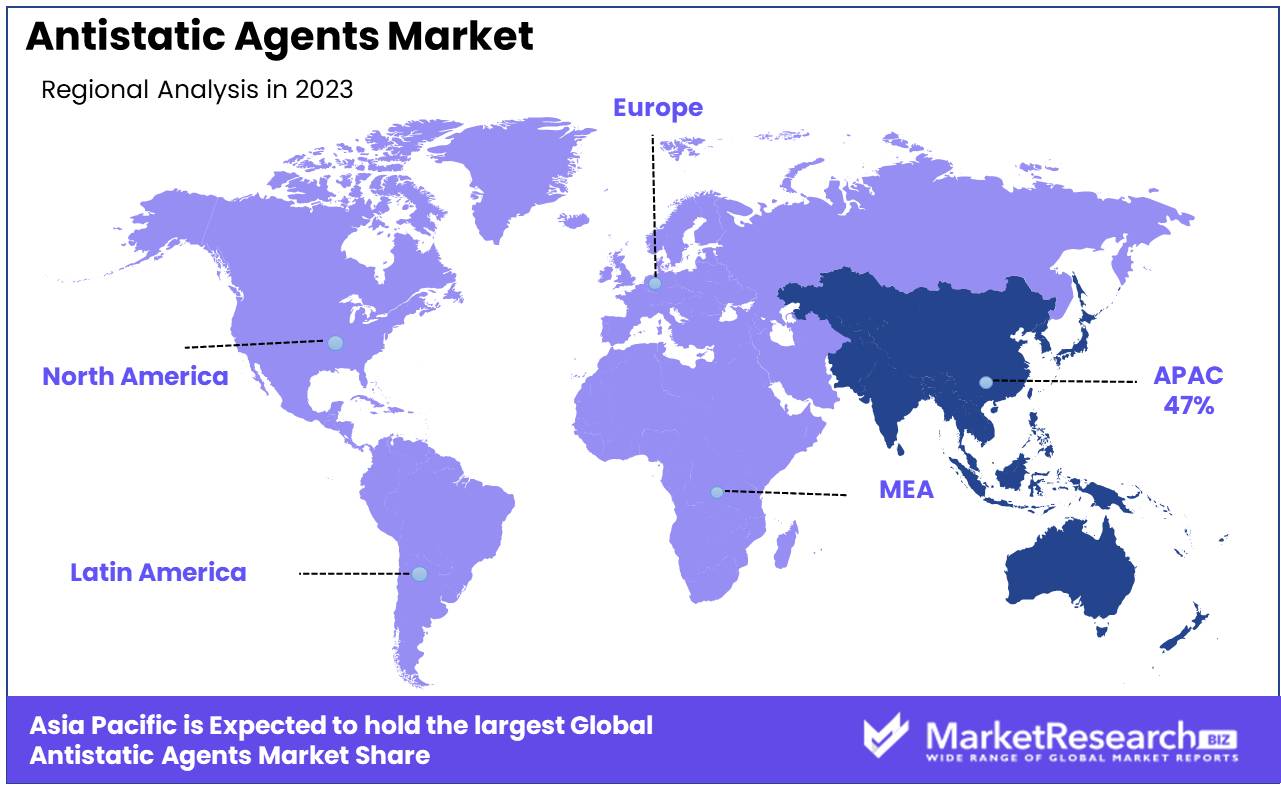

- Regional Dominance: The Asia Pacific region dominates the antistatic agents market with a notable 47% share.

- Growth Opportunity: The rising demand for electronics and advancements in packaging materials create substantial growth opportunities for the antistatic agents market.

Driving factors

Static Control Needs in Electronics

The demand for antistatic agents is significantly driven by the increasing static control needs in the electronics industry. As electronic devices become smaller and more sensitive, they are increasingly vulnerable to electrostatic discharge (ESD), which can damage components and reduce product reliability. Antistatic agents play a crucial role in mitigating these risks by preventing the buildup of static charges on surfaces and materials used in electronic assembly and packaging.

The growth is directly correlated with the rising adoption of antistatic agents to enhance product performance and reliability in electronic applications. Moreover, as innovations in electronics continue to evolve towards smaller form factors and higher functionality, the demand for advanced antistatic solutions is expected to escalate further, driving market expansion.

Packaging Sector Investments

Investments in the packaging sector are another pivotal factor fueling the growth of the antistatic agents market. Packaging materials are essential in protecting goods during storage, transportation, and display, especially in industries such as food, pharmaceuticals, and consumer electronics. Antistatic agents are crucial additives in packaging materials like films, trays, and containers, as they prevent static buildup that can attract dust, affect product aesthetics, and even pose safety risks in sensitive environments.

The packaging industry is witnessing substantial investments aimed at enhancing product shelf life, ensuring regulatory compliance, and improving sustainability. Reports indicate a steady increase in packaging expenditures worldwide, with a notable shift towards compliant antistatic agents. This trend aligns with growing consumer awareness and regulatory pressures for sustainable packaging solutions, thereby driving the market for antistatic agents that offer both performance and environmental benefits.

Eco-Friendly, Compliant Agents

The shift towards eco-friendly and compliant antistatic agents marks a significant influence on the market dynamics. Regulatory bodies worldwide are imposing stricter guidelines on chemical usage, prompting manufacturers to develop formulations that are biodegradable, non-toxic, and compliant with environmental standards. This trend is particularly evident in developed markets where consumer preferences favor sustainable products.

Companies are investing in research and development to innovate new antistatic agents derived from renewable sources or utilizing biodegradable materials. Market studies highlight a growing preference among end-users for products that not only meet performance requirements but also align with corporate sustainability goals. Manufacturers offering eco-friendly antistatic agents are gaining a competitive edge, driving market growth by capturing a larger share of environmentally conscious consumers and businesses.

Restraining Factors

Food Packaging Regulations

Food packaging regulations play a critical role in shaping the antistatic agents market, particularly in ensuring product safety, hygiene, and compliance with stringent health standards. Regulatory bodies worldwide impose strict guidelines on packaging materials to prevent contamination, extend shelf life, and maintain food quality during storage and transportation. Antistatic agents are essential additives in food packaging films and containers to prevent static buildup, which can attract dust and potentially compromise food safety.

Manufacturers in the antistatic agents market must navigate these regulations to develop formulations that meet both performance criteria and regulatory requirements. This regulatory environment drives innovation towards safer, more effective antistatic solutions that are compatible with food contact applications. As global food consumption continues to rise, particularly in emerging markets, the demand for compliant antistatic agents is expected to grow steadily, supported by ongoing advancements in packaging technology and materials science.

Oil/Gas Price Volatility

Oil and gas price volatility significantly impacts the antistatic agents market due to its influence on raw material costs and manufacturing expenses. Many antistatic agents are derived from petrochemical sources, making them sensitive to fluctuations in oil and gas prices. When energy prices rise, the cost of producing and transporting antistatic agents increases, leading to higher overall production costs for manufacturers. This cost pressure often necessitates price adjustments, which can affect market demand and profitability.

Periods of lower oil and gas prices may offer cost relief to manufacturers, potentially stimulating market growth by improving price competitiveness and affordability of antistatic products. Moreover, volatility in oil and gas prices can influence investment decisions in renewable and alternative energy sources, impacting the development of eco-friendly antistatic agents derived from bio-based or sustainable materials. As global energy markets continue to fluctuate, strategic planning and resource management become crucial for stakeholders in the antistatic agents market to navigate cost dynamics effectively and maintain competitive positioning.

By Form Analysis

In the Antistatic Agents Market, liquid forms hold a notable 38% share.

In 2023, Liquid held a dominant market position in the By Form segment of the Antistatic Agents Market, capturing more than a 38% share. This segment's leadership underscores the widespread preference for liquid antistatic agents due to their ease of application, versatility in formulation, and effectiveness in mitigating static electricity across various industries. Liquid antistatic agents are favored for their ability to be easily incorporated into manufacturing processes, ensuring uniform distribution and consistent performance in preventing static buildup on surfaces of plastics, textiles, electronics, and packaging materials.

Powder emerged as another significant segment within the Antistatic Agents Market's By Form category, holding a substantial market share exceeding 27%. Powdered antistatic agents are valued for their ability to provide localized treatment and precise application in specific manufacturing processes where liquid formulations may not be suitable. These agents offer flexibility in handling and storage, catering to industries requiring controlled static dissipation in sensitive environments and applications.

Pellets represent a niche yet growing segment in the Antistatic Agents Market, characterized by their solid form and controlled release properties. Pelletized antistatic agents are designed for applications requiring prolonged effectiveness and sustained antistatic protection in polymers, films, and molded products. This segment appeals to manufacturers seeking durable and efficient solutions to minimize static electricity during processing and handling of materials.

Microbeads, though smaller in market share compared to liquid and powder forms, offer specialized antistatic capabilities in niche applications such as electronics manufacturing and specialty coatings. Microbead antistatic agents provide enhanced surface modification and durability, contributing to improved product performance and reliability in static-sensitive environments.

By Product Analysis

Quaternary ammonium compounds are the most prominent product type in the antistatic agents market, representing 33% of the market share

In 2023, Quaternary ammonium compounds held a dominant market position in the By Product segment of the Antistatic Agents Market, capturing more than a 33% share. This segment's leadership underscores the widespread adoption of quaternary ammonium compounds (QACs) due to their effectiveness, versatility, and compatibility with various materials across industries requiring static control solutions. QACs function by modifying surface properties to reduce static electricity buildup on plastics, textiles, and electronics, making them integral to manufacturing processes where static dissipation is critical for product quality and performance.

Ethoxylated Fatty Acid Amines emerged as another significant segment within the Antistatic Agents Market's By Product category, holding a substantial market share exceeding 25%. These compounds are valued for their surfactant properties and ability to reduce surface tension, enhancing antistatic performance and compatibility in diverse applications such as detergents, coatings, and industrial processes.

Glycerol Monostearate represents a niche yet growing segment in the Antistatic Agents Market, characterized by its emulsifying and antistatic properties. This compound is utilized in food packaging, pharmaceuticals, and personal care products to prevent static cling and improve handling characteristics of materials.

Alkylsulfonates, though smaller in market share compared to QACs and ethoxylated fatty acid amines, offer specialized antistatic properties and surface-active characteristics in industrial applications. These compounds provide effective static control solutions in formulations for paints, adhesives, and coatings, enhancing product performance and durability.

Diethanolamides and Other segments encompass a variety of specialized antistatic agents tailored to specific industry needs and applications. Diethanolamides are valued for their stability and compatibility in formulations requiring foam stabilization and static control in detergents and personal care products.

By Polymer Analysis

Polypropylene (PP) is the dominant polymer used in the antistatic agents market, constituting 28% of materials employed.

In 2023, Polypropylene (PP) held a dominant market position in the By Polymer segment of the Antistatic Agents Market, capturing more than a 28% share. This segment's leadership underscores the extensive use of polypropylene in diverse industries such as packaging, automotive, electronics, and textiles, where static electricity management is crucial for product quality and safety. Polypropylene's popularity is attributed to its favorable properties such as lightweight, durability, chemical resistance, and ease of processing, making it an ideal material for applications requiring antistatic performance.

Acrylonitrile Butadiene Styrene (ABS) emerged as another significant segment within the Antistatic Agents Market's By Polymer category, holding a substantial market share exceeding 22%. ABS polymers are valued for their high impact strength, heat resistance, and dimensional stability, making them suitable for applications in consumer electronics, appliances, and automotive interiors where static control is essential for product reliability and performance.

Polyethylene (PE) represents a diverse segment in the Antistatic Agents Market, characterized by its versatility, flexibility, and widespread use in packaging, construction, and agricultural applications. PE polymers benefit from antistatic additives that enhance their performance in preventing static buildup and maintaining product integrity during handling and transportation.

Polyethylene Terephthalate (PET) holds a niche yet growing market share in the Antistatic Agents Market, particularly in the packaging and textiles sectors. PET polymers are recognized for their transparency, barrier properties, and recyclability, with antistatic treatments enhancing their suitability for sensitive electronic components and food packaging applications.

Polyvinyl Chloride (PVC) maintains a significant presence in the Antistatic Agents Market, leveraging its affordability, versatility, and flame retardant properties in construction, healthcare, and consumer goods industries. Antistatic additives in PVC formulations reduce static electricity, ensuring product safety, cleanliness, and durability in diverse applications such as flooring, medical devices, and electrical insulation.

Other polymers encompass a variety of specialized materials and formulations tailored to specific industry needs and applications within the Antistatic Agents Market. These include polycarbonates, polyamides, and specialty thermoplastics that contribute to innovative solutions for static electricity management in advanced materials, electronics, and industrial sectors.

By End-Use Analysis

The electronics sector is the largest end-use industry for antistatic agents, accounting for 27% of consumption

In 2023, Electronics held a dominant market position in the By End-Use segment of the Antistatic Agents Market, capturing more than a 27% share. This segment's leadership underscores the critical role of antistatic agents in ensuring the reliability, functionality, and longevity of electronic components and devices. Electronics manufacturers rely on antistatic agents to mitigate static electricity, which can damage sensitive electronic circuits during production, assembly, and transportation. Antistatic agents help maintain electrostatic discharge (ESD) control in cleanroom environments, semiconductor fabrication facilities, and electronics assembly lines, ensuring product quality and operational reliability.

Packaging emerged as another significant segment within the Antistatic Agents Market's By End-Use category, holding a substantial market share exceeding 23%. Antistatic agents in packaging materials prevent static buildup on surfaces of plastic films, trays, and containers, reducing dust attraction, improving handling efficiency, and preserving product quality during storage and distribution.

Automotive applications represent a diverse segment in the Antistatic Agents Market, characterized by their use in interior components, dashboard assemblies, and automotive electronics. Antistatic agents play a key role in automotive materials such as plastics, textiles, and coatings to minimize static-related issues, enhance driver comfort, and ensure the reliable operation of electronic systems and sensors in vehicles.

Textiles hold a significant presence in the Antistatic Agents Market, leveraging these agents to improve comfort, performance, and safety in apparel, upholstery, and industrial fabrics. Antistatic treatments in textiles reduce static cling, enhance wearer comfort, and prevent static-related hazards in workplace environments, contributing to product durability and consumer satisfaction.

The Military sector maintains a specialized segment within the Antistatic Agents Market, focusing on applications in defense equipment, uniforms, and electronic devices. Antistatic agents play a critical role in military applications by ensuring operational readiness, reliability of communication systems, and protection of sensitive electronic equipment in challenging environments.

Other end-use segments encompass a variety of specialized applications and industries where static electricity management is essential for operational efficiency and product performance. These include healthcare equipment, aerospace components, and industrial machinery, where antistatic agents contribute to safety, reliability, and compliance with stringent industry standards.

Key Market Segments

By Form

- Liquid

- Powder

- Pellets

- Microbeads

- Others

By Product

- Ethoxylated Fatty Acid Amines

- Glycerol Monostearate

- Alkylsulfonates

- Quaternary ammonium compounds

- Diethanolamides

- Others

By Polymer

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Others

By End-Use

- Packaging

- Electronics

- Automotive

- Textiles

- Military

- Others

Growth Opportunity

Large-Scale Plastic Adoption Driving Demand

The proliferation of plastics in diverse applications continues to fuel demand for antistatic agents. As industries such as packaging, automotive, electronics, and aerospace increasingly rely on plastic materials for their lightweight, durable, and cost-effective properties, the need for effective static control measures becomes paramount. Antistatic agents play a crucial role in enhancing the performance and longevity of plastic products by preventing static buildup, which can otherwise impair functionality and aesthetics.

This trend is reinforced by statistics indicating robust growth in global plastic consumption, projected to reach over 600 million metric tons annually by 2025. As a result, the market for antistatic agents is expected to expand significantly, driven by the escalating adoption of plastics across diverse end-use sectors.

Demand Surge in Automotive, Electronics, and Aerospace

The automotive, electronics, and aerospace industries represent key growth sectors for the antistatic agents market in 2024. In automotive manufacturing, antistatic agents are integral to enhancing the durability and reliability of interior components and electronic systems. With the automotive sector rebounding from global supply chain disruptions, demand for antistatic solutions is projected to rise, supported by increasing vehicle production and technological advancements in electric and autonomous vehicles.

In the electronics industry, where static control is critical to safeguarding sensitive components from electrostatic discharge (ESD), the demand for high-performance antistatic agents continues to grow. Moreover, the aerospace sector relies on antistatic agents to maintain safety and operational efficiency in aircraft manufacturing and maintenance, further driving market expansion.

Latest Trends

Textile High-Speed Process Adoption

One of the prominent trends in the antistatic agents market is the increasing adoption of high-speed processes in textile manufacturing. As textile production evolves towards faster and more efficient machinery, the risk of static buildup also intensifies, particularly in synthetic fibers and yarns. Antistatic agents play a crucial role in mitigating these challenges by ensuring consistent fiber quality, reducing processing defects, and enhancing overall operational efficiency.

This trend is supported by statistics indicating substantial growth in global textile production, driven by rising consumer demand for apparel and technical textiles. As textile manufacturers seek to optimize production capabilities while maintaining product integrity, the demand for specialized antistatic solutions tailored to high-speed processes is expected to grow significantly.

Antistatic Coatings for Various Applications

Another notable trend is the expanding use of antistatic coatings across a wide range of applications beyond traditional sectors. Antistatic coatings offer versatile solutions for reducing static electricity on surfaces such as packaging materials, electronic devices, automotive components, and industrial equipment. These coatings not only enhance product performance by preventing dust attraction and electrostatic discharge but also contribute to improving operational safety and reliability.

With advancements in coating technologies and formulations, there is a growing emphasis on developing environmentally friendly and durable antistatic coatings that comply with regulatory standards. This trend aligns with increasing consumer preferences for sustainable and high-performance materials across various industries, driving innovation and market expansion for antistatic agents globally.

Regional Analysis

Asia Pacific leads the global antistatic agents market with a significant 47% share, driven by its large-scale manufacturing sector

The antistatic agents market is characterized by distinct regional trends, shaped by varying industrial demands, regulatory environments, and technological advancements. Asia Pacific dominates the global market, holding a commanding 47% share, primarily driven by the region’s expansive manufacturing sector. The region's rapid industrialization, coupled with increasing investments in advanced manufacturing technologies, propels the demand for antistatic agents.

In North America, the antistatic agents market is experiencing steady growth, with the United States and Canada at the forefront. The region's market is driven by strong demand from the electronics, automotive, and aerospace sectors. North America's focus on high-performance materials and stringent regulatory standards ensure the widespread adoption of antistatic agents to meet safety and performance requirements.

Europe follows closely, with countries like Germany, France, and the UK leading the market. The region’s demand for antistatic agents is driven by its well-established automotive and electronics industries. Europe’s stringent regulations on safety and environmental impact promote the use of high-quality antistatic agents.

The Middle East & Africa region shows promising growth potential, particularly in the packaging and electronics sectors. The UAE and South Africa are notable markets within this region, benefiting from increasing industrial activities and a growing focus on quality and safety standards.

Latin America is gradually emerging as a potential market for antistatic agents, with Brazil and Mexico being key contributors. The region’s growth is supported by an expanding manufacturing base, particularly in the automotive and consumer electronics sectors.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global antistatic agents market is poised for robust growth, driven by increasing demand across various industries such as electronics, packaging, textiles, and automotive. Key players in this market demonstrate diverse capabilities and strategic initiatives to capitalize on this growth.

Solvay S.A. and BASF SE are prominent in the market, leveraging their extensive research and development capabilities to innovate and expand their portfolio of antistatic agents. Their global presence and strong customer relationships enable them to meet the evolving needs of industries seeking effective static control solutions.

Croda International PLC. and Nouryon emphasize sustainability and performance in their antistatic agent offerings. Their focus on bio-based and eco-friendly formulations resonates well with environmentally conscious industries, driving adoption and market penetration.

PolyOne Corporation and Evonik Industries AG specialize in polymer additives, including antistatic agents, catering to the packaging and automotive sectors. Their technological expertise and customization capabilities enable them to deliver tailored solutions that enhance product performance and reliability.

Clariant and Arkema excel in specialty chemicals, offering a wide range of antistatic agents that address specific industry requirements. Their commitment to innovation and strategic partnerships strengthens their position in the competitive market landscape.

Riken Vitamin Co. Ltd., Kao Group, Mitsubishi Chemical Corporation, and DowDuPont bring significant expertise from diverse sectors, contributing advanced technologies and global market reach to the antistatic agents market.

Market Key Players

- Solvay S.A.

- Croda International PLC.

- PolyOne Corporation

- BASF SE

- Nouryon

- Clariant

- Riken Vitamin Co. Ltd.

- Kao Group

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- DowDuPont

- Arkema

Recent Development

- In May 2024, Dow introduced eco-friendly antistatic solutions for electronics, aiming to reduce carbon footprint and improve product performance.

- In June 2023, BASF launched innovative antistatic agents for polymers, enhancing conductivity and durability in packaging materials.

Report Scope

Report Features Description Market Value (2023) USD 559.9 Mn Forecast Revenue (2033) USD 1063.4 Mn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder, Pellets, Microbeads, Others), By Product (Ethoxylated Fatty Acid Amines, Glycerol Monostearate, Alkylsulfonates, Quaternary ammonium compounds, Diethanolamides, Others), By Polymer (Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Polyethylene (PE), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Others), By End-Use (Packaging, Electronics, Automotive, Textiles, Military, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Solvay S.A., Croda International PLC., PolyOne Corporation, BASF SE, Nouryon, Clariant, Riken Vitamin Co. Ltd., Kao Group, Evonik Industries AG, Mitsubishi Chemical Corporation, DowDuPont, Arkema Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Solvay S.A.

- Croda International PLC.

- PolyOne Corporation

- BASF SE

- Nouryon

- Clariant

- Riken Vitamin Co. Ltd.

- Kao Group

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- DowDuPont

- Arkema