Antimicrobial Powder Coating Market By Material (Silver, Copper, Polymeric, Organic, Other materials), By Application (Building & Construction, Food Processing, Textiles, Home Appliances, Healthcare, Marine, Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49643

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

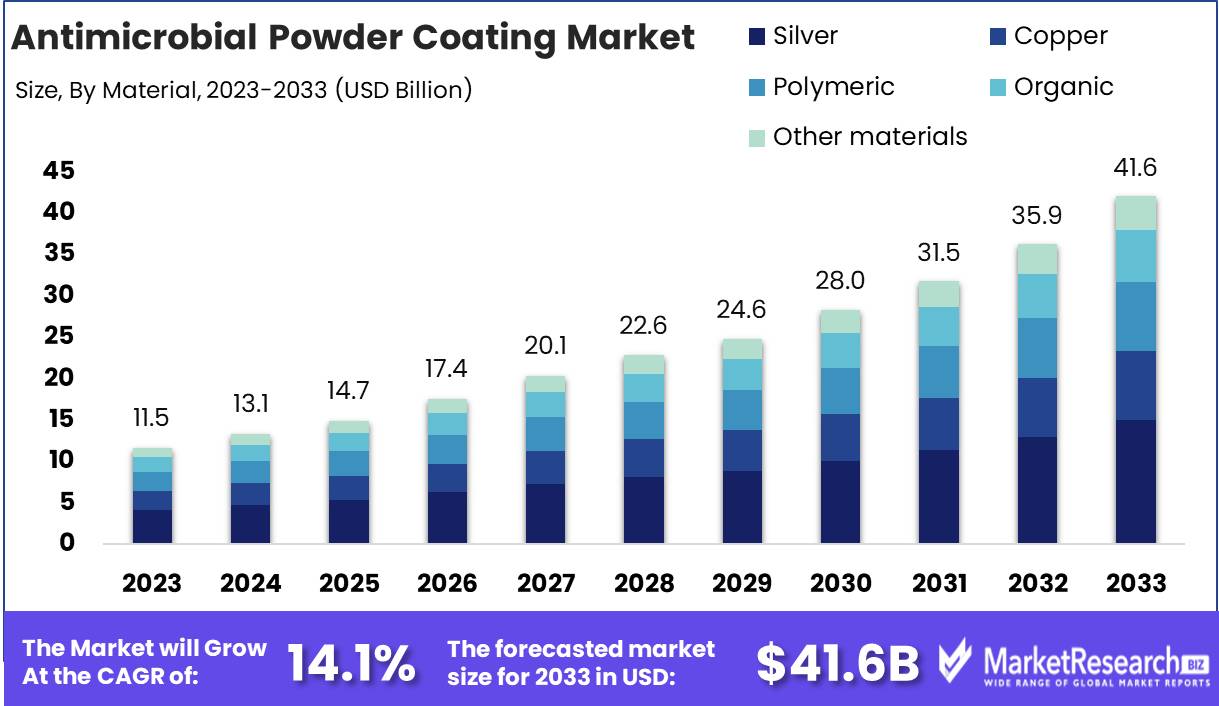

The Antimicrobial Powder Coating Market was valued at USD 11.5 billion in 2023. It is expected to reach USD 41.6 billion by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

The Antimicrobial Powder Coating Market encompasses advanced surface treatments designed to inhibit the growth of microbes such as bacteria, fungi, and mold on various substrates. These coatings are integral to sectors prioritizing hygiene and safety, including healthcare, food processing, and HVAC systems. The market is driven by stringent health regulations and a growing awareness of biosecurity. Antimicrobial powder coatings not only extend the functional life of treated surfaces but also play a crucial role in public health by reducing microbial contamination. This market is evolving with innovations in material science, catering to the increasing demand for durable and effective antimicrobial solutions.

The Antimicrobial Powder Coating Market is poised for significant growth, driven by a heightened global awareness of health and hygiene, particularly spotlighted by the recent COVID-19 pandemic. This has amplified the demand across various industries, including healthcare, food processing, and public infrastructure, which are now under stringent mandates to maintain high standards of sanitation and cleanliness. The incorporation of antimicrobial properties in coatings ensures long-term surface protection against pathogens, aligning with government regulations aimed at enhancing public safety.

However, the adoption of antimicrobial powder coatings is tempered by several challenges. The high costs associated with the development and application of advanced coating technologies pose a significant barrier for many businesses, particularly small to medium enterprises.

Additionally, the process of achieving regulatory compliance and obtaining necessary certifications for these specialized coatings is often rigorous and time-consuming. Despite these hurdles, the long-term benefits such as reduced microbial spread and lower health-related liabilities support a strong business case for investment in this market. As organizations continue to prioritize health and safety, the demand for antimicrobial coatings is expected to remain robust, fostering innovation and technological advancements in the field.

Key Takeaways

- Market Growth: The Antimicrobial Powder Coating Market was valued at USD 11.5 billion in 2023. It is expected to reach USD 41.6 billion by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

- By Material: Silver dominates the Antimicrobial Powder Coating Market with robust properties.

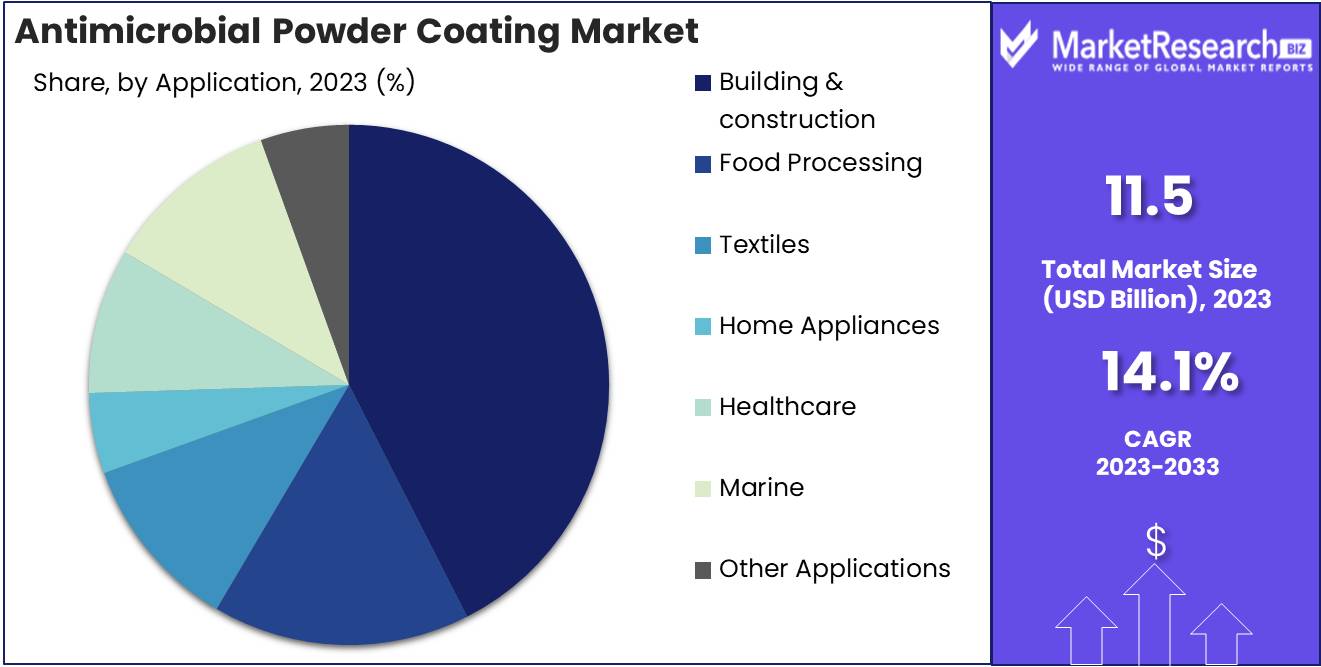

- By Application: Building & Construction dominates Antimicrobial Powder Coating Market applications.

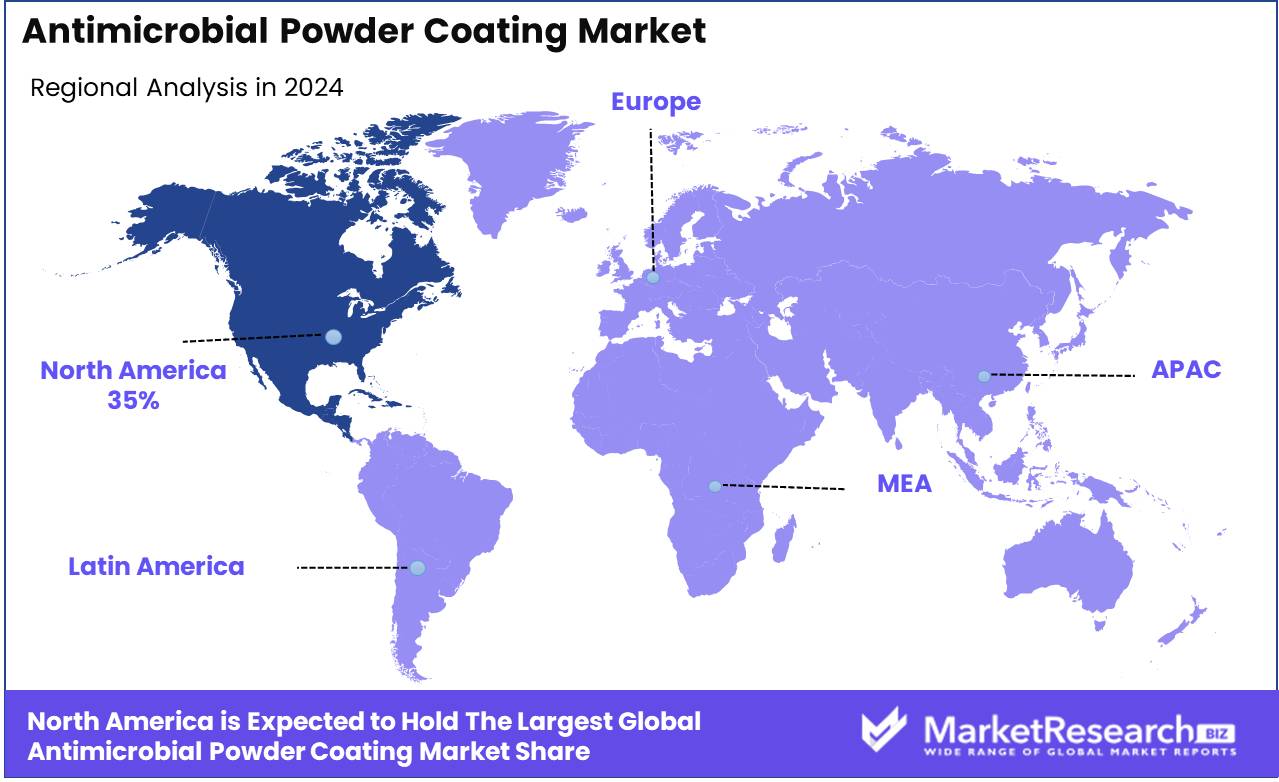

- Regional Dominance: North America leads with a 35% largest market share in antimicrobial coatings.

- Growth Opportunity: The antimicrobial powder coating market is set to grow, driven by demands in food processing and rising hygiene awareness.

Driving factors

Increasing Demand for Antimicrobial Coatings in the Healthcare and Medical Industries

The healthcare and medical industries have experienced a significant rise in the demand for antimicrobial powder coatings. This increase is driven by the heightened awareness and stringent regulations regarding hygiene and infection control within medical facilities. Antimicrobial coatings are critical in reducing the transmission of harmful microorganisms on surfaces such as medical devices, hospital beds, and other high-touch areas. According to a recent market study, the healthcare sector accounted for approximately 40% of the total demand for antimicrobial powder coatings, underscoring its pivotal role in market expansion.

Growing Market for Indoor Air Quality Products

The rising concern over indoor air quality (IAQ) has led to an increased use of antimicrobial powder coatings in HVAC systems, air purifiers, and ventilation systems. As people spend more time indoors, the need for cleaner and healthier indoor air has become more pronounced. Antimicrobial coatings help to inhibit the growth of mold, bacteria, and other pathogens on the surfaces of these systems, thereby improving air quality and reducing the risk of respiratory illnesses. This trend is further supported by stringent regulations and standards for IAQ in residential, commercial, and industrial buildings, contributing significantly to market growth.

Rising Applications of Antimicrobial Coatings in Plastic Packaging

The application of antimicrobial powder coatings in plastic packaging is expanding due to the increasing demand for longer shelf-life and safer packaging solutions in the food and beverage industry. Antimicrobial coatings prevent the growth of bacteria and fungi on packaging surfaces, enhancing the safety and quality of packaged goods. This trend is particularly evident in the food packaging segment, projected to grow at a CAGR of 8% over the next five years. The growing consumer preference for hygienic and contamination-free products drives the adoption of antimicrobial coatings in this sector, further propelling market growth.

Restraining Factors

Stringent Government Regulations: Regulatory Hurdles as a Restraint and Driver

Government regulations on the use of chemicals and materials in powder coatings have a profound impact on the antimicrobial powder coating market. These regulations can often act as a double-edged sword. On one hand, stringent environmental and safety standards may limit the use of certain hazardous substances, which can restrict market growth by increasing compliance costs and delaying product launches. For instance, regulations such as REACH in Europe and similar standards in the US mandate rigorous testing and reporting, which can prolong the time to market and increase the expense involved in product development.

On the other hand, these regulations also drive innovation within the industry. As manufacturers seek to comply with strict guidelines, there is a push towards developing safer, more environmentally friendly antimicrobial coatings. This regulatory pressure can thus indirectly foster market growth by encouraging the adoption of advanced, compliant technologies and materials that meet or exceed regulatory standards. As companies innovate to stay compliant, they create more effective and safer products that can penetrate new market segments, thereby expanding the overall market base.

High Production Costs: Economic Constraints Limiting Market Expansion

The high production costs associated with manufacturing antimicrobial powder coatings significantly impact market growth. These costs are driven by several factors, including the price of raw materials, particularly specialty chemicals that are essential for imparting antimicrobial properties, and the technology required to incorporate these properties into coatings effectively. Moreover, the processes involved in ensuring that coatings are durable, effective, and consistently of high quality can further elevate expenses.

These high costs can restrain market growth by limiting the affordability and accessibility of antimicrobial powder coatings, particularly in cost-sensitive markets. Small and medium-sized enterprises (SMEs) may find it particularly challenging to adopt these coatings due to the high upfront investment required. Consequently, the market might experience slower growth rates in regions or sectors where cost constraints are more pronounced.

By Material Analysis

Silver dominates the Antimicrobial Powder Coating Market with robust properties.

In 2023, Silver held a dominant market position in the "By Material" segment of the Antimicrobial Powder Coating Market. Known for its robust antimicrobial properties, silver has been widely utilized in coatings to prevent the growth of bacteria, fungi, and algae on various surfaces, making it highly valued across healthcare, food processing, and HVAC industries. Following silver, copper is another key material used in this market due to its natural antimicrobial characteristics which are effective against a broad spectrum of microorganisms, thus enhancing the lifespan and safety of coated products.

Polymeric materials also play a significant role in this sector. These coatings incorporate antimicrobial agents into a polymer matrix, offering durability and effective microbial resistance, suitable for use in environments requiring stringent hygiene standards. Organic materials, though less common, are sought after for their environmental benefits and lower toxicity, catering to the rising demand for sustainable solutions in coatings.

Lastly, the "Other materials" category includes various innovative composites and specialized substances designed to meet specific industry needs, such as resistance to extreme conditions and tailored microbial target spectra. These materials are integral to expanding the application range of antimicrobial powder coatings, driving further innovations and adoption in diverse industries.

By Application Analysis

Building & Construction dominates Antimicrobial Powder Coating Market applications.

In 2023, The Building & Construction sector held a dominant market position in the "By Application" segment of the Antimicrobial Powder Coating Market. This prominence can be attributed to the increased emphasis on sanitary building materials and the rising adoption of coatings that reduce microbial growth in public spaces and hospitals. Following closely, the Food Processing industry significantly integrates antimicrobial powder coatings to ensure hygiene and prevent contamination, critical in processing and packaging facilities. In the Textile sector, these coatings are applied to fabrics to inhibit microbial growth, enhancing the durability and hygiene of the finished products, which is especially valued in healthcare and consumer applications.

Home Appliances also benefit from antimicrobial powder coatings, as they help maintain surface cleanliness and durability in appliances frequently exposed to moisture and touch. The Healthcare sector's usage underscores the necessity for sterile environments, applying these coatings in various medical devices and hospital infrastructures.

In Marine applications, these coatings protect against harsh marine environments, preventing algae and bacterial growth that can corrode surfaces. Lastly, Other Applications across various industries employ these coatings for their protective qualities and to enhance the longevity and safety of their products. Each application area showcases the versatility and essential role of antimicrobial powder coatings in modern industry practices.

Key Market Segments

By Material

- Silver

- Copper

- Polymeric

- Organic

- Other materials

By Application

- Building & construction

- Food Processing

- Textiles

- Home Appliances

- Healthcare

- Marine

- Other Applications

Growth Opportunity

Expansion in Food Processing

The global antimicrobial powder coating market is poised for significant expansion, driven by burgeoning demand within the food processing industry. As food producers increasingly focus on the safety and longevity of their products, the application of antimicrobial coatings is becoming a strategic imperative. These coatings are crucial for preventing the growth of bacteria, molds, and fungi on various food-contact surfaces, thereby extending the shelf life of food products and enhancing food safety. The expansion of the food processing sector, particularly in emerging economies, offers a fertile ground for the adoption of advanced antimicrobial solutions, underscoring a major growth opportunity for the market.

Rising Awareness of Hygiene

Parallel to industrial demand, consumer awareness regarding hygiene and the environment is catalyzing the market's growth. In the wake of global health crises, there is a heightened consumer and regulatory focus on hygiene standards in both public and private spaces. Antimicrobial powder coatings are increasingly utilized in high-contact areas such as hospitals, schools, and public transport systems to prevent the spread of pathogens. This surge in hygiene consciousness is expected to drive demand across various end-use sectors, further amplifying market growth.

Latest Trends

Construction Industry Adoption

The antimicrobial powder coating market is witnessing significant growth within the construction sector. This surge can be attributed to heightened health and safety standards, especially in public infrastructure and healthcare facilities. The intrinsic property of these coatings to inhibit the growth of bacteria, mold, and fungi makes them particularly valuable in environments demanding stringent hygiene.

Moreover, the trend towards sustainable building practices has fostered the integration of these coatings, as they contribute to longer material lifespans and reduced maintenance costs. The expanding urban infrastructure in emerging economies further catalyzes this trend, with substantial investments directed toward hospital, school, and public transportation projects incorporating antimicrobial solutions to ensure public health safety.

Consumer Products Influence

In the consumer products sector, antimicrobial powder coatings are increasingly becoming a standard feature, especially in appliances, electronics, and fixtures. The ongoing COVID-19 pandemic aftermath has permanently altered consumer behavior, with a pronounced shift towards hygiene-centric products. Manufacturers are responding by embedding antimicrobial properties in everyday products to meet consumer demands for healthier living environments. This trend is particularly strong in high-contact items such as door handles, kitchen appliances, and personal devices, which are now frequently being treated with antimicrobial coatings to prevent the spread of pathogens. This shift not only enhances product functionality but also serves as a competitive differentiator in the crowded consumer goods market. The increasing consumer awareness and preference for antimicrobial products are poised to drive robust growth in this segment throughout.

Regional Analysis

North America leads with a 35% largest market share in antimicrobial coatings.

The Antimicrobial Powder Coating Market demonstrates varied performance across key global regions. In North America, the market is experiencing significant growth, driven by heightened awareness regarding hygiene and the increasing adoption of antimicrobial coatings in healthcare, food processing, and HVAC systems. This region dominates the market with approximately 35% largest share, underscored by robust technological advancements and stringent regulatory standards promoting antimicrobial applications.

Moving to Europe, the market is driven by a strong demand in the healthcare sector and increasing regulations for antimicrobial coatings in public and private spaces. Innovations in eco-friendly and sustainable coatings are further catalyzing market growth.

In Asia Pacific, the market is expanding rapidly due to the growing healthcare infrastructure and rising standards of living. This region is witnessing a surge in demand for antimicrobial coatings from the construction and food safety sectors, making it a rapidly emerging market.

The Middle East & Africa and Latin America are experiencing gradual growth in the antimicrobial powder coatings market. Factors such as increasing urbanization and the expansion of healthcare facilities contribute to this growth, though at a slower pace compared to North America and Asia Pacific. These regions are focusing on improving healthcare standards, which in turn boosts the demand for antimicrobial solutions in various applications.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global Antimicrobial Powder Coating Market, 2024 sees a competitive landscape where major players are actively expanding their market presence through strategic innovations and alliances. Companies like AkzoNobel N.V., and Axalta Coating Systems are at the forefront, leveraging their extensive R&D capabilities to introduce advanced, eco-friendly coatings that meet the increasing regulatory demands for safer and more sustainable products.

PPG Industries, Inc., and The Sherwin-Williams Company, both with strong global footprints, are enhancing their product portfolios through acquisitions and collaborations, aiming to offer comprehensive solutions across various industries including healthcare, food processing, and construction. This strategy not only broadens their market reach but also reinforces their brand position as a leader in antimicrobial solutions.

Meanwhile, companies like DuPont and Nippon Paint Holdings Co., Ltd. focus on the integration of nanotechnology and biotechnology to develop coatings that provide long-lasting antimicrobial protection without compromising the environmental or aesthetic aspects. Their innovations are particularly significant in sectors that demand stringent hygiene standards.

Emerging players like Burke Industrial Coatings and Troy Corporation are also making notable strides by targeting niche markets with specialized products, thus enhancing their competitive edge.

Collectively, these key players are driving the market's growth by focusing on technological advancements, strategic partnerships, and a deep understanding of the diverse needs of their customers. This dynamic approach is crucial in adapting to the evolving market trends and customer expectations in the antimicrobial powder coatings industry.

Market Key Players

- AkzoNobel N.V.

- AK Steel Corp.

- Lonza

- Diamond Vogel

- DuPont

- Axalta Coating Systems

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Koninklijke DSM N.V.

- Burke Industrial Coatings

- The Sherwin-Williams Company

- Troy Corporation

Recent Development

- In June 2024, Sherwin-Williams launched a new line of eco-friendly antimicrobial powder coatings. These coatings not only inhibit microbial growth but also reduce the environmental impact by utilizing sustainable raw materials and manufacturing processes. The initiative aligns with global sustainability goals and addresses the increasing demand for green building materials.

- In April 2024, PPG Industries acquired a specialty coatings company, BioCoat Solutions, to expand its antimicrobial coatings portfolio. This strategic move is expected to strengthen PPG’s position in the market, providing advanced solutions for sectors requiring stringent hygiene standards, including food processing and medical device manufacturing.

- In March 2024, AkzoNobel introduced an innovative range of antimicrobial powder coatings aimed at enhancing surface hygiene in high-touch environments such as healthcare facilities and public transport. The new product line leverages advanced silver ion technology to offer long-lasting protection against a wide range of microorganisms.

Report Scope

Report Features Description Market Value (2023) USD 11.5 Billion Forecast Revenue (2033) USD 41.6 Billion CAGR (2024-2032) 14.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Silver, Copper, Polymeric, Organic, Other materials), By Application (Building & Construction, Food Processing, Textiles, Home Appliances, Healthcare, Marine, Other Applications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AkzoNobel N.V., AK Steel Corp., Lonza, Diamond Vogel, DuPont, Axalta Coating Systems, Nippon Paint Holdings Co., Ltd., PPG Industries, Inc., RPM International Inc., Koninklijke DSM N.V., Burke Industrial Coatings, The Sherwin-Williams Company, Troy Corporation Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AkzoNobel N.V.

- AK Steel Corp.

- Lonza

- Diamond Vogel

- DuPont

- Axalta Coating Systems

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Koninklijke DSM N.V.

- Burke Industrial Coatings

- The Sherwin-Williams Company

- Troy Corporation