Animal Vaccine Market By Product (Attenuated Live, Recombinant, DNA, Inactivated, Subunit), By Animal Type (Livestock, Poultry, Aqua, Reptiles, Insects, Swine, Canine, Feline), By Route of Administration (Subcutaneous Administration, Intramuscular Administration, Intranasal Administration), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46652

-

May 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

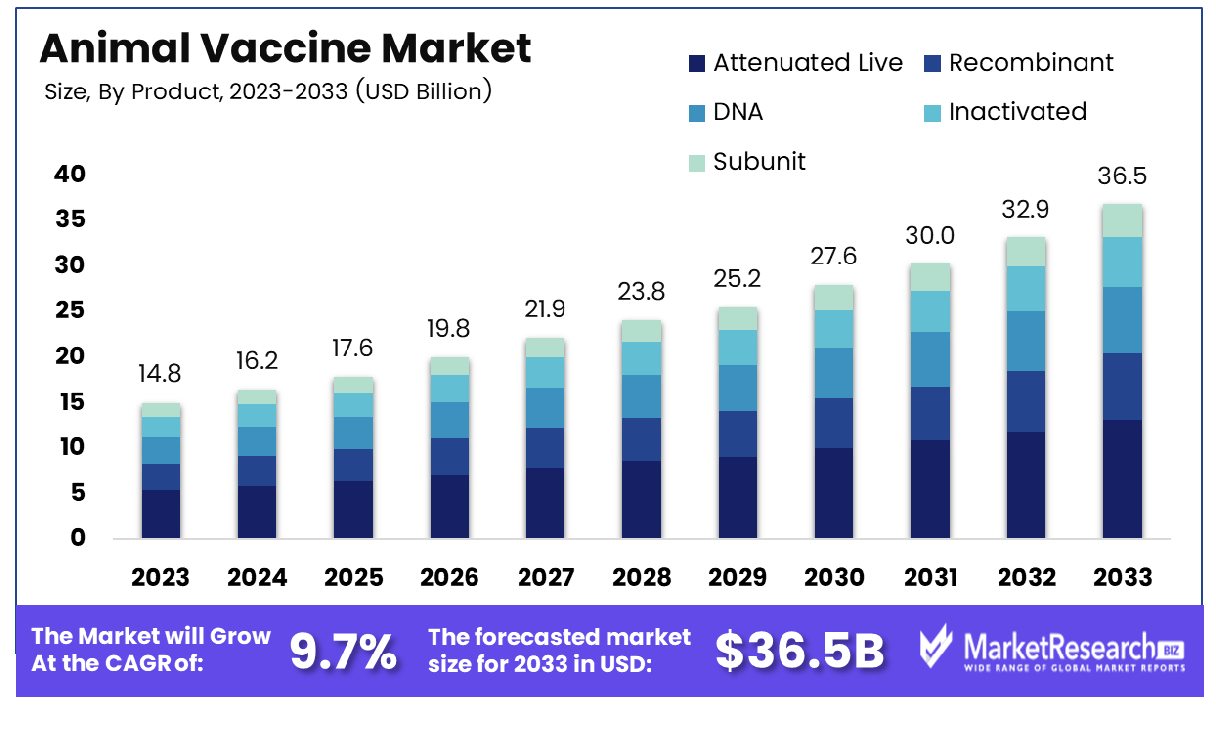

The Global Animal Vaccine Market was valued at USD 14.8 Bn in 2023. It is expected to reach USD 36.5 Bn by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

The Animal Vaccine Market encompasses the dynamic landscape of pharmaceuticals designed to prevent and treat diseases among animals, safeguarding their health and bolstering agricultural productivity. This market segment caters to diverse sectors including livestock farming, companion animal care, and wildlife conservation. It integrates cutting-edge biotechnologies, extensive research, and stringent regulatory standards to develop efficacious vaccines tailored to specific animal species and regional disease profiles. As global demand for safe food production escalates and concerns about zoonotic diseases rise, the Animal Vaccine Market assumes paramount importance, driving innovation, sustainability, and resilience across the animal health ecosystem.

The Animal Vaccine Market continues to exhibit robust growth trajectories driven by escalating demand for enhanced animal health solutions amidst evolving agricultural practices and heightened concerns about zoonotic diseases. Recent industry developments underscore this trajectory, with notable advancements amplifying market dynamics. For instance, Boehringer Ingelheim India's launch of the single-shot poultry vaccine, VAXXITEK HVT+IBD, in 2021, marks a significant milestone in combating infectious diseases in poultry, addressing industry challenges such as efficacy and ease of administration. This innovative solution not only enhances poultry health but also streamlines vaccination processes, offering efficiency gains for producers.

The Animal Vaccine Market continues to exhibit robust growth trajectories driven by escalating demand for enhanced animal health solutions amidst evolving agricultural practices and heightened concerns about zoonotic diseases. Recent industry developments underscore this trajectory, with notable advancements amplifying market dynamics. For instance, Boehringer Ingelheim India's launch of the single-shot poultry vaccine, VAXXITEK HVT+IBD, in 2021, marks a significant milestone in combating infectious diseases in poultry, addressing industry challenges such as efficacy and ease of administration. This innovative solution not only enhances poultry health but also streamlines vaccination processes, offering efficiency gains for producers.Automazioni VX, Inc. formed a partnership with Merck Animal Health in 2021 to introduce a new subcutaneous chick vaccination technology called Innoject Pro, a novel subcutaneous chick vaccination technology, exemplify the industry's commitment to innovation and technological advancement. This collaboration leverages Merck Animal Health's expertise in animal health solutions with Automazioni VX, Inc.'s cutting-edge vaccination technology, aiming to revolutionize chick vaccination practices. The introduction of Innoject Pro signifies a paradigm shift towards more efficient, precise, and user-friendly vaccination methods, catering to the evolving needs of poultry producers and driving market expansion.

As the Animal Vaccine Market continues its upward trajectory, fueled by technological innovation, strategic partnerships, and increasing awareness about animal health, stakeholders must remain vigilant to capitalize on emerging opportunities and navigate evolving regulatory landscapes. The convergence of advancements in biotechnology, data analytics, and regulatory frameworks presents avenues for transformative growth and industry leadership.

Key Takeaways

- Market Value: The Global Animal Vaccine Market was valued at USD 14.8 Bn in 2023. It is expected to reach USD 36.5 Bn by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

- By Product: Attenuated live vaccines dominate this segment, capturing approximately 40% of the market share.

- By Animal Type: Livestock Vaccines for livestock animals are the dominant segment, holding approximately 30% of the market share.

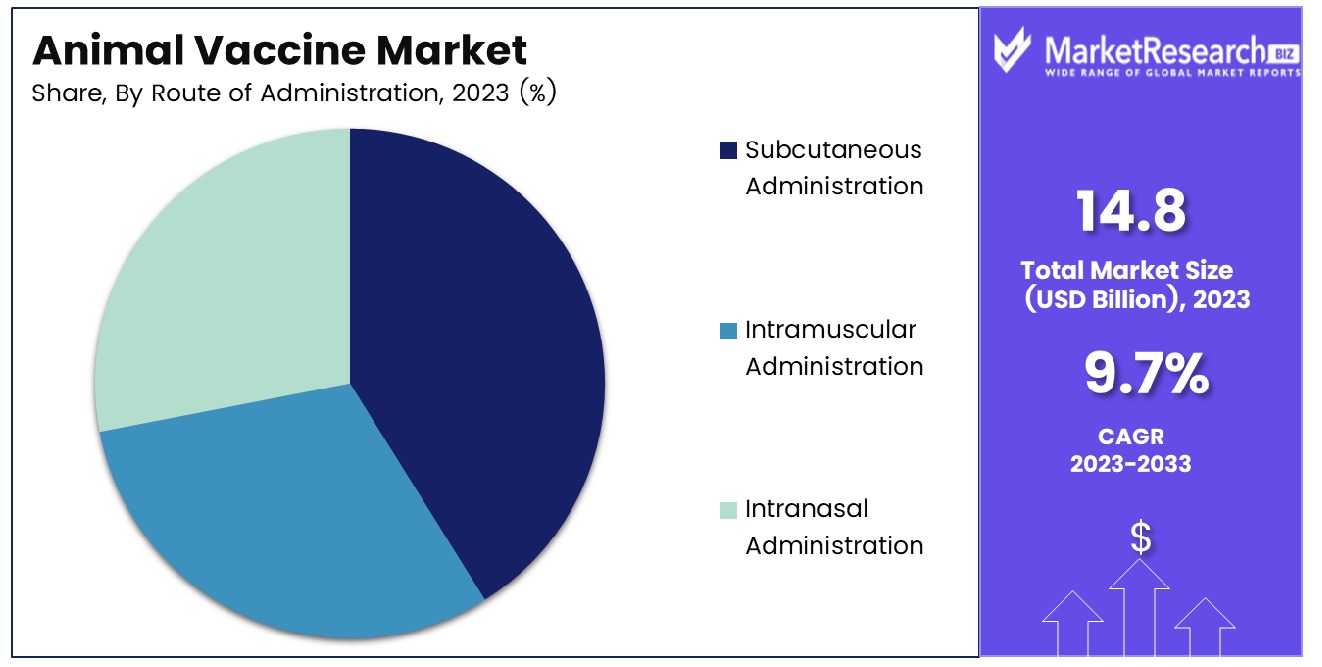

- By Route of Administration: Subcutaneous Administration vaccines administered via subcutaneous route dominate this segment, comprising approximately 45% of the market.

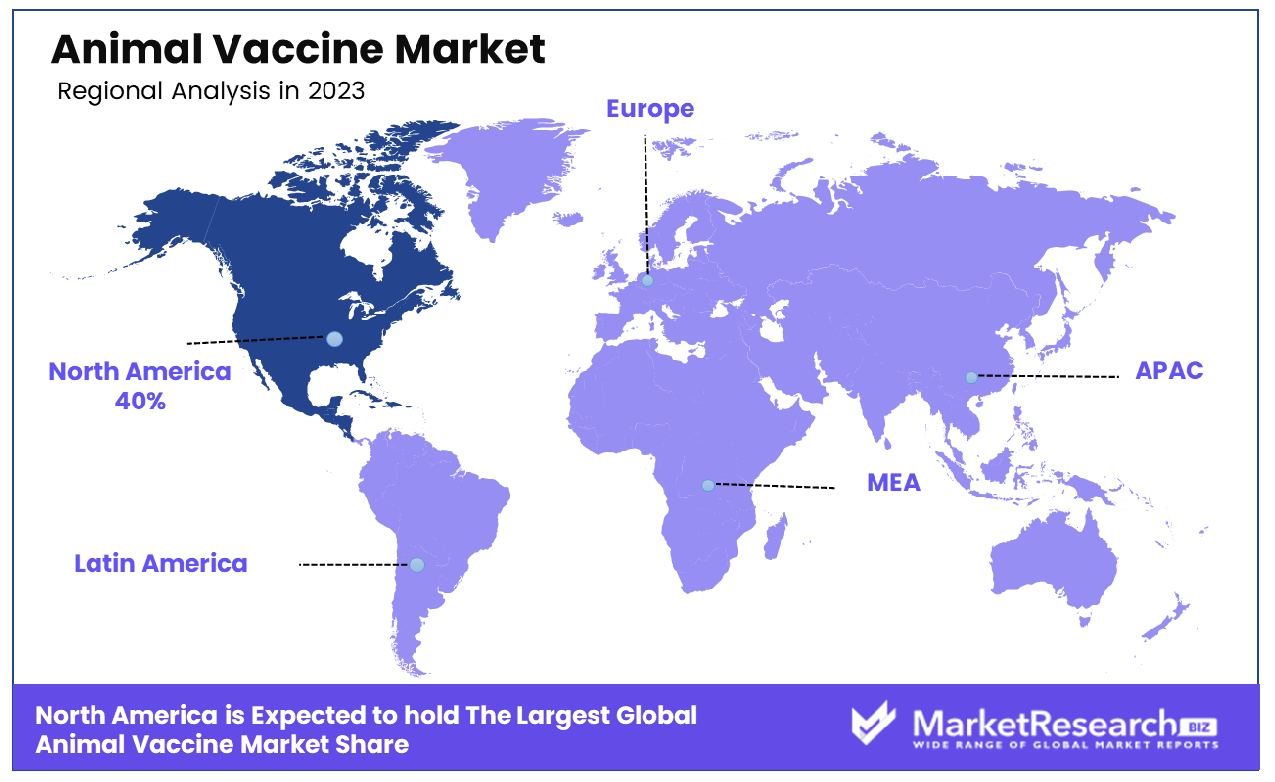

- Regional Dominance: North America dominates the animal vaccine market with about 40% market share, owing to its advanced veterinary infrastructure, substantial R&D investments, and heightened awareness of animal health..

- Growth Opportunity: An untapped growth opportunity for the animal vaccine market exists in developing innovative solutions for emerging diseases and expanding accessibility to remote regions.

Driving factors

Increasing Demand for Animal-Derived Food Products

As the global population expands, so does the demand for animal-derived food products such as meat, dairy, and eggs. This growing demand is driving increased production and intensification of animal agriculture, creating a need for effective disease prevention measures to ensure the health and productivity of livestock. Animal vaccines play a crucial role in preventing infectious diseases in livestock populations, thereby safeguarding food production and supply chains.

Growing Awareness of Zoonotic Diseases

The emergence of zoonotic diseases, which are transmitted between animals and humans, has sparked heightened awareness of the interconnectedness of animal and human health. Diseases such as avian influenza, rabies, and brucellosis pose significant threats to public health and agricultural economies. As a result, there is a growing recognition of the importance of controlling these diseases at their source through vaccination programs in animal populations. The prevention of zoonotic diseases not only protects human health but also contributes to the overall sustainability of animal agriculture.

Restraining Factors

High Cost of Vaccine Development

The development and commercialization of animal vaccines involve significant research and development costs, including preclinical studies, clinical trials, and regulatory approval processes. These high costs can act as a barrier to entry for smaller vaccine developers and limit the availability of vaccines for certain diseases or species. Additionally, the market for animal vaccines may be constrained by pricing pressures, as producers and governments seek to minimize healthcare expenditures in the livestock sector.

Limited Access to Veterinary Services

In many regions, particularly in developing countries and rural areas, access to veterinary services is limited, resulting in inadequate vaccination coverage and disease control measures in animal populations. Factors such as geographic remoteness, infrastructure challenges, and socioeconomic disparities contribute to this limited access. Without proper veterinary care and vaccination programs, livestock are more susceptible to disease outbreaks, resulting in economic losses for farmers and food insecurity for communities.

By Product Analysis

In 2023, Attenuated Live held a dominant market position in the By Product segment of the Animal Vaccine Market, capturing more than a 40% share.

Attenuated Live vaccines, which use a weakened form of the pathogen to stimulate a strong immune response, dominated the Animal Vaccine Market by Product in 2023 with over 40% market share. The efficacy of these vaccines in providing long-lasting immunity with a single dose has made them highly preferred among veterinarians and livestock owners. The ability to replicate within the host and present antigens in a natural manner ensures robust and comprehensive protection against various diseases.

Recombinant vaccines, which utilize genetic engineering to produce specific antigens that trigger an immune response, represent a significant segment of the animal vaccine market. These vaccines offer several advantages, including safety, stability, and the ability to target specific pathogens with precision.

DNA vaccines, involving the direct introduction of genetic material into the host to induce an immune response, are an emerging segment within the animal vaccine market. While still relatively new, DNA vaccines hold great promise due to their stability, ease of production, and potential to provide broad protection.

Inactivated vaccines, which contain pathogens that have been killed or inactivated, form a crucial part of the animal vaccine market. These vaccines are known for their safety, as they cannot cause the disease they are designed to protect against. The inactivated vaccine segment is widely used for both pets and livestock, especially in scenarios where live vaccines pose a risk.

Subunit vaccines, composed of specific protein fragments of the pathogen rather than the whole organism, are an important segment in the animal vaccine market. These vaccines offer a high level of safety and a reduced risk of adverse reactions, making them particularly suitable for use in sensitive species and young animals.

By Animal Type Analysis

In 2023, Livestock held a dominant market position in the By Animal Type segment of the Animal Vaccine Market, capturing more than a 30% share.

Livestock vaccines, crucial for protecting animals such as cattle, sheep, and goats from infectious diseases, led the Animal Vaccine Market by Animal Type in 2023 with over 30% market share. This segment's dominance is driven by the critical role of livestock in the agricultural economy and the need to ensure the health and productivity of these animals. The high incidence of diseases such as foot-and-mouth disease, bovine respiratory disease, and clostridial infections has heightened the demand for effective vaccines.

The Poultry segment, which includes vaccines for chickens, turkeys, and other birds, is another significant sector of the animal vaccine market. Poultry vaccines are essential for preventing diseases such as avian influenza, Newcastle disease, and infectious bursal disease, which can have devastating effects on poultry farms.

Aqua vaccines cater to the health needs of fish and other aquatic animals, addressing diseases like bacterial infections, parasitic infestations, and viral diseases. The Aqua segment is gaining importance due to the rising demand for aquaculture products and the need to maintain healthy fish populations.

The Reptiles segment, although smaller, serves an important niche in the animal vaccine market. This segment includes vaccines developed for reptiles such as snakes, lizards, and turtles, primarily in captive and conservation settings. The demand for reptile vaccines is driven by the need to protect these animals from specific diseases and to ensure the health of reptile collections in zoos, aquariums, and private ownership.

Insect vaccines are an emerging area within the animal vaccine market, particularly for use in insect farming and pollinator health. This segment includes vaccines designed to protect bees, silkworms, and other beneficial insects from diseases and parasites.

Swine vaccines are critical for preventing diseases such as porcine reproductive and respiratory syndrome (PRRS), swine influenza, and foot-and-mouth disease in pigs. The Swine segment holds a significant share of the animal vaccine market, supported by the global demand for pork and the necessity of maintaining healthy swine herds.

The Canine segment includes vaccines for dogs, addressing diseases like rabies, distemper, and parvovirus. The high prevalence of pet ownership and the growing awareness of preventive healthcare for pets support the demand for canine vaccines.

The Feline segment covers vaccines for cats, protecting against diseases such as feline leukemia, calicivirus, and panleukopenia. The rising number of cat owners and the emphasis on preventive veterinary care are key factors driving the demand for feline vaccines.

By Route of Administration Analysis

In 2023, Subcutaneous Administration held a dominant market position in the By Route of Administration segment of the Animal Vaccine Market, capturing more than a 45% share.

Subcutaneous Administration, which involves injecting the vaccine just under the skin, led the Animal Vaccine Market by Route of Administration in 2023, capturing over 45% of the market share. This method is widely preferred due to its ease of administration, minimal stress on animals, and effective immune response. Subcutaneous vaccines are commonly used for a variety of animals including livestock, poultry, pets, and exotic species. The simplicity of the injection process, coupled with advancements in vaccine formulations that ensure consistent and prolonged immune responses, has solidified this route as the most favored among veterinarians and animal handlers.

Intramuscular Administration, which involves injecting the vaccine directly into the muscle, is another critical segment in the animal vaccine market. This method is known for producing a strong and lasting immune response and is often used for vaccines that require deep tissue absorption. Intramuscular vaccines are commonly administered to larger animals, such as cattle, swine, and horses, and are also used in pet vaccinations.

Intranasal Administration, involving the delivery of the vaccine through the nasal passages, is gaining popularity in the animal vaccine market. This method is particularly advantageous for respiratory diseases as it stimulates local immunity at the site of infection. Intranasal vaccines are frequently used for pets, especially dogs and cats, as well as for livestock such as cattle. The non-invasive nature of intranasal administration reduces stress on animals and is easier to administer, especially in younger or more anxious animals.

Key Market Segments

By Product

- Attenuated Live

- Recombinant

- DNA

- Inactivated

- Subunit

By Animal Type

- Livestock

- Poultry

- Aqua

- Reptiles

- Insects

- Swine

- Canine

- Feline

By Route of Administration

- Subcutaneous Administration

- Intramuscular Administration

- Intranasal Administration

Growth Opportunity

Increasing Demand for Companion Animal Healthcare

The rise in pet ownership and the growing human-animal bond have led to increased spending on companion animal healthcare services, including vaccinations. Pet owners are increasingly proactive about preventive healthcare for their pets, driving demand for vaccines against common infectious diseases such as canine distemper, feline leukemia, and rabies. As a result, the companion animal vaccine market presents significant growth opportunities for manufacturers and distributors.

Novel Vaccine Platforms and Delivery Technologies

Advances in vaccine research and development have led to the emergence of novel vaccine platforms and delivery technologies that offer enhanced efficacy, safety, and convenience. These include recombinant DNA vaccines, vectored vaccines, and adjuvants that enhance immune responses. Furthermore, innovations in vaccine delivery systems, such as needle-free injectors and oral vaccines, are making vaccination more accessible and efficient, particularly in large-scale animal populations. By leveraging these technologies, vaccine developers can address unmet needs in animal health and capitalize on emerging market opportunities.

Latest Trends

Personalized and Targeted Vaccines

Personalized medicine approaches, tailored to the specific needs of individual animals or populations, are gaining traction in the animal vaccine market. By targeting vaccines to the unique genetic, immunological, and epidemiological characteristics of different species or breeds, veterinarians can optimize vaccine efficacy and minimize adverse effects. Personalized vaccines also enable more precise disease control strategies, such as herd immunity management and outbreak response.

Thermostable and Needle-Free Vaccines

The development of thermostable vaccines, which remain stable and effective under a wide range of temperature conditions, addresses critical challenges in vaccine distribution and storage, particularly in resource-limited settings and tropical climates. Likewise, the adoption of needle-free vaccine delivery systems offers numerous advantages, including reduced stress and trauma for animals, improved safety for vaccine administrators, and increased convenience and efficiency in mass vaccination campaigns. These trends reflect ongoing efforts to enhance vaccine accessibility, safety, and efficacy while minimizing logistical barriers and animal welfare concerns.

Regional Analysis

Animal Vaccine Market in 2023 is led by North America with a dominant 40% market share, driven by advanced veterinary infrastructure and high expenditure on animal health.

In 2023, North America held a dominant position in the Animal Vaccine Market, capturing a substantial 40% share. This dominance is attributed to the region's advanced veterinary infrastructure, high expenditure on pet healthcare, and well-established livestock industry. The United States, in particular, plays a significant role with its robust veterinary services and extensive livestock population. Increasing pet ownership, coupled with a high prevalence of zoonotic diseases, drives the demand for animal vaccines.

Europe follows closely, characterized by its stringent animal health regulations and high awareness of animal welfare. The European Union's comprehensive policies on animal health and welfare, along with initiatives such as the Animal Health Strategy, promote the use of vaccines to prevent and control diseases in both pets and livestock.

The Asia-Pacific region shows significant growth potential in the animal vaccine market, driven by its large livestock population and increasing awareness about animal health. Government initiatives to support veterinary services and the increasing adoption of pets in urban areas contribute to market expansion.

Latin America also plays a crucial role, with countries such as Brazil and Argentina leading the market. The region's extensive agricultural and livestock activities, combined with a growing focus on animal health management, drive the demand for vaccines. Brazil, in particular, has a large cattle population and is a significant exporter of beef, which underscores the importance of maintaining healthy herds through effective vaccination programs.

The Middle East & Africa region, while having a smaller share, is witnessing gradual growth in the animal vaccine market. The region faces challenges such as limited access to veterinary services and financial constraints, but international partnerships and investments in animal health infrastructure are fostering market development.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Animal Vaccine Market saw substantial contributions from key players such as Dechra Pharmaceuticals Plc, Zoetis, Vetoquinol S.A., Idexx Laboratories, Inc., Merck & Co., Inc., Elanco, Boehringer Ingelheim Gmbh, Virbac, Heska, Ceva Santé Animale, and Norbrook Inc. These companies have played pivotal roles in shaping the market dynamics through innovative products, strategic collaborations, and robust research and development efforts.

Zoetis emerges as a frontrunner in the animal vaccine market, leveraging its extensive portfolio of vaccines and pharmaceuticals for livestock and companion animals. The company's strong global presence, coupled with a focus on research-driven solutions, positions it as a key player driving innovation and market growth. Zoetis' commitment to animal health and welfare, along with its strategic partnerships with veterinary professionals and farmers, underscores its leadership in the market.

Merck & Co., Inc. and Elanco are other prominent players with significant contributions to the animal vaccine market. With a diverse range of vaccines for various animal species and diseases, these companies play critical roles in disease prevention and control in both livestock and companion animals. Their continued investments in research and development, along with a focus on addressing emerging health challenges, ensure their relevance and competitiveness in the market.

Dechra Pharmaceuticals Plc and Vetoquinol S.A. excel in providing pharmaceutical solutions, including vaccines, for companion animals. Their focus on innovation, product quality, and customer satisfaction has earned them strong market positions and loyal customer bases. Through strategic acquisitions and partnerships, these companies continue to expand their product offerings and geographical reach, further strengthening their presence in the global animal vaccine market.

Boehringer Ingelheim Gmbh, Virbac, and Ceva Santé Animale are key players in the livestock vaccine segment, offering a wide range of vaccines for farm animals. Their comprehensive solutions for disease prevention, along with a focus on biosecurity and animal welfare, make them preferred partners for farmers and veterinarians worldwide.

Market Key Players

- Dechra Pharmaceuticals Plc

- Zoetis

- Vetoquinol S.A.

- Idexx Laboratories, Inc.

- Merck & Co., Inc.

- Elanco

- Boehringer Ingelheim Gmbh

- Virbac

- Heska

- Ceva Santé Animale

- Norbrook Inc.

Recent Development

- In May 2024, Zoetis introduces a breakthrough vaccine for a prevalent livestock disease, bolstering animal health globally. The vaccine promises to enhance disease resistance and improve overall productivity.

- In May 2024, Merck Animal Health unveils a novel vaccine against a common poultry ailment, offering comprehensive protection for poultry farmers. The vaccine is poised to revolutionize poultry health management.

Report Scope

Report Features Description Market Value (2023) USD 14.8 Bn Forecast Revenue (2033) USD 36.5 Bn CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Attenuated Live, Recombinant, DNA, Inactivated, Subunit), By Animal Type (Livestock, Poultry, Aqua, Reptiles, Insects, Swine, Canine, Feline), By Route of Administration (Subcutaneous Administration, Intramuscular Administration, Intranasal Administration) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dechra Pharmaceuticals Plc, Zoetis, Vetoquinol S.A., Idexx Laboratories, Inc., Merck & Co., Inc., Elanco, Boehringer Ingelheim Gmbh, Virbac, Heska, Ceva Santé Animale, Norbrook Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Animal Vaccine Market Overview

- 2.1. Animal Vaccine Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Animal Vaccine Market Dynamics

- 3. Global Animal Vaccine Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Animal Vaccine Market Analysis, 2016-2021

- 3.2. Global Animal Vaccine Market Opportunity and Forecast, 2023-2032

- 3.3. Global Animal Vaccine Market Analysis, Opportunity and Forecast, By By Product , 2016-2032

- 3.3.1. Global Animal Vaccine Market Analysis by By Product : Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product , 2016-2032

- 3.3.3. Attenuated Live

- 3.3.4. Recombinant

- 3.3.5. DNA

- 3.3.6. Inactivated

- 3.3.7. Subunit

- 3.4. Global Animal Vaccine Market Analysis, Opportunity and Forecast, By By Animal Type , 2016-2032

- 3.4.1. Global Animal Vaccine Market Analysis by By Animal Type : Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Animal Type , 2016-2032

- 3.4.3. Livestock

- 3.4.4. Poultry

- 3.4.5. Aqua

- 3.4.6. Reptiles

- 3.4.7. Insects

- 3.4.8. Swine

- 3.4.9. Canine

- 3.4.10. Feline

- 3.5. Global Animal Vaccine Market Analysis, Opportunity and Forecast, By By Route of Administration, 2016-2032

- 3.5.1. Global Animal Vaccine Market Analysis by By Route of Administration: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Route of Administration, 2016-2032

- 3.5.3. Subcutaneous Administration

- 3.5.4. Intramuscular Administration

- 3.5.5. Intranasal Administration

- 4. North America Animal Vaccine Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Animal Vaccine Market Analysis, 2016-2021

- 4.2. North America Animal Vaccine Market Opportunity and Forecast, 2023-2032

- 4.3. North America Animal Vaccine Market Analysis, Opportunity and Forecast, By By Product , 2016-2032

- 4.3.1. North America Animal Vaccine Market Analysis by By Product : Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product , 2016-2032

- 4.3.3. Attenuated Live

- 4.3.4. Recombinant

- 4.3.5. DNA

- 4.3.6. Inactivated

- 4.3.7. Subunit

- 4.4. North America Animal Vaccine Market Analysis, Opportunity and Forecast, By By Animal Type , 2016-2032

- 4.4.1. North America Animal Vaccine Market Analysis by By Animal Type : Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Animal Type , 2016-2032

- 4.4.3. Livestock

- 4.4.4. Poultry

- 4.4.5. Aqua

- 4.4.6. Reptiles

- 4.4.7. Insects

- 4.4.8. Swine

- 4.4.9. Canine

- 4.4.10. Feline

- 4.5. North America Animal Vaccine Market Analysis, Opportunity and Forecast, By By Route of Administration, 2016-2032

- 4.5.1. North America Animal Vaccine Market Analysis by By Route of Administration: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Route of Administration, 2016-2032

- 4.5.3. Subcutaneous Administration

- 4.5.4. Intramuscular Administration

- 4.5.5. Intranasal Administration

- 4.6. North America Animal Vaccine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Animal Vaccine Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Animal Vaccine Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Animal Vaccine Market Analysis, 2016-2021

- 5.2. Western Europe Animal Vaccine Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By By Product , 2016-2032

- 5.3.1. Western Europe Animal Vaccine Market Analysis by By Product : Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product , 2016-2032

- 5.3.3. Attenuated Live

- 5.3.4. Recombinant

- 5.3.5. DNA

- 5.3.6. Inactivated

- 5.3.7. Subunit

- 5.4. Western Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By By Animal Type , 2016-2032

- 5.4.1. Western Europe Animal Vaccine Market Analysis by By Animal Type : Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Animal Type , 2016-2032

- 5.4.3. Livestock

- 5.4.4. Poultry

- 5.4.5. Aqua

- 5.4.6. Reptiles

- 5.4.7. Insects

- 5.4.8. Swine

- 5.4.9. Canine

- 5.4.10. Feline

- 5.5. Western Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By By Route of Administration, 2016-2032

- 5.5.1. Western Europe Animal Vaccine Market Analysis by By Route of Administration: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Route of Administration, 2016-2032

- 5.5.3. Subcutaneous Administration

- 5.5.4. Intramuscular Administration

- 5.5.5. Intranasal Administration

- 5.6. Western Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Animal Vaccine Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Animal Vaccine Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Animal Vaccine Market Analysis, 2016-2021

- 6.2. Eastern Europe Animal Vaccine Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By By Product , 2016-2032

- 6.3.1. Eastern Europe Animal Vaccine Market Analysis by By Product : Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product , 2016-2032

- 6.3.3. Attenuated Live

- 6.3.4. Recombinant

- 6.3.5. DNA

- 6.3.6. Inactivated

- 6.3.7. Subunit

- 6.4. Eastern Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By By Animal Type , 2016-2032

- 6.4.1. Eastern Europe Animal Vaccine Market Analysis by By Animal Type : Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Animal Type , 2016-2032

- 6.4.3. Livestock

- 6.4.4. Poultry

- 6.4.5. Aqua

- 6.4.6. Reptiles

- 6.4.7. Insects

- 6.4.8. Swine

- 6.4.9. Canine

- 6.4.10. Feline

- 6.5. Eastern Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By By Route of Administration, 2016-2032

- 6.5.1. Eastern Europe Animal Vaccine Market Analysis by By Route of Administration: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Route of Administration, 2016-2032

- 6.5.3. Subcutaneous Administration

- 6.5.4. Intramuscular Administration

- 6.5.5. Intranasal Administration

- 6.6. Eastern Europe Animal Vaccine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Animal Vaccine Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Animal Vaccine Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Animal Vaccine Market Analysis, 2016-2021

- 7.2. APAC Animal Vaccine Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Animal Vaccine Market Analysis, Opportunity and Forecast, By By Product , 2016-2032

- 7.3.1. APAC Animal Vaccine Market Analysis by By Product : Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product , 2016-2032

- 7.3.3. Attenuated Live

- 7.3.4. Recombinant

- 7.3.5. DNA

- 7.3.6. Inactivated

- 7.3.7. Subunit

- 7.4. APAC Animal Vaccine Market Analysis, Opportunity and Forecast, By By Animal Type , 2016-2032

- 7.4.1. APAC Animal Vaccine Market Analysis by By Animal Type : Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Animal Type , 2016-2032

- 7.4.3. Livestock

- 7.4.4. Poultry

- 7.4.5. Aqua

- 7.4.6. Reptiles

- 7.4.7. Insects

- 7.4.8. Swine

- 7.4.9. Canine

- 7.4.10. Feline

- 7.5. APAC Animal Vaccine Market Analysis, Opportunity and Forecast, By By Route of Administration, 2016-2032

- 7.5.1. APAC Animal Vaccine Market Analysis by By Route of Administration: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Route of Administration, 2016-2032

- 7.5.3. Subcutaneous Administration

- 7.5.4. Intramuscular Administration

- 7.5.5. Intranasal Administration

- 7.6. APAC Animal Vaccine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Animal Vaccine Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Animal Vaccine Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Animal Vaccine Market Analysis, 2016-2021

- 8.2. Latin America Animal Vaccine Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Animal Vaccine Market Analysis, Opportunity and Forecast, By By Product , 2016-2032

- 8.3.1. Latin America Animal Vaccine Market Analysis by By Product : Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product , 2016-2032

- 8.3.3. Attenuated Live

- 8.3.4. Recombinant

- 8.3.5. DNA

- 8.3.6. Inactivated

- 8.3.7. Subunit

- 8.4. Latin America Animal Vaccine Market Analysis, Opportunity and Forecast, By By Animal Type , 2016-2032

- 8.4.1. Latin America Animal Vaccine Market Analysis by By Animal Type : Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Animal Type , 2016-2032

- 8.4.3. Livestock

- 8.4.4. Poultry

- 8.4.5. Aqua

- 8.4.6. Reptiles

- 8.4.7. Insects

- 8.4.8. Swine

- 8.4.9. Canine

- 8.4.10. Feline

- 8.5. Latin America Animal Vaccine Market Analysis, Opportunity and Forecast, By By Route of Administration, 2016-2032

- 8.5.1. Latin America Animal Vaccine Market Analysis by By Route of Administration: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Route of Administration, 2016-2032

- 8.5.3. Subcutaneous Administration

- 8.5.4. Intramuscular Administration

- 8.5.5. Intranasal Administration

- 8.6. Latin America Animal Vaccine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Animal Vaccine Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Animal Vaccine Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Animal Vaccine Market Analysis, 2016-2021

- 9.2. Middle East & Africa Animal Vaccine Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Animal Vaccine Market Analysis, Opportunity and Forecast, By By Product , 2016-2032

- 9.3.1. Middle East & Africa Animal Vaccine Market Analysis by By Product : Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product , 2016-2032

- 9.3.3. Attenuated Live

- 9.3.4. Recombinant

- 9.3.5. DNA

- 9.3.6. Inactivated

- 9.3.7. Subunit

- 9.4. Middle East & Africa Animal Vaccine Market Analysis, Opportunity and Forecast, By By Animal Type , 2016-2032

- 9.4.1. Middle East & Africa Animal Vaccine Market Analysis by By Animal Type : Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Animal Type , 2016-2032

- 9.4.3. Livestock

- 9.4.4. Poultry

- 9.4.5. Aqua

- 9.4.6. Reptiles

- 9.4.7. Insects

- 9.4.8. Swine

- 9.4.9. Canine

- 9.4.10. Feline

- 9.5. Middle East & Africa Animal Vaccine Market Analysis, Opportunity and Forecast, By By Route of Administration, 2016-2032

- 9.5.1. Middle East & Africa Animal Vaccine Market Analysis by By Route of Administration: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Route of Administration, 2016-2032

- 9.5.3. Subcutaneous Administration

- 9.5.4. Intramuscular Administration

- 9.5.5. Intranasal Administration

- 9.6. Middle East & Africa Animal Vaccine Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Animal Vaccine Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Animal Vaccine Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Animal Vaccine Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Animal Vaccine Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Dechra Pharmaceuticals Plc

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Zoetis

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Vetoquinol S.A.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Idexx Laboratories, Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Merck & Co., Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Elanco

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Boehringer Ingelheim Gmbh

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Virbac

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Heska

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Ceva Santé Animale

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Norbrook Inc.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Dechra Pharmaceuticals Plc

- Zoetis

- Vetoquinol S.A.

- Idexx Laboratories, Inc.

- Merck & Co., Inc.

- Elanco

- Boehringer Ingelheim Gmbh

- Virbac

- Heska

- Ceva Santé Animale

- Norbrook Inc.