Aircraft Seating Market By Aircraft Type Analysis (Wide Body Aircraft, General aviation, Narrow Body Aircraft, Other), By Seating Class Analysis (Economy class, Premium economy class, First class, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

24256

-

March 2023

-

157

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

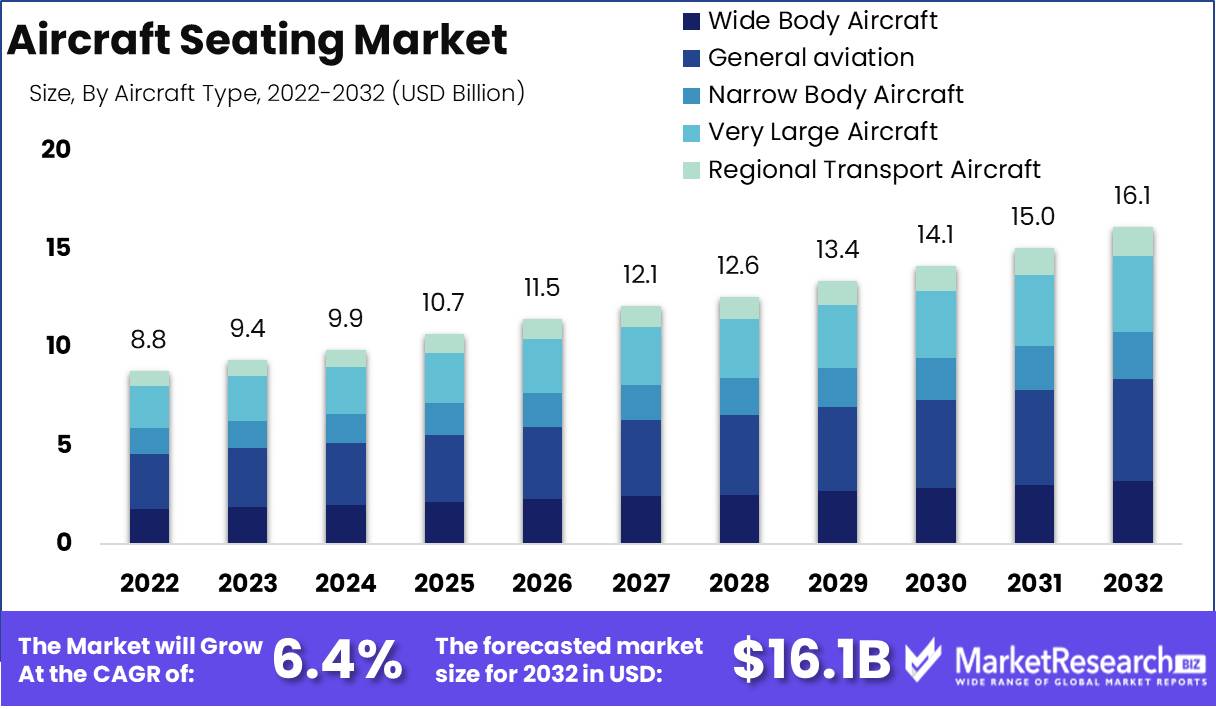

The Aircraft Seating Market size is expected to be worth around USD 16.1 Bn by 2032 from USD 8.8 Bn in 2022, growing at a CAGR of 6.4% during the forecast period from 2023 to 2032.

The aviation realm incorporates the captivating aircraft seating market, where the conception, fabrication, and promotion of seats specifically designed for airplanes take center stage. This dynamic market is driven by the unwavering desire to provide passengers with seating arrangements that are not only comfortable but also prioritize their safety.

Seating within aircraft is an essential component of the aviation industry, as discerning passengers anticipate a thoroughly satisfying and enjoyable flight. Given the ever-increasing volume of air traffic, airlines are faced with a difficult dilemma: how to provide unparalleled seating options while adhering to principles of affordability.

It should come as no surprise that, in tandem with the unrelenting evolution of aircraft, the demand for cutting-edge seating technology has skyrocketed to unimaginable heights. To satisfy the desires of discerning customers, airlines have begun adopting modern cabin designs, personalized spatial configurations, and cutting-edge entertainment systems. This, in turn, has sparked an avalanche of competitive pricing strategies and an unquenchable desire to incorporate the most advanced seating technologies.

Within the sprawling tapestry of the aircraft seating market, there is a multitude of astounding innovations that have left an indelible mark on the fabric of the industry. The introduction of flatbeds, which can accommodate even the most finicky sleepers, has revolutionized the concept of sleeping in flight. Moreover, seating experts have pioneered the incorporation of adjustable lumbar support and headrests, thereby enhancing the already impressive realm of personalized comfort.

As if that weren't enough, airlines have begun incorporating innovative materials, such as memory foam and breathable fabric, into their seating arrangements in an effort to increase both comfort and durability. In a relentless pursuit of perfection, the forefront of seating technology has ingeniously woven mobile charging points, USB ports, and Wi-Fi connectivity into the very fabric of their products, thereby catering to the insatiable demands of passengers desiring to remain continuously connected.

Within the alluring contours of the aircraft seating market, a multitude of industries have pledged their allegiance and invested their intellectual and financial strength. Recognizing the paramount significance of passenger satisfaction, airlines invest substantial resources in enhancing their seating options, thereby enhancing the overall travel experience.

Airplane manufacturers, gripped by an unwavering desire to differentiate their prodigious creations from the competition, relentlessly incorporate novel seating designs into their aerial wonders. Simultaneously, seat manufacturers invest in research and development to stretch the boundaries of seating technology, while simultaneously streamlining the manufacturing process for maximum efficiency.

Driving factors

Rising Aircraft Seating Demand

Several reasons are driving the aircraft seating market upward. First, global air travel demand has boosted aircraft seating sales. New aircraft orders and deliveries also boost the aircraft seating market. Airlines are realizing the importance of passenger comfort and experience. Technology has created lightweight, ergonomic, and comfy aircraft seats.

Premium Seating Increases

Low-cost carriers (LCCs) have made airlines prioritize seating layouts to increase passenger capacity. This has increased demand for premium and business-class seating for travelers seeking elegance and comfort. The aircraft seating market is growing as emerging economies' middle classes travel more. Smart and linked aircraft seating is also driving this trend.

Efficiency Fuels Market

Lighter aircraft seats reduce fuel consumption and carbon emissions. This supports the green aviation movement. Regulations change frequently, which might affect the aircraft seating market. Aircraft seating may be affected by regulatory changes.

New Seating Technologies

Virtual and augmented reality could change the in-flight experience and alter the aircraft seating market. Supersonic travel and alternative transportation may disrupt the aircraft seating market. Air travelers' expectations are also changing. The experience economy and eco-friendly product demand may affect the aircraft seating market.

Restraining Factors

Difficulties of the Aircraft Seating Industry

Over the years, the aircraft seating market has expanded significantly due to the rising global demand for air travel. However, there are a number of factors that pose a challenge to the development of the industry. The aircraft seating industry is governed by stringent regulatory requirements and certification procedures. These standards are implemented to ensure that aircraft seats satisfy the safety and performance requirements of the aviation industry. Seat manufacturers may find it difficult to comply with these regulations and certification processes.

Obstacles to Compliance for Seat Manufacturers

To obtain certification, seat manufacturers must adhere to a number of design and production standards. This necessitates the use of particular materials, testing protocols, and certifications. Compliance with these standards can be expensive, time-intensive, and resource-intensive. As a result, these regulatory standards can be a significant entry barrier for new participants in the aircraft seating industry.

Expensive Investments in Aircraft Seating

The creation and manufacture of aircraft seating can be an expensive endeavor. Design and production processes require specialized knowledge, which can increase costs. In addition, using specialized materials and testing apparatus can be costly. Costs associated with research and development can also be substantial, particularly when developing new materials or devising innovative seat configurations.

Impact of the Pandemic on Seat Manufacturers

The pandemic of COVID-19 has had a significant effect on the aircraft seating industry. The pandemic has disrupted global supply chains, resulting in raw material and component shortages. This has resulted in delivery delays for aircraft seating. The pandemic has also precipitated a sharp decline in air travel, which has decreased the demand for aircraft seating. Some seat manufacturers have experienced decreased production rates, unemployment, and even bankruptcy as a result.

Seating Space and Weight Restrictions

Space and weight restrictions present an additional obstacle for the aircraft seating industry. Aircraft manufacturers must strike a balance between the need for passenger comfort and the need to maximize capacity and weight on board aircraft. This has led to the creation of seating that is both lightweight and space-efficient. However, these seats may not be as comfortable as conventional seating. Designing innovative seat configurations to satisfy space and weight restrictions can be a time-consuming and costly endeavor.

Aircraft Type Analysis

The general aviation segment dominates with a significant market share in the aircraft seating market, which is divided into several segments. This market segment consists of private and commercial jet aircraft, which represent the majority of the aircraft seating market. With the growing demand for personal and leisure travel, the general aviation segment is gaining popularity worldwide.

The expansion of the general aviation segment is being aided by the economic growth of emerging economies like India and China. These economies are experiencing an increase in the number of high-net-worth individuals who prefer private aircraft for business and personal travel. Enhanced air connectivity and air travel infrastructure in these nations are also fueling demand for general aviation.

Consumer trends and behavior toward the general aviation segment are also increasing significantly. The rise in disposable income among consumers has contributed to the expansion of the luxury travel market. As part of the luxury travel industry, general aviation has experienced remarkable growth.

Due to an increase in personal and leisure travel, as well as the economic growth of emerging economies, the general aviation segment of the aircraft seating market is anticipated to grow at the quickest rate over the next few years.

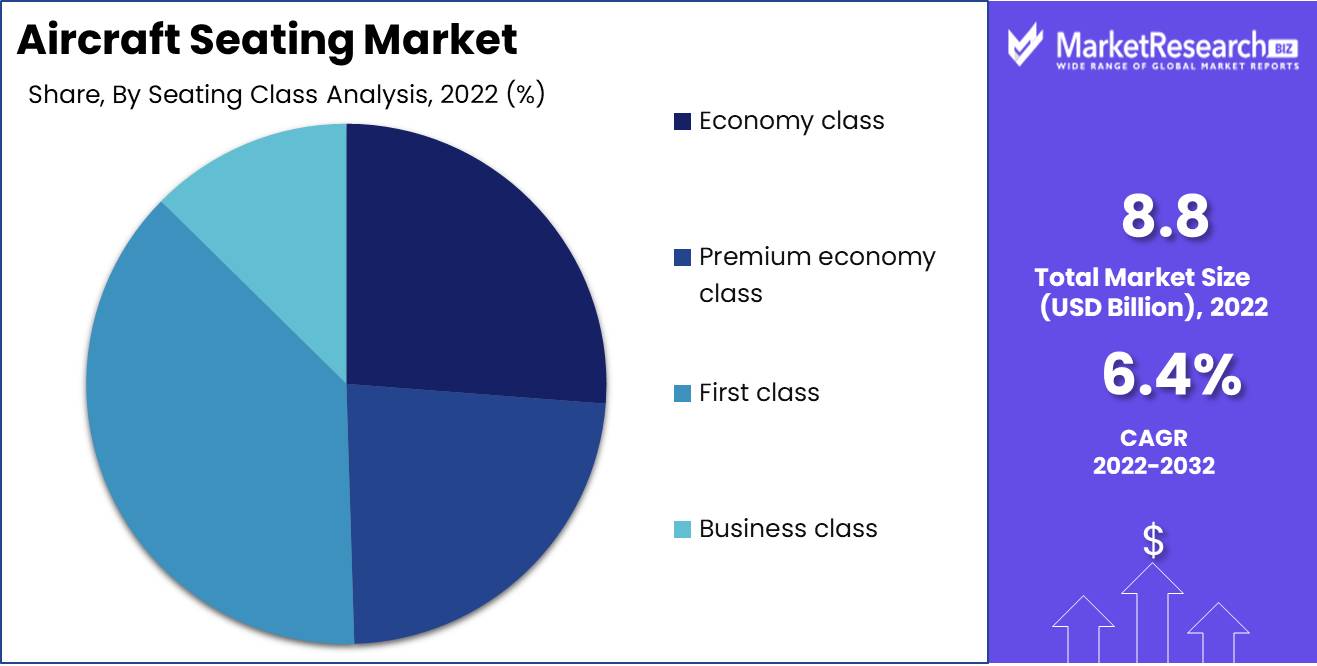

Seating Class Analysis

With a significant market share, First Class Seating dominates the aircraft seating market. This is due to the growing demand for opulent and comfortable travel options. As the number of high-net-worth individuals increases worldwide, so does the demand for luxury travel. Moreover, the advent of social media has made the luxury travel experience more important than ever, resulting in an increase in demand for first-class seating.

Emerging economies' economic growth is also propelling the adoption of first-class seating. As consumers' disposable income increases, they seek out extravagant travel experiences. In emerging economies, this has led to the development of the luxury travel segment, which includes first-class seating options.

Additionally, consumer trends and behavior regarding first-class seating are on the rise. Customers are prepared to pay more for the additional comfort and services that come with a first-class seat as the demand for luxury travel increases.

Due to the rise in luxury travel and the rising demand for comfortable and luxurious travel options, the first-class seating segment of the aircraft seating market is anticipated to experience the highest growth rate over the next few years.

Key Market Segments

By Aircraft Type Analysis

- Wide Body Aircraft

- General aviation

- Narrow Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

By Seating Class Analysis

- Economy class

- Premium economy class

- First class

- Business class

Growth Opportunity

Demand for Aircraft Seating in Emerging Economies Is Growing

Due to a variety of opportunities, the aircraft seating market has tremendous growth potential. The world's fastest-growing economies, such as India, China, and Southeast Asia, are driving an increase in air travel demand. This strongly indicates that aircraft seating demand will continue to rise in the near future. Additionally, the market is expanding as a result of a growing trend toward customization and individualization of aircraft accommodation options, which satisfies consumer preferences for tailored and distinctive options.

Aviation is revolutionized by Eco-Friendly, Lightweight Seating

The increasing demand for lightweight and eco-friendly aircraft seats is a significant growth driver for the aircraft seating market. This is a direct response to environmental concerns, with the aerospace industry seeking to develop environmentally favorable and sustainable seating options. These eco-friendly seating options will revolutionize the aviation industry, and companies that implement these solutions will be able to distinguish themselves as market leaders.

The market for Premium Aircraft Seating is Growing

Growth in the aircraft seating market is also being driven by the growing demand for premium seating options in business and first class. The demand for premium seating options is growing as the number of individuals desiring high-end, luxurious travel experiences rises. Airlines that invest in premium accommodation options can provide their passengers with greater comfort and a more pleasurable experience, which can lead to increased customer loyalty, a positive brand image, and more profitable operations.

Intelligent and Connected Seating Improves Airline Productivity

In addition to premium seating options, the aircraft seating market is witnessing a rise in the adoption of smart and connected seating solutions. These solutions provide real-time monitoring and data analytics, which can assist airlines in optimizing their operational efficiency and boosting passenger comfort. Connected seating solutions, such as monitoring passenger movement, temperature, and humidity levels, can provide airline operators with valuable business intelligence, allowing them to make more informed business decisions.

IoT Increases Demand for Intelligent Aircraft Seating

Moreover, the rise of the Internet of Things (IoT) and technological solutions is rapidly transforming the aviation industry, which coincides with a growing interest in smart and connected seating solutions. Consequently, aircraft seating manufacturers are adapting their designs and offerings to satisfy the demand for smart and connected seating solutions.

Latest Trends

Increasing Interest in Sustainable Aircraft Seating

Over the years, the aviation industry has experienced substantial development, which has led to an increase in demand for comfortable and high-quality aircraft seating solutions. The global aircraft seating market has been influenced by a number of trends that have emerged in recent years. These trends are driven by a desire for improved passenger comfort and experience, as well as a growing demand for environmentally friendly and sustainable aviation practices.

IoT Transforms Aircraft Seating

In recent years, the aviation industry has come under intensified scrutiny due to its substantial carbon footprint. As a consequence, there is a growing demand for environmentally friendly and sustainable aviation practices. This trend has had a significant impact on the aircraft seating market, with airlines increasingly seeking seating solutions made from sustainable or recyclable materials.

Customization of Seating Options Takes Flight

The Internet of Things (IoT) has had a significant impact on numerous industries, including the aviation industry. Aircraft have increasingly adopted intelligent and connected seating solutions in recent years. Utilizing sensors and other IoT technologies, these solutions capture valuable data that can be used to improve the passenger experience and operational efficiency.

Fuel Economy Drives Demand for Lightweight Seating

Many passengers today desire greater control over their in-flight experience, which has led to a growing trend toward the customization and individualization of aircraft seating options. Increasingly, airlines allow passengers to select their own accommodation preferences, including seat type, location, and amenities. This trend has been driven by the desire for greater comfort and convenience, as well as the need for differentiation in a market that is becoming increasingly competitive.

Innovative Improvements to Passenger Amenities

Due to the importance of aircraft seat weight in determining fuel efficiency, there is a growing demand for lightweight and ergonomic aircraft seats. While maintaining the highest standards of safety and durability, these seats are designed to reduce weight and enhance passenger comfort. Lightweight seating solutions can assist airlines in reducing their fuel consumption and carbon footprint, while ergonomic seating solutions can reduce passenger discomfort and boost overall satisfaction.

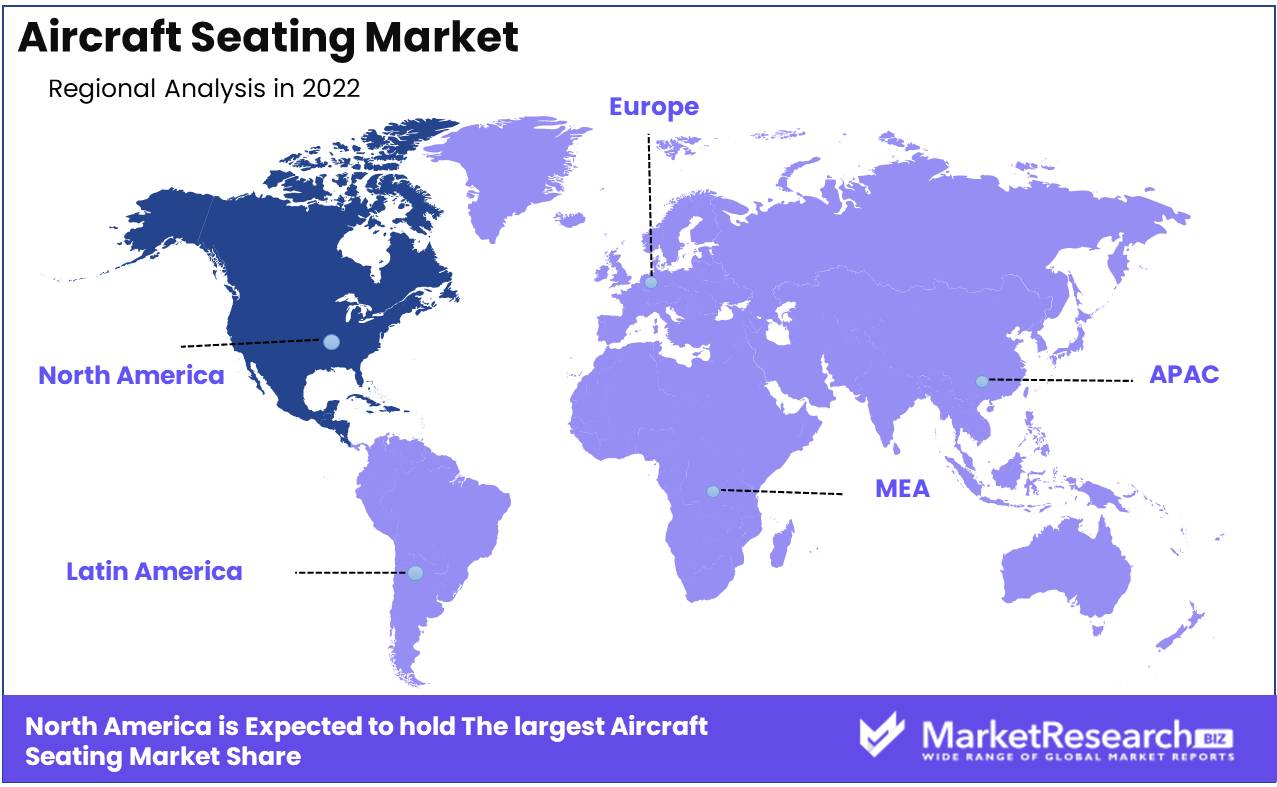

Regional Analysis

Because of the presence of significant aircraft manufacturers and airlines, North America dominates the aircraft seating market. The aircraft seating market is characterized by constant design, technological, and material advancements. In this dynamic market, North America has emerged as the dominant player. The region has a competitive edge over other markets due to the presence of key aircraft manufacturers and airlines.

The presence of major aircraft manufacturers such as Boeing and Airbus contributes significantly to North America's dominance in the aircraft seating market. These manufacturers have a significant impact on the selection of seating for their aircraft, and consequently, their requirements and specifications dictate the market. Boeing, for example, has a significant presence in North America, with a number of production facilities and offices in the region.

The presence of these aircraft manufacturers in North America has generated a thriving market for aircraft seating manufacturers. It gives them a competitive edge over their rivals in other regions, as they are frequently asked to provide seating for the newest aircraft models from these manufacturers. Additionally, having a presence in the same region as the customers facilitates communication and expedite the fulfillment of customer requirements.

In addition, these airlines have a significant revenue stream, allowing them to invest significantly in developing superior seating solutions for their passengers. This investment expands the market for aircraft seating manufacturers in North America, giving them access to a larger customer base and a greater potential for significant revenue.

The innovative nature of the region also contributes to North America's dominance in the aircraft seating market. In recent years, the aircraft seating market has undergone significant technological advancements, with lie-flat mattresses, integrated entertainment systems, and enhanced privacy features becoming increasingly popular among passengers.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The aircraft seating market is characterized by intense competition and rapid technological and design innovation. Major market players have been investing significantly in R&D to develop high-quality seating solutions that provide passengers with the highest levels of comfort, safety, and value.

Companies like RECARO Aircraft Seating, Zodiac Aerospace, and JAMCO Corporation are at the pinnacle of the market. These companies have been industry leaders for decades, offering a vast array of seating solutions for commercial and business aircraft. RECARO is renowned for its luxurious economy and business class seats, whereas Zodiac is known for its innovative designs that prioritize passenger convenience. JAMCO specializes in first-class and opulent seating, catering to the requirements of discriminating clients who demand the best.

B/E Aerospace, a subsidiary of Rockwell Collins, is another major participant in the market. B/E Aerospace is one of the foremost providers of aircraft interiors, including seating solutions, and has a significant presence in both commercial and business aviation. The company's design and manufacturing expertise has enabled it to secure contracts with major airlines such as Emirates, Qatar Airways, and American Airlines.

Geven, Aviointeriors, and Acro Aircraft Seating are three additional notable market players. These companies have demonstrated the ability to create innovative products that satisfy the needs of both airlines and passengers. As the demand for aircraft seating solutions continues to rise, it is likely that these key players will remain at the forefront of the industry, driving innovation and shaping the future of air travel.

Top Key Players in Aircraft Seating Market

- Zodiac Aerospace

- B/E Aerospace Inc.

- RECARO Aircraft Seating GmbH & Co. KG

- Geven S.p.A.

- Aviointeriors S.p.A.

- Acro Aircraft Seating Ltd.

- Thompson Aero Seating Ltd.

- HAECO Americas LLC

- ZIM FLUGSITZ

- STELIA Aerospace S.A.S.

Recent Development

- In 2023, Sustainable Materials and Design will be implemented As environmental concerns increase, aircraft seat manufacturers are increasingly incorporating sustainable materials and employing eco-friendly design practices.

- In 2022, Enhanced In-Flight Entertainment Systems will be implemented. In recent years, airlines have upgraded their in-flight entertainment systems by incorporating larger touchscreens with high-definition resolution, enhanced content libraries, and improved connectivity options.

- In 2021, Improved Ergonomics and Comfort Aircraft seat manufacturers have been concentrating on enhancing the ergonomics and comfort of seats.

- In 2020, Socially distant seating arrangements will become the norm. With the emergence of the COVID-19 pandemic, airlines implemented a variety of safety measures, including social separation on board.

- In 2019, Premium Economy Seating will be introduced. In recent years, a number of airlines have introduced a new seating class known as Premium Economy.

Report Scope:

Report Features Description Market Value (2022) USD 8.8 Bn Forecast Revenue (2032) USD 16.1 Bn CAGR (2023-2032) 6.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Aircraft Type Analysis (Wide Body Aircraft, General aviation, Narrow Body Aircraft, Very Large Aircraft, Regional Transport Aircraft), By Seating Class Analysis (Economy class, Premium economy class, First class, Business class) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Zodiac Aerospace, B/E Aerospace Inc., RECARO Aircraft Seating GmbH & Co. KG, Geven S.p.A., Aviointeriors S.p.A., Acro Aircraft Seating Ltd., Thompson Aero Seating Ltd., HAECO Americas LLC, ZIM FLUGSITZ, STELIA Aerospace S.A.S. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Aircraft Seating Market Overview

- 2.1. Aircraft Seating Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Aircraft Seating Market Dynamics

- 3. Global Aircraft Seating Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Aircraft Seating Market Analysis, 2016-2021

- 3.2. Global Aircraft Seating Market Opportunity and Forecast, 2023-2032

- 3.3. Global Aircraft Seating Market Analysis, Opportunity and Forecast, By By Aircraft Type Analysis, 2016-2032

- 3.3.1. Global Aircraft Seating Market Analysis by By Aircraft Type Analysis: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Aircraft Type Analysis, 2016-2032

- 3.3.3. Wide Body Aircraft

- 3.3.4. General aviation

- 3.3.5. Narrow Body Aircraft

- 3.3.6. Very Large Aircraft

- 3.3.7. Regional Transport Aircraft

- 3.4. Global Aircraft Seating Market Analysis, Opportunity and Forecast, By By Seating Class Analysis, 2016-2032

- 3.4.1. Global Aircraft Seating Market Analysis by By Seating Class Analysis: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seating Class Analysis, 2016-2032

- 3.4.3. Economy class

- 3.4.4. Premium economy class

- 3.4.5. First class

- 3.4.6. Business class

- 3.5. Global Aircraft Seating Market Analysis, Opportunity and Forecast, By , 2016-2032

- 3.5.1. Global Aircraft Seating Market Analysis by : Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 4. North America Aircraft Seating Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Aircraft Seating Market Analysis, 2016-2021

- 4.2. North America Aircraft Seating Market Opportunity and Forecast, 2023-2032

- 4.3. North America Aircraft Seating Market Analysis, Opportunity and Forecast, By By Aircraft Type Analysis, 2016-2032

- 4.3.1. North America Aircraft Seating Market Analysis by By Aircraft Type Analysis: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Aircraft Type Analysis, 2016-2032

- 4.3.3. Wide Body Aircraft

- 4.3.4. General aviation

- 4.3.5. Narrow Body Aircraft

- 4.3.6. Very Large Aircraft

- 4.3.7. Regional Transport Aircraft

- 4.4. North America Aircraft Seating Market Analysis, Opportunity and Forecast, By By Seating Class Analysis, 2016-2032

- 4.4.1. North America Aircraft Seating Market Analysis by By Seating Class Analysis: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seating Class Analysis, 2016-2032

- 4.4.3. Economy class

- 4.4.4. Premium economy class

- 4.4.5. First class

- 4.4.6. Business class

- 4.5. North America Aircraft Seating Market Analysis, Opportunity and Forecast, By , 2016-2032

- 4.5.1. North America Aircraft Seating Market Analysis by : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 4.6. North America Aircraft Seating Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Aircraft Seating Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Aircraft Seating Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Aircraft Seating Market Analysis, 2016-2021

- 5.2. Western Europe Aircraft Seating Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By By Aircraft Type Analysis, 2016-2032

- 5.3.1. Western Europe Aircraft Seating Market Analysis by By Aircraft Type Analysis: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Aircraft Type Analysis, 2016-2032

- 5.3.3. Wide Body Aircraft

- 5.3.4. General aviation

- 5.3.5. Narrow Body Aircraft

- 5.3.6. Very Large Aircraft

- 5.3.7. Regional Transport Aircraft

- 5.4. Western Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By By Seating Class Analysis, 2016-2032

- 5.4.1. Western Europe Aircraft Seating Market Analysis by By Seating Class Analysis: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seating Class Analysis, 2016-2032

- 5.4.3. Economy class

- 5.4.4. Premium economy class

- 5.4.5. First class

- 5.4.6. Business class

- 5.5. Western Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By , 2016-2032

- 5.5.1. Western Europe Aircraft Seating Market Analysis by : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 5.6. Western Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Aircraft Seating Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Aircraft Seating Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Aircraft Seating Market Analysis, 2016-2021

- 6.2. Eastern Europe Aircraft Seating Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By By Aircraft Type Analysis, 2016-2032

- 6.3.1. Eastern Europe Aircraft Seating Market Analysis by By Aircraft Type Analysis: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Aircraft Type Analysis, 2016-2032

- 6.3.3. Wide Body Aircraft

- 6.3.4. General aviation

- 6.3.5. Narrow Body Aircraft

- 6.3.6. Very Large Aircraft

- 6.3.7. Regional Transport Aircraft

- 6.4. Eastern Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By By Seating Class Analysis, 2016-2032

- 6.4.1. Eastern Europe Aircraft Seating Market Analysis by By Seating Class Analysis: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seating Class Analysis, 2016-2032

- 6.4.3. Economy class

- 6.4.4. Premium economy class

- 6.4.5. First class

- 6.4.6. Business class

- 6.5. Eastern Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By , 2016-2032

- 6.5.1. Eastern Europe Aircraft Seating Market Analysis by : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 6.6. Eastern Europe Aircraft Seating Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Aircraft Seating Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Aircraft Seating Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Aircraft Seating Market Analysis, 2016-2021

- 7.2. APAC Aircraft Seating Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Aircraft Seating Market Analysis, Opportunity and Forecast, By By Aircraft Type Analysis, 2016-2032

- 7.3.1. APAC Aircraft Seating Market Analysis by By Aircraft Type Analysis: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Aircraft Type Analysis, 2016-2032

- 7.3.3. Wide Body Aircraft

- 7.3.4. General aviation

- 7.3.5. Narrow Body Aircraft

- 7.3.6. Very Large Aircraft

- 7.3.7. Regional Transport Aircraft

- 7.4. APAC Aircraft Seating Market Analysis, Opportunity and Forecast, By By Seating Class Analysis, 2016-2032

- 7.4.1. APAC Aircraft Seating Market Analysis by By Seating Class Analysis: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seating Class Analysis, 2016-2032

- 7.4.3. Economy class

- 7.4.4. Premium economy class

- 7.4.5. First class

- 7.4.6. Business class

- 7.5. APAC Aircraft Seating Market Analysis, Opportunity and Forecast, By , 2016-2032

- 7.5.1. APAC Aircraft Seating Market Analysis by : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 7.6. APAC Aircraft Seating Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Aircraft Seating Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Aircraft Seating Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Aircraft Seating Market Analysis, 2016-2021

- 8.2. Latin America Aircraft Seating Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Aircraft Seating Market Analysis, Opportunity and Forecast, By By Aircraft Type Analysis, 2016-2032

- 8.3.1. Latin America Aircraft Seating Market Analysis by By Aircraft Type Analysis: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Aircraft Type Analysis, 2016-2032

- 8.3.3. Wide Body Aircraft

- 8.3.4. General aviation

- 8.3.5. Narrow Body Aircraft

- 8.3.6. Very Large Aircraft

- 8.3.7. Regional Transport Aircraft

- 8.4. Latin America Aircraft Seating Market Analysis, Opportunity and Forecast, By By Seating Class Analysis, 2016-2032

- 8.4.1. Latin America Aircraft Seating Market Analysis by By Seating Class Analysis: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seating Class Analysis, 2016-2032

- 8.4.3. Economy class

- 8.4.4. Premium economy class

- 8.4.5. First class

- 8.4.6. Business class

- 8.5. Latin America Aircraft Seating Market Analysis, Opportunity and Forecast, By , 2016-2032

- 8.5.1. Latin America Aircraft Seating Market Analysis by : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 8.6. Latin America Aircraft Seating Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Aircraft Seating Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Aircraft Seating Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Aircraft Seating Market Analysis, 2016-2021

- 9.2. Middle East & Africa Aircraft Seating Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Aircraft Seating Market Analysis, Opportunity and Forecast, By By Aircraft Type Analysis, 2016-2032

- 9.3.1. Middle East & Africa Aircraft Seating Market Analysis by By Aircraft Type Analysis: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Aircraft Type Analysis, 2016-2032

- 9.3.3. Wide Body Aircraft

- 9.3.4. General aviation

- 9.3.5. Narrow Body Aircraft

- 9.3.6. Very Large Aircraft

- 9.3.7. Regional Transport Aircraft

- 9.4. Middle East & Africa Aircraft Seating Market Analysis, Opportunity and Forecast, By By Seating Class Analysis, 2016-2032

- 9.4.1. Middle East & Africa Aircraft Seating Market Analysis by By Seating Class Analysis: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Seating Class Analysis, 2016-2032

- 9.4.3. Economy class

- 9.4.4. Premium economy class

- 9.4.5. First class

- 9.4.6. Business class

- 9.5. Middle East & Africa Aircraft Seating Market Analysis, Opportunity and Forecast, By , 2016-2032

- 9.5.1. Middle East & Africa Aircraft Seating Market Analysis by : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 9.6. Middle East & Africa Aircraft Seating Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Aircraft Seating Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Aircraft Seating Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Aircraft Seating Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Aircraft Seating Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Zodiac Aerospace

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. B/E Aerospace Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. RECARO Aircraft Seating GmbH & Co. KG

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Geven S.p.A.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Aviointeriors S.p.A.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Acro Aircraft Seating Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Thompson Aero Seating Ltd.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. HAECO Americas LLC

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. ZIM FLUGSITZ

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. STELIA Aerospace S.A.S.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

-

- Figure 1: Global Aircraft Seating Market Revenue (US$ Mn) Market Share by By Aircraft Type Analysis in 2022

- Figure 2: Global Aircraft Seating Market Attractiveness Analysis by By Aircraft Type Analysis, 2016-2032

- Figure 3: Global Aircraft Seating Market Revenue (US$ Mn) Market Share by By Seating Class Analysisin 2022

- Figure 4: Global Aircraft Seating Market Attractiveness Analysis by By Seating Class Analysis, 2016-2032

- Figure 5: Global Aircraft Seating Market Revenue (US$ Mn) Market Share by in 2022

- Figure 6: Global Aircraft Seating Market Attractiveness Analysis by , 2016-2032

- Figure 7: Global Aircraft Seating Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Aircraft Seating Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 12: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Figure 13: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 14: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 16: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Figure 17: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 18: Global Aircraft Seating Market Share Comparison by Region (2016-2032)

- Figure 19: Global Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 20: Global Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Figure 21: Global Aircraft Seating Market Share Comparison by (2016-2032)

- Figure 22: North America Aircraft Seating Market Revenue (US$ Mn) Market Share by By Aircraft Type Analysisin 2022

- Figure 23: North America Aircraft Seating Market Attractiveness Analysis by By Aircraft Type Analysis, 2016-2032

- Figure 24: North America Aircraft Seating Market Revenue (US$ Mn) Market Share by By Seating Class Analysisin 2022

- Figure 25: North America Aircraft Seating Market Attractiveness Analysis by By Seating Class Analysis, 2016-2032

- Figure 26: North America Aircraft Seating Market Revenue (US$ Mn) Market Share by in 2022

- Figure 27: North America Aircraft Seating Market Attractiveness Analysis by , 2016-2032

- Figure 28: North America Aircraft Seating Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Aircraft Seating Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 33: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Figure 34: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 35: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 37: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Figure 38: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 39: North America Aircraft Seating Market Share Comparison by Country (2016-2032)

- Figure 40: North America Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 41: North America Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Figure 42: North America Aircraft Seating Market Share Comparison by (2016-2032)

- Figure 43: Western Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by By Aircraft Type Analysisin 2022

- Figure 44: Western Europe Aircraft Seating Market Attractiveness Analysis by By Aircraft Type Analysis, 2016-2032

- Figure 45: Western Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by By Seating Class Analysisin 2022

- Figure 46: Western Europe Aircraft Seating Market Attractiveness Analysis by By Seating Class Analysis, 2016-2032

- Figure 47: Western Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by in 2022

- Figure 48: Western Europe Aircraft Seating Market Attractiveness Analysis by , 2016-2032

- Figure 49: Western Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Aircraft Seating Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 54: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Figure 55: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 56: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 58: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Figure 59: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 60: Western Europe Aircraft Seating Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 62: Western Europe Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Figure 63: Western Europe Aircraft Seating Market Share Comparison by (2016-2032)

- Figure 64: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by By Aircraft Type Analysisin 2022

- Figure 65: Eastern Europe Aircraft Seating Market Attractiveness Analysis by By Aircraft Type Analysis, 2016-2032

- Figure 66: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by By Seating Class Analysisin 2022

- Figure 67: Eastern Europe Aircraft Seating Market Attractiveness Analysis by By Seating Class Analysis, 2016-2032

- Figure 68: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by in 2022

- Figure 69: Eastern Europe Aircraft Seating Market Attractiveness Analysis by , 2016-2032

- Figure 70: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Aircraft Seating Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 75: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Figure 76: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 77: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 79: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Figure 80: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 81: Eastern Europe Aircraft Seating Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 83: Eastern Europe Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Figure 84: Eastern Europe Aircraft Seating Market Share Comparison by (2016-2032)

- Figure 85: APAC Aircraft Seating Market Revenue (US$ Mn) Market Share by By Aircraft Type Analysisin 2022

- Figure 86: APAC Aircraft Seating Market Attractiveness Analysis by By Aircraft Type Analysis, 2016-2032

- Figure 87: APAC Aircraft Seating Market Revenue (US$ Mn) Market Share by By Seating Class Analysisin 2022

- Figure 88: APAC Aircraft Seating Market Attractiveness Analysis by By Seating Class Analysis, 2016-2032

- Figure 89: APAC Aircraft Seating Market Revenue (US$ Mn) Market Share by in 2022

- Figure 90: APAC Aircraft Seating Market Attractiveness Analysis by , 2016-2032

- Figure 91: APAC Aircraft Seating Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Aircraft Seating Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 96: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Figure 97: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 98: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 100: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Figure 101: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 102: APAC Aircraft Seating Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 104: APAC Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Figure 105: APAC Aircraft Seating Market Share Comparison by (2016-2032)

- Figure 106: Latin America Aircraft Seating Market Revenue (US$ Mn) Market Share by By Aircraft Type Analysisin 2022

- Figure 107: Latin America Aircraft Seating Market Attractiveness Analysis by By Aircraft Type Analysis, 2016-2032

- Figure 108: Latin America Aircraft Seating Market Revenue (US$ Mn) Market Share by By Seating Class Analysisin 2022

- Figure 109: Latin America Aircraft Seating Market Attractiveness Analysis by By Seating Class Analysis, 2016-2032

- Figure 110: Latin America Aircraft Seating Market Revenue (US$ Mn) Market Share by in 2022

- Figure 111: Latin America Aircraft Seating Market Attractiveness Analysis by , 2016-2032

- Figure 112: Latin America Aircraft Seating Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Aircraft Seating Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 117: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Figure 118: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 119: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 121: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Figure 122: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 123: Latin America Aircraft Seating Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 125: Latin America Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Figure 126: Latin America Aircraft Seating Market Share Comparison by (2016-2032)

- Figure 127: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Market Share by By Aircraft Type Analysisin 2022

- Figure 128: Middle East & Africa Aircraft Seating Market Attractiveness Analysis by By Aircraft Type Analysis, 2016-2032

- Figure 129: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Market Share by By Seating Class Analysisin 2022

- Figure 130: Middle East & Africa Aircraft Seating Market Attractiveness Analysis by By Seating Class Analysis, 2016-2032

- Figure 131: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Market Share by in 2022

- Figure 132: Middle East & Africa Aircraft Seating Market Attractiveness Analysis by , 2016-2032

- Figure 133: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Aircraft Seating Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 138: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Figure 139: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 140: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 142: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Figure 143: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 144: Middle East & Africa Aircraft Seating Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Figure 146: Middle East & Africa Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Figure 147: Middle East & Africa Aircraft Seating Market Share Comparison by (2016-2032)

List of Tables

- Table 1: Global Aircraft Seating Market Comparison by By Aircraft Type Analysis (2016-2032)

- Table 2: Global Aircraft Seating Market Comparison by By Seating Class Analysis (2016-2032)

- Table 3: Global Aircraft Seating Market Comparison by (2016-2032)

- Table 4: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Table 8: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Table 9: Global Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 10: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Table 12: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Table 13: Global Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 14: Global Aircraft Seating Market Share Comparison by Region (2016-2032)

- Table 15: Global Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Table 16: Global Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Table 17: Global Aircraft Seating Market Share Comparison by (2016-2032)

- Table 18: North America Aircraft Seating Market Comparison by By Seating Class Analysis (2016-2032)

- Table 19: North America Aircraft Seating Market Comparison by (2016-2032)

- Table 20: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Table 24: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Table 25: North America Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 26: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Table 28: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Table 29: North America Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 30: North America Aircraft Seating Market Share Comparison by Country (2016-2032)

- Table 31: North America Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Table 32: North America Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Table 33: North America Aircraft Seating Market Share Comparison by (2016-2032)

- Table 34: Western Europe Aircraft Seating Market Comparison by By Aircraft Type Analysis (2016-2032)

- Table 35: Western Europe Aircraft Seating Market Comparison by By Seating Class Analysis (2016-2032)

- Table 36: Western Europe Aircraft Seating Market Comparison by (2016-2032)

- Table 37: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Table 41: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Table 42: Western Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 43: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Table 45: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Table 46: Western Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 47: Western Europe Aircraft Seating Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Table 49: Western Europe Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Table 50: Western Europe Aircraft Seating Market Share Comparison by (2016-2032)

- Table 51: Eastern Europe Aircraft Seating Market Comparison by By Aircraft Type Analysis (2016-2032)

- Table 52: Eastern Europe Aircraft Seating Market Comparison by By Seating Class Analysis (2016-2032)

- Table 53: Eastern Europe Aircraft Seating Market Comparison by (2016-2032)

- Table 54: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Table 58: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Table 59: Eastern Europe Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 60: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Table 62: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Table 63: Eastern Europe Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 64: Eastern Europe Aircraft Seating Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Table 66: Eastern Europe Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Table 67: Eastern Europe Aircraft Seating Market Share Comparison by (2016-2032)

- Table 68: APAC Aircraft Seating Market Comparison by By Aircraft Type Analysis (2016-2032)

- Table 69: APAC Aircraft Seating Market Comparison by By Seating Class Analysis (2016-2032)

- Table 70: APAC Aircraft Seating Market Comparison by (2016-2032)

- Table 71: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Table 75: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Table 76: APAC Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 77: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Table 79: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Table 80: APAC Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 81: APAC Aircraft Seating Market Share Comparison by Country (2016-2032)

- Table 82: APAC Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Table 83: APAC Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Table 84: APAC Aircraft Seating Market Share Comparison by (2016-2032)

- Table 85: Latin America Aircraft Seating Market Comparison by By Aircraft Type Analysis (2016-2032)

- Table 86: Latin America Aircraft Seating Market Comparison by By Seating Class Analysis (2016-2032)

- Table 87: Latin America Aircraft Seating Market Comparison by (2016-2032)

- Table 88: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Table 92: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Table 93: Latin America Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 94: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Table 96: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Table 97: Latin America Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 98: Latin America Aircraft Seating Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Table 100: Latin America Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Table 101: Latin America Aircraft Seating Market Share Comparison by (2016-2032)

- Table 102: Middle East & Africa Aircraft Seating Market Comparison by By Aircraft Type Analysis (2016-2032)

- Table 103: Middle East & Africa Aircraft Seating Market Comparison by By Seating Class Analysis (2016-2032)

- Table 104: Middle East & Africa Aircraft Seating Market Comparison by (2016-2032)

- Table 105: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by By Aircraft Type Analysis (2016-2032)

- Table 109: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by By Seating Class Analysis (2016-2032)

- Table 110: Middle East & Africa Aircraft Seating Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 111: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Aircraft Type Analysis (2016-2032)

- Table 113: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by By Seating Class Analysis (2016-2032)

- Table 114: Middle East & Africa Aircraft Seating Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 115: Middle East & Africa Aircraft Seating Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Aircraft Seating Market Share Comparison by By Aircraft Type Analysis (2016-2032)

- Table 117: Middle East & Africa Aircraft Seating Market Share Comparison by By Seating Class Analysis (2016-2032)

- Table 118: Middle East & Africa Aircraft Seating Market Share Comparison by (2016-2032)

- 1. Executive Summary

-

- Zodiac Aerospace

- B/E Aerospace Inc.

- RECARO Aircraft Seating GmbH & Co. KG

- Geven S.p.A.

- Aviointeriors S.p.A.

- Acro Aircraft Seating Ltd.

- Thompson Aero Seating Ltd.

- HAECO Americas LLC

- ZIM FLUGSITZ

- STELIA Aerospace S.A.S.