Aircraft Galley Systems Market By Type Analysis (Standard Galley, Modular Galley, Customized Galley), By Fit Analysis (Line Fit, Retro Fit), By Inserts Analysis (Electric, Non-Electric Insert), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50656

-

August 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

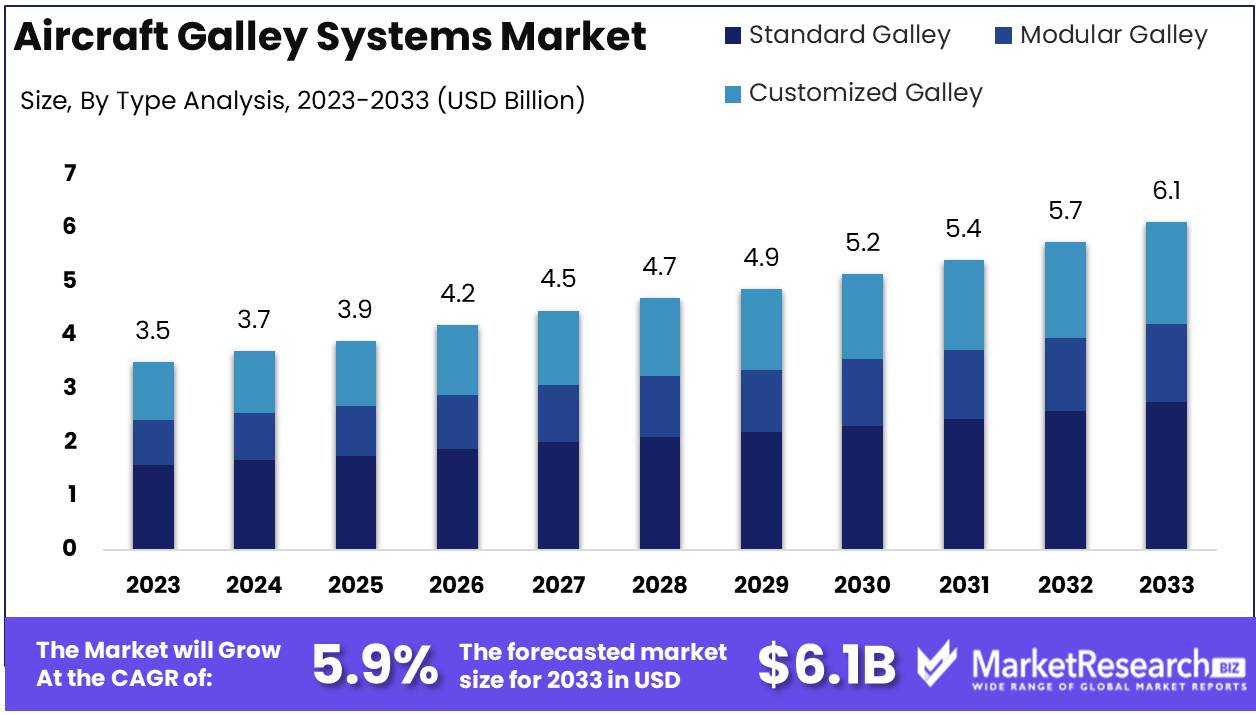

The Aircraft Galley Systems Market was valued at USD 3.5 billion in 2023. It is expected to reach USD 6.1 billion by 2033, with a CAGR of 5.9% during the forecast period from 2024 to 2033.

The Aircraft Galley Systems Market encompasses the design, production, and integration of onboard kitchen systems in commercial and military aircraft. These systems are crucial for food storage, preparation, and service during flights, ensuring passenger comfort and operational efficiency. The market is driven by the increasing demand for enhanced in-flight services, advancements in lightweight and modular galley designs, and the rising number of aircraft deliveries globally.

The Aircraft Galley Systems Market is poised for sustained growth, driven by the increasing global air passenger traffic and the rise in aircraft deliveries. As airlines continue to expand their fleets to meet growing demand, the need for efficient and advanced galley systems has become more critical. These systems are essential for optimizing space, enhancing operational efficiency, and improving the overall passenger experience. The market is further bolstered by technological advancements that focus on lightweight materials and energy-efficient designs, which align with the broader industry trend toward sustainability.

However, the high initial costs associated with these systems pose a significant challenge, particularly for budget carriers and smaller airlines. Despite this, the long-term benefits, including improved fuel efficiency and reduced operational costs, make these investments worthwhile.

Moreover, the continuous rise in air passenger traffic, particularly in emerging markets, underscores the importance of modernizing aircraft interiors, including galley systems. Airlines are increasingly focusing on providing superior in-flight services, and a well-equipped galley is integral to this strategy. The growth in aircraft deliveries, particularly in the Asia-Pacific region, where demand for new aircraft is robust, is expected to further drive the market. While high initial costs remain a barrier, the market is likely to witness sustained growth as airlines prioritize passenger experience and operational efficiency in an increasingly competitive landscape.

Key Takeaways

- Market Growth: The Aircraft Galley Systems Market was valued at USD 3.5 billion in 2023. It is expected to reach USD 6.1 billion by 2033, with a CAGR of 5.9% during the forecast period from 2024 to 2033.

- By Type Analysis: The Standard Galley segment dominated the market, driven by versatility and cost-effectiveness.

- By Fit Analysis: Line Fit dominated the Aircraft Galley Systems Market.

- By Inserts Analysis: Electric Inserts dominate due to efficiency, sustainability, and modernization in aviation.

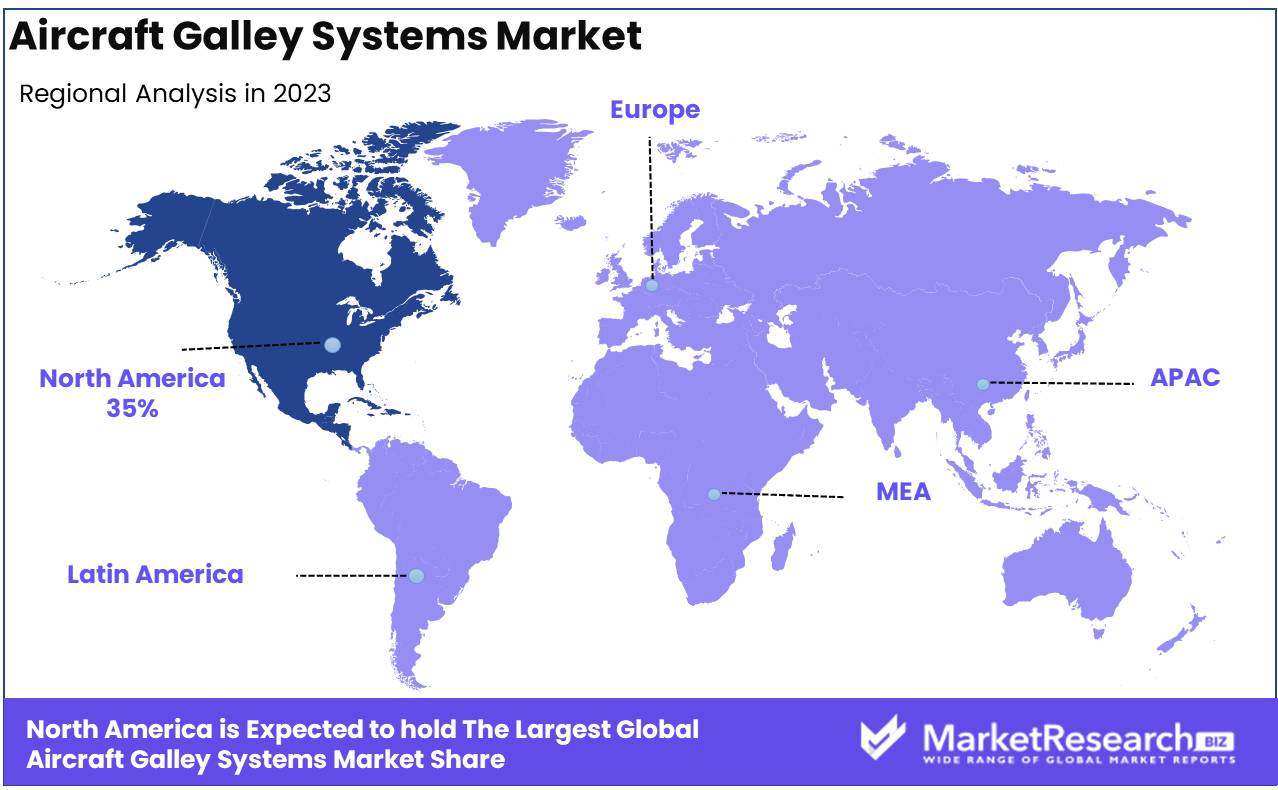

- Regional Dominance: North America dominates the Aircraft Galley Systems Market with a 35% share; Asia Pacific grows fastest.

- Growth Opportunity: The Aircraft Galley Systems Market is expected to witness robust growth driven by the dual forces of increasing demand for lightweight, energy-efficient systems and the expanding LCC market.

Driving factors

Surge in Air Passenger Traffic Fuels Demand for Aircraft Galley Systems

The increasing global air passenger traffic is a significant Aircraft Galley Systems Market driver. As more passengers travel by air, airlines must expand their fleets and optimize existing aircraft to accommodate higher volumes. According to the International Air Transport Association (IATA), air passenger numbers are projected to exceed 4 billion annually by 2024, reinforcing the need for efficient galley systems to support onboard services. This surge in demand for air travel directly correlates with the need for more advanced and capable galley systems that can handle the increased load, thereby driving market growth.

Enhanced Passenger Experience Elevates Importance of Galley Systems

The focus on enhancing passenger experience is another crucial factor contributing to the growth of the Aircraft Galley Systems Market. Modern travelers expect a high level of service, including quality food and beverage options, which places significant pressure on airlines to upgrade and improve their galley systems. Airlines are increasingly investing in innovative galley designs that can facilitate better meal preparation and service efficiency, thereby enhancing overall passenger satisfaction. This trend is particularly strong in premium and long-haul flights, where the quality of onboard services can significantly impact customer loyalty and brand differentiation. The drive to improve passenger experience is pushing airlines to adopt more sophisticated galley systems, thus fueling market expansion.

Technological Advancements Drive Efficiency and Innovation in Galley Systems

Technological advancements are playing a pivotal role in the evolution of the Aircraft Galley Systems Market. Innovations such as lightweight materials, modular designs, and advanced food preparation technologies are transforming traditional galley systems into more efficient and versatile units. These advancements not only reduce the weight and space occupied by galleys but also enhance their functionality, enabling airlines to offer a wider range of services without compromising efficiency.

For instance, the integration of smart technologies, such as IoT-enabled appliances and energy-efficient systems, allows for real-time monitoring and better resource management, further boosting the operational efficiency of aircraft galleys. As airlines seek to optimize both cost and service quality, the adoption of these advanced galley systems is expected to grow, driving market expansion.

Restraining Factors

Balancing Innovation and Efficiency: The Impact of Design and Weight Constraints on the Aircraft Galley Systems Market

Design and weight constraints play a critical role in shaping the growth trajectory of the Aircraft Galley Systems Market. In the aerospace industry, where every additional kilogram can significantly affect fuel efficiency and operational costs, manufacturers face the challenge of developing galley systems that are both lightweight and functional. The need to balance these constraints with the demand for more sophisticated, space-efficient designs has led to slower innovation and higher production costs, thereby restraining market growth.

This trade-off between innovation and efficiency has pushed manufacturers to invest in research and development, seeking materials and technologies that can reduce weight without compromising functionality. For instance, the increasing use of lightweight composite materials, while addressing some weight concerns, also brings higher costs and complex manufacturing processes, limiting widespread adoption.

Technological Demands and Cost Implications: The Requirement for Advanced Systems in the Aircraft Galley Systems Market

The increasing requirement for advanced systems within aircraft galleys such as smart appliances, energy-efficient ovens, and automated meal preparation units poses both opportunities and challenges for the market. While these innovations enhance passenger experience and operational efficiency, they also introduce complexities in design, integration, and cost. The demand for advanced systems necessitates sophisticated engineering solutions that must comply with stringent aviation standards, further complicating the design process and increasing the overall weight of the galley systems.

Additionally, the high costs associated with the development and integration of these advanced systems can deter airlines from investing in new or upgraded galley systems, particularly in a market where cost-efficiency is paramount. This creates a restraining effect on market growth as manufacturers and airlines alike navigate the balance between adopting cutting-edge technologies and managing operational costs.

By Type Analysis Analysis

The Standard Galley segment dominated the market, driven by versatility and cost-effectiveness.

In 2023, The Standard Galley segment held a dominant market position in the Aircraft Galley Systems Market. This segment’s leadership can be attributed to its widespread adoption across various aircraft types, owing to its cost-effectiveness and versatility in meeting the needs of both commercial and military aviation. Standard galleys are preferred by airlines due to their standardized design, which ensures compatibility across multiple aircraft models, leading to streamlined operations and maintenance.

The Modular Galley segment also showed significant growth, driven by the increasing demand for customization and flexibility in aircraft interiors. Modular galleys offer airlines the ability to tailor the galley configurations to specific flight requirements, enhancing operational efficiency and passenger service capabilities. This segment is particularly favored in newer aircraft models where adaptability is a key requirement.

Meanwhile, the Customized Galley segment catered to niche markets, particularly in business jets and VIP aircraft, where bespoke designs and luxury features are prioritized. Although this segment represents a smaller share of the market, its importance is growing as demand for personalized and premium travel experiences increases, especially in the high-net-worth individual (HNWI) and corporate sectors.

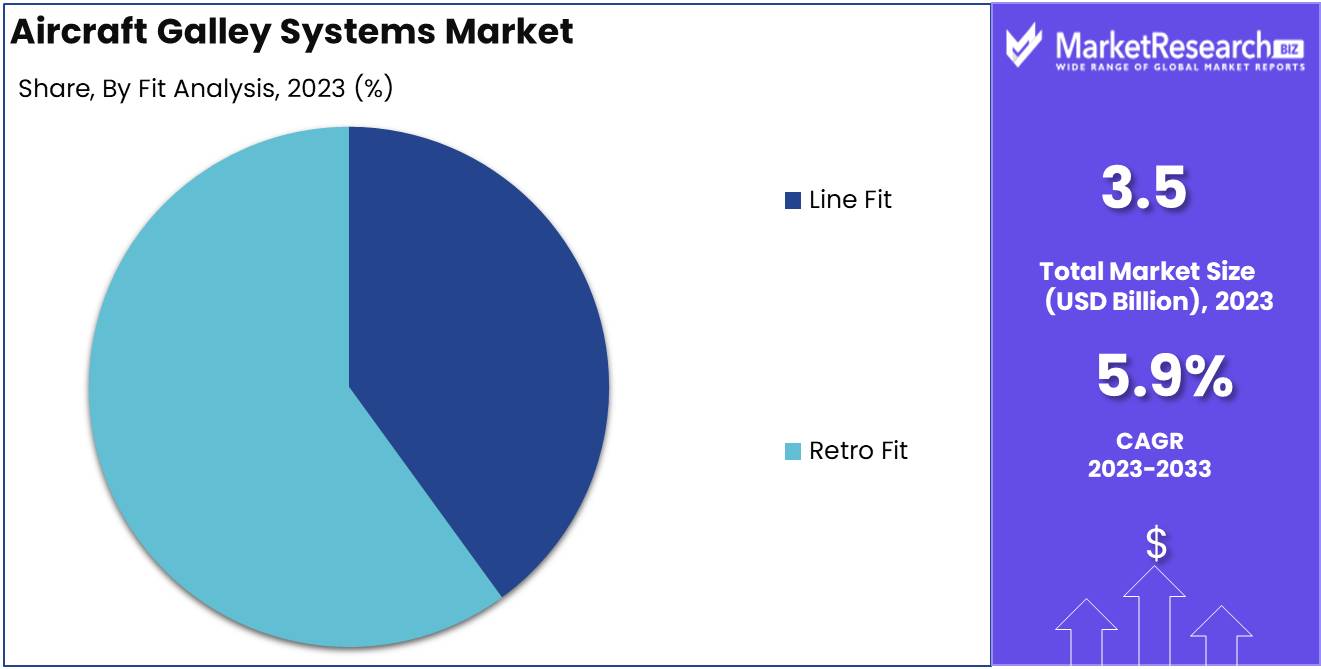

By Fit Analysis Analysis

Line Fit dominated the Aircraft Galley Systems Market in 2023.

In 2023, Line Fit held a dominant market position in the Fit Analysis segment of the Aircraft Galley Systems Market. This dominance is primarily attributed to the consistent demand for new aircraft production and the need to equip these aircraft with advanced galley systems from the outset. Airlines prioritize the integration of cutting-edge galley systems in newly manufactured aircraft to enhance passenger experience and operational efficiency. The focus on fuel efficiency and the adoption of lightweight materials in line-fit galleys also contributed to their growing preference among manufacturers.

Conversely, the Retro Fit segment has experienced significant growth, driven by the ongoing trend of modernizing existing aircraft fleets. Airlines are increasingly retrofitting their older aircraft with state-of-the-art galley systems to match the standards of new models and meet evolving passenger expectations. This retrofit demand is further fueled by the need to extend the service life of older aircraft, ensuring compliance with safety regulations and optimizing in-flight service capabilities. As airlines seek to balance cost-efficiency with passenger comfort, both line fit and retrofit segments continue to play crucial roles in the Aircraft Galley Systems Market.

By Inserts Analysis Analysis

Electric Inserts dominate due to efficiency, sustainability, and modernization in aviation.

In 2023, Electric Inserts held a dominant market position in the Aircraft Galley Systems Market's Inserts Analysis segment. The growing emphasis on energy efficiency and sustainability in aviation has driven the adoption of electric inserts, which offer significant advantages in terms of weight reduction, ease of installation, and operational efficiency. Airlines are increasingly opting for electric inserts due to their ability to reduce fuel consumption and maintenance costs, which directly impacts the overall cost-efficiency of aircraft operations. These inserts, including ovens, coffee makers, and water heaters, are preferred for their compatibility with modern aircraft designs that prioritize electrical power systems over traditional hydraulic and pneumatic systems.

In contrast, Non-Electric Inserts such as standard trays and storage units remain crucial but are largely confined to legacy aircraft and low-cost carriers that seek cost-effective solutions without upgrading to newer technologies. Despite their ongoing utility, the non-electric segment is expected to witness slower growth as the industry continues to pivot toward electric solutions. This shift is indicative of the broader trend in aviation toward modernization and sustainability, further consolidating the market dominance of electric inserts.

Key Market Segments

By Type Analysis

- Standard Galley

- Modular Galley

- Customized Galley

By Fit Analysis

- Line Fit

- Retro Fit

By Inserts Analysis

- Electric

- Non-Electric Insert

Growth Opportunity

Increasing Demand for Lightweight and Energy-Efficient Galley Systems

The global Aircraft Galley Systems Market is poised to benefit significantly from the growing emphasis on lightweight and energy-efficient solutions. As airlines seek to enhance fuel efficiency and reduce operational costs, there is an increasing demand for galley systems that are not only lighter but also more energy-efficient. These systems contribute directly to reducing the overall weight of aircraft, leading to lower fuel consumption and carbon emissions, which align with the industry's broader sustainability goals. The integration of advanced materials and technologies in galley systems presents a substantial growth opportunity, as airlines continue to modernize their fleets with eco-friendly solutions.

Expansion of the Low-Cost Carrier (LCC) Market

The rapid expansion of the Low-Cost Carrier (LCC) market is another key opportunity driving growth in the Aircraft Galley Systems Market. LCCs are increasingly capturing market share, particularly in emerging economies, leading to a surge in demand for aircraft equipped with efficient and cost-effective galley systems. The need for streamlined operations and cost management is pushing LCCs to adopt galley systems that optimize space and functionality without compromising on service quality. This trend is expected to bolster demand for modular and versatile galley configurations that can be easily adapted to the specific needs of LCCs, thereby offering significant growth potential for manufacturers in this space.

Latest Trends

Shift to Modular Designs

The Aircraft Galley Systems Market is expected to witness a significant shift towards modular designs. This trend is driven by the increasing demand for flexible and customizable galley configurations that can be easily adapted to different aircraft types and operational requirements. Airlines are seeking solutions that allow for efficient use of space while reducing weight, leading to enhanced fuel efficiency. Modular galley systems offer the advantage of quick reconfiguration during maintenance or retrofitting, minimizing downtime and associated costs. This trend is likely to gain momentum as airlines prioritize operational efficiency and cost-effectiveness.

Integration of Smart Technology

Another key trend in the Aircraft Galley Systems Market is the integration of smart technology. As airlines continue to enhance passenger experience, there is a growing focus on incorporating advanced technologies within galley systems. Smart galleys equipped with IoT-enabled appliances and sensors can streamline operations, enabling real-time monitoring of inventory, equipment status, and energy consumption. This integration facilitates predictive maintenance and enhances crew efficiency, contributing to a more seamless inflight service.

Moreover, the adoption of smart galley systems aligns with the broader trend of digital transformation in the aviation industry, where connectivity and data analytics play a crucial role in optimizing operational performance.

Regional Analysis

North America dominates the Aircraft Galley Systems Market with a 35% share; Asia Pacific is growing fastest.

The Aircraft Galley Systems Market exhibits varied growth dynamics across regions, reflecting the influence of regional economic conditions, aviation industry development, and technological advancements. North America dominates the market, holding a significant share of approximately 35%, driven by the presence of major aircraft manufacturers such as Boeing and strong demand for commercial aviation. The region's mature aviation infrastructure and high passenger traffic further support this dominance. Europe follows closely, supported by robust airline networks and the presence of leading galley system suppliers. The market in Europe is expected to experience steady growth, bolstered by continuous investments in fleet modernization and passenger comfort enhancements.

In the Asia Pacific region, the market is growing rapidly, fueled by the expanding aviation sector, increasing air passenger traffic, and rising investments in aircraft fleet expansion by airlines in countries like China and India. The region is poised to witness the highest CAGR during the forecast period, as airlines focus on enhancing their in-flight services and expanding their international routes.

The Middle East & Africa and Latin America regions, while smaller in market size, are also experiencing growth due to the increasing demand for modern aircraft and the expansion of regional airlines. In the Middle East, the growth is particularly driven by major carriers like Emirates and Qatar Airways, which are investing heavily in fleet upgrades and passenger experience. Latin America shows potential for growth as regional economic conditions improve and air travel becomes more accessible.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Aircraft Galley Systems Market is poised for significant growth, driven by innovations and strategic initiatives by leading industry players. Key companies such as Safran and Boeing are at the forefront, leveraging their extensive expertise in aerospace technologies to enhance galley systems' efficiency, weight reduction, and passenger comfort. Safran continues to push the boundaries with advanced modular designs, while Boeing's integration of galley systems into next-generation aircraft models underscores its commitment to delivering comprehensive solutions.

Bucher Group and AVIC Cabin Systems are also notable contributors, focusing on customizable galley systems tailored to varying airline requirements. Their emphasis on lightweight materials and efficient space utilization resonates with airlines striving to optimize operational efficiency. Meanwhile, GAL Aerospace and RTX are expanding their market presence through strategic partnerships and innovation in galley inserts and components, catering to the evolving demands of both commercial and business aviation sectors.

Jamco Corporation and DYNAMO Aviation are expected to play crucial roles by introducing state-of-the-art galley systems that incorporate smart technologies, enhancing functionality and reducing maintenance costs. Companies like Diehl Stiftung & Co. KG and Zodiac Aerospace (a part of Safran) are also driving market dynamics by focusing on sustainability and energy efficiency in their product offerings.

The collective efforts of these key players, characterized by continuous innovation and strategic collaborations, are expected to significantly shape the competitive landscape of the Aircraft Galley Systems Market, driving it toward sustained growth and technological advancement.

Market Key Players

- SAFRAN

- Boeing

- Bucher Group

- AVIC Cabin Systems

- GAL Aerospace

- RTX

- Jamco Corporation

- DYNAMO Aviation

- Aerolux Ltd

- Diehl Stiftung & Co. KG

- Zodiac Aerospace

- Rockwell Collins Inc.

- JAMCO Corporation

- AIM Altitude

- Turkish Cabin Interior

- Korita Aviation

Recent Development

- In June 2024, Zodiac Aerospace, a major player in the aircraft interior market, announced the expansion of its modular galley systems. The company introduced new configurations that allow airlines to customize galleys according to specific needs, focusing on optimizing space and improving service efficiency. This expansion is part of Zodiac’s broader strategy to enhance its market share in the competitive aircraft interiors segment.

- In May 2024, Diehl Aviation launched its new smart galley solutions, integrating IoT technology to enhance operational efficiency. The smart galleys feature real-time monitoring and predictive maintenance capabilities, allowing airlines to optimize galley management and reduce downtime. This innovation positions Diehl Aviation at the forefront of the digital transformation in aircraft galley systems.

- In April 2024, Collins Aerospace unveiled its latest lightweight galley systems designed to reduce overall aircraft weight. The new systems incorporate advanced composite materials, reducing the galley’s weight by up to 15%. This development aligns with the industry's shift towards fuel efficiency and sustainability, making Collins Aerospace a key player in the next generation of aircraft interiors.

Report Scope

Report Features Description Market Value (2023) USD 3.5 Billion Forecast Revenue (2033) USD 6.1 Billion CAGR (2024-2032) 5.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type Analysis (Standard Galley, Modular Galley, Customized Galley), By Fit Analysis (Line Fit, Retro Fit), By Inserts Analysis (Electric, Non-Electric Insert) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape SAFRAN, Boeing, Bucher Group, AVIC Cabin Systems, GAL Aerospace, RTX, Jamco Corporation, DYNAMO Aviation, Aerolux Ltd, Diehl Stiftung & Co. KG, Zodiac Aerospace, Rockwell Collins Inc. , JAMCO Corporation , AIM Altitude, Turkish Cabin Interior, Korita Aviation Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- SAFRAN

- Boeing

- Bucher Group

- AVIC Cabin Systems

- GAL Aerospace

- RTX

- Jamco Corporation

- DYNAMO Aviation

- Aerolux Ltd

- Diehl Stiftung & Co. KG

- Zodiac Aerospace

- Rockwell Collins Inc.

- JAMCO Corporation

- AIM Altitude

- Turkish Cabin Interior

- Korita Aviation