AI Camera Market By Type (Surveillance Cameras, Smartphone Cameras and Others), By Technology (Deep learning, Natural Language Processing, Computer Vision, Context-Aware Computing), By End-user (BFSI, Healthcare, Automotiv and Others), By connectivity (Wired, Wireless), By biometric method (Image Recognition, Facial Recognition and Others ), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51186

-

Sept 2024

-

230

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

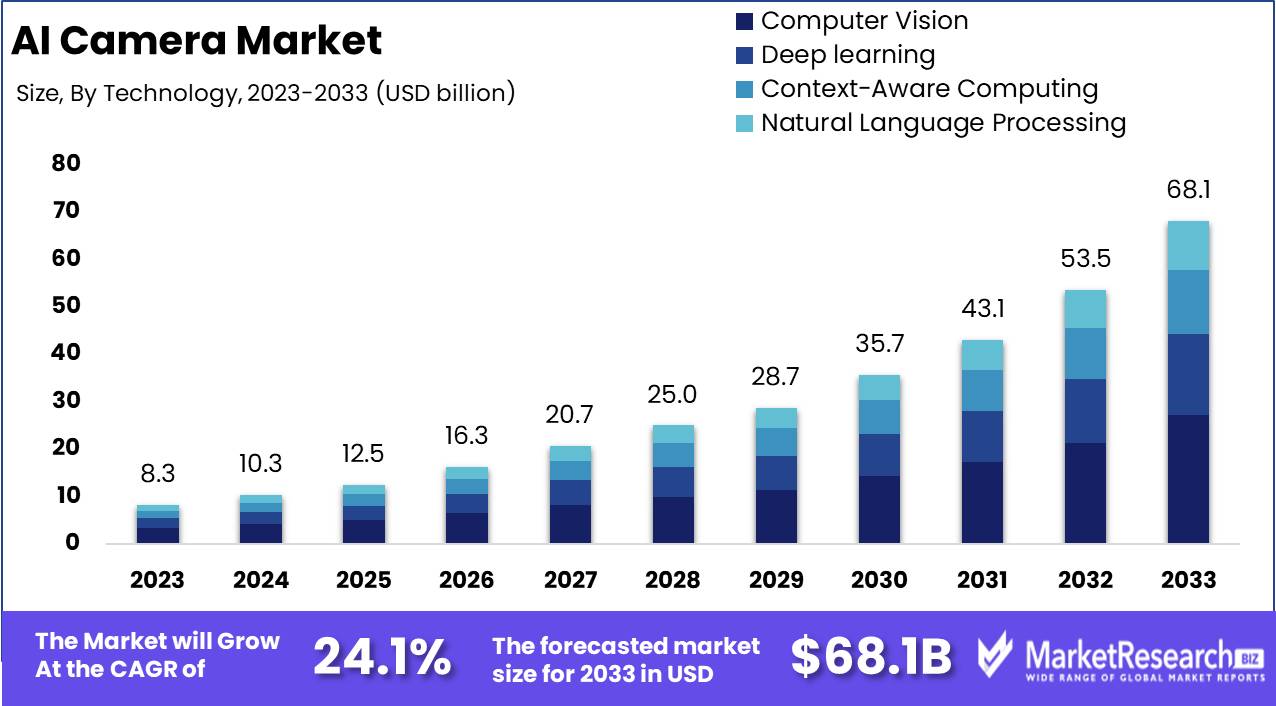

The Global AI Camera Market was valued at USD 8.3 Billion in 2023. It is expected to reach USD 68.1 Billion by 2033, with a Compound annual growth rate (CAGR) of 24.1% during the forecast period from 2024 to 2033.

The AI Camera Market encompasses a range of imaging devices integrated with artificial intelligence technology to enhance image processing and functionality. These cameras, equipped with AI algorithms, automate tasks such as object recognition, scene detection, and image enhancement, supporting applications in smartphones, automotive, surveillance, and healthcare industries. The market's growth is propelled by advancements in machine learning and the increasing adoption of edge computing in image processing. This technology not only streamlines operations across various sectors but also opens up new possibilities for intelligent imaging solutions that are both adaptive and responsive to user needs.

The AI camera market is positioned for significant growth, driven by increasing demand for smart surveillance, security, and operational efficiency across industries. As AI integration accelerates, cameras equipped with advanced machine learning algorithms are transforming key sectors such as security, healthcare, retail, and manufacturing. Key industry players are leveraging AI to optimize video analytics, enhance situational awareness, and deliver actionable insights in real-time, addressing a wide range of use cases from crime prevention to customer behavior analysis. A pivotal factor in the market’s expansion is the growing reliance on AI cameras to enable automation, improve decision-making, and support digital resilience efforts, particularly in the context of cybersecurity. The shift towards AI-driven solutions reflects broader industry trends of digital transformation and operational efficiency, where businesses are increasingly prioritizing innovation through AI to stay competitive.

Strategic investments by leading companies underscore the importance of AI-powered camera technologies. Cisco’s $1 billion investment fund announced at Cisco Live 2024, which focuses on AI infrastructure development and partnerships with companies such as Cohere and Mistral AI, highlights the significance of AI cameras in networking and security solutions. Similarly, Accenture's $3 billion commitment to AI innovation, with a focus on enhancing business efficiency, demonstrates the cross-industry demand for AI-powered cameras, particularly in sectors like retail analytics and healthcare monitoring.

Advantech’s introduction of the ICAM-520/500 series, featuring SONY industrial-grade sensors and an NVIDIA AI system, further emphasizes the importance of AI in industrial settings, offering scalable solutions for cloud-to-edge vision AI applications. Meanwhile, Resideo's expansion of its VX Series with the First Alert VX5 Indoor Camera, which features advanced event detection and privacy modes, reflects a growing focus on consumer-centric innovations. These developments indicate that the AI camera market will continue to evolve rapidly, driven by technological advancements, strategic partnerships, and increasing use cases across industries.

Key Takeaways

- Market Growth: The global AI camera market report is projected to grow from USD 8.3 billion in 2023 to USD 68.1 billion by 2033, with a CAGR of 24.1% during the forecast period.

- By Type: In 2023, surveillance cameras led the AI camera market with a 38.0% market share, driven by demand for advanced security solutions.

- By Technology: Computer Vision dominated the technology segment, holding over 40% of the market due to its integration in sectors like automotive and healthcare.

- By End-user: Consumer electronics led the end-user segment with over 35% of the market, supported by the proliferation of AI in smartphones and home devices.

- By Connectivity: Wired connectivity held a dominant position with more than 55% market share, due to its reliability in high-performance industries like surveillance and healthcare.

- Regional Growth: North America led the AI camera market with a 37.4% share, driven by strong AI adoption in security, automotive, and consumer electronics sectors.

- Growth Opportunity: Innovations in AI and machine learning are set to drive significant growth in the AI camera market, particularly with real-time object detection and smart home integration.

- Restraint: Data security concerns and compliance with privacy regulations, such as GDPR and CCPA, remain key challenges that could slow market adoption.

Driving factors

Rising Demand for Surveillance Solutions

The rising demand for advanced surveillance solutions is a pivotal driver of growth in the AI camera market. Globally, industries such as public safety, transportation, and retail are increasingly investing in AI-enabled surveillance systems to enhance security and operational efficiency. These AI cameras, equipped with facial recognition, behavioral analytics, and automated threat detection, provide significant improvements over traditional systems, allowing real-time monitoring and proactive response mechanisms.

This growth is largely fueled by urbanization, rising crime rates, and the increasing emphasis on smart city infrastructure. Governments and private enterprises are adopting AI-powered surveillance for border control, traffic management, and critical infrastructure protection, further boosting demand.

The integration of AI enhances surveillance systems by reducing human error and providing continuous, intelligent monitoring. As organizations aim to minimize operational risks and comply with stricter regulatory environments, AI cameras are becoming indispensable. Moreover, as the complexity of cyber and physical threats increases, the role of AI in delivering predictive insights and automated responses becomes crucial in safeguarding assets, contributing significantly to market expansion.

Technological Advancements

Technological advancements in AI and imaging technologies are rapidly expanding the capabilities of AI cameras, thereby fueling market growth. Breakthroughs in machine learning algorithms, edge computing, and image processing technologies have significantly enhanced the performance of AI cameras, enabling faster data processing and more accurate identification and analysis. These advancements have made AI cameras more affordable, energy-efficient, and accessible across a broader range of industries, including healthcare, automotive, and industrial sectors.

For instance, the integration of 5G connectivity enables AI cameras to process vast amounts of data with minimal latency, crucial for applications requiring real-time decision-making, such as autonomous vehicles and smart manufacturing.

Furthermore, advancements in AI deep learning and neural networks have made it possible for cameras to recognize complex patterns, predict behaviors, and learn from continuous data streams, all of which are essential in applications like facial recognition, automated retail checkouts, and precision agriculture. The constant evolution of AI capabilities not only expands the potential applications of AI cameras but also creates opportunities for new revenue streams in software updates and AI-as-a-service (AIaaS) models.

Restraining Factors

Data Security Concerns

Data security is a major concern within the AI camera market, primarily because AI cameras collect and process vast amounts of sensitive information, such as personal, behavioral, and facial recognition data. Growing privacy regulations, including the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., impose strict requirements on data handling, which many companies struggle to comply with. Fears around unauthorized data access, hacking, and misuse of personal information make consumers hesitant to adopt AI camera technologies, slowing down the market’s growth trajectory.

Businesses also face a high risk of reputational damage and potential financial penalties for non-compliance, discouraging rapid implementation of AI-based camera systems in sensitive environments like retail, healthcare, and public spaces. This hesitancy impacts demand, especially in regions where regulatory frameworks around data protection are stringent.

Moreover, this factor creates a feedback loop with technology development. Companies are required to invest heavily in cybersecurity solutions, which increases operational costs, further delaying the development and release of AI cameras. Ultimately, until the industry can offer solutions with robust and transparent data security features, consumer trust will continue to be a significant barrier to widespread adoption.

High Initial Costs

The high initial costs associated with AI camera systems also act as a substantial barrier to market growth. These systems require advanced hardware components, including high-performance processors, sophisticated sensors, and enhanced storage capacities to process large volumes of real-time data. Additionally, the software algorithms that enable AI functionalities, such as facial recognition, object tracking, and pattern analysis, demand significant upfront R&D investment.

Smaller businesses and emerging markets often struggle to justify the capital expenditure required to deploy AI camera systems, limiting market penetration in cost-sensitive regions. For instance, many small-to-medium enterprises (SMEs) opt for cheaper, traditional CCTV alternatives, which provide basic security at a fraction of the cost, thereby narrowing the target consumer base for AI cameras.

Another cost-related factor is the maintenance and operational overhead of AI camera systems. Integrating AI capabilities often requires ongoing software updates, system scaling, and cybersecurity measures, further increasing long-term costs. While large corporations may absorb these costs as part of their digital transformation initiatives, this remains prohibitive for smaller organizations, contributing to slower overall market expansion.

By Type Analysis

Surveillance Cameras Lead AI Camera Market with 38.0% largest Market Share in 2023

In 2023, Surveillance Cameras held a dominant position in the By Type segment of the AI Camera Market, capturing more than 38.0% of the overall market share. This substantial share can be attributed to the increasing adoption of AI-powered surveillance systems across both public and private sectors. The growing need for advanced security solutions, especially in smart city projects, coupled with advancements in facial recognition and real-time monitoring capabilities, has fueled the demand for AI-integrated surveillance cameras. Their ability to enhance threat detection, reduce false alarms, and streamline video analytics makes them a critical asset in modern security infrastructures.

Smartphone Cameras emerged as another significant contributor, accounting for approximately 30.5% of the market. The proliferation of AI-enabled features such as scene recognition, portrait enhancements, and computational photography in smartphones has boosted consumer demand for high-performance cameras. The integration of AI in smartphone cameras continues to revolutionize mobile photography, driving manufacturers to prioritize innovations that enhance user experiences and image quality.

Digital Cameras, holding about 15.2% of the market share, have seen a moderate yet steady growth due to the rising implementation of AI for features like autofocus, subject tracking, and image stabilization. While smartphone cameras have encroached on the digital camera market, niche applications such as professional photography, where superior image quality is paramount, continue to support the segment.

Industrial Cameras captured around 9.8% of the market share in 2023. These cameras are gaining traction in industries such as manufacturing, logistics, and healthcare, where AI-driven vision systems are critical for quality control, automation, and process optimization. The combination of AI with machine vision technologies enables real-time analytics and decision-making, driving the demand for AI-enabled industrial cameras.

Finally, Others, which includes specialized cameras used in sectors like healthcare (e.g., medical imaging) and automotive (e.g., AI-assisted driving cameras), comprised approximately 6.5% of the market. Although a smaller portion of the overall market, this segment is anticipated to witness significant growth, particularly as AI applications in niche markets become more widespread and sophisticated.

By Technology Analysis

Computer Vision Leads AI Camera Market with Over 40% Largest Share in 2023

In 2023, Computer Vision held a dominant market position in the "By Technology" segment of the AI Camera Market, capturing more than 40.0% of the overall share. This significant lead is driven by the increasing integration of AI-powered image recognition and object detection across industries such as automotive, healthcare, and retail. The rapid advancements in machine learning algorithms and the proliferation of high-quality image sensors further solidified Computer Vision's competitive edge in the AI camera ecosystem.

Meanwhile, Deep Learning accounted for a substantial portion of the market, reflecting its growing role in enhancing the accuracy and efficiency of AI cameras. Deep learning's capabilities in handling vast amounts of data and improving real-time decision-making have been particularly impactful in security and surveillance applications, where quick and accurate threat detection is critical.

Context-Aware Computing is also gaining momentum in the AI camera market, offering users more intuitive and personalized interactions. Its ability to understand and react to environmental factors makes it highly valuable in smart home systems, autonomous vehicles, and augmented reality (AR) experiences. As the demand for more sophisticated user experiences increases, context-aware computing is expected to see further adoption.

Natural Language Processing (NLP), although holding a smaller market share compared to other technologies, has shown significant potential, especially in enhancing voice-activated camera systems and enabling more seamless human-computer interactions. NLP’s ability to interpret and process language data efficiently positions it for future growth as AI cameras become more integrated with voice recognition systems and smart assistants.

By End-user Analysis

Consumer Electronics Leads AI Camera Market with Over 35% Largest Revenue Share in 2023

In 2023, the AI Camera Market was prominently segmented by end-user into the following categories: Consumer Electronics, BFSI (Banking, Financial Services, and Insurance), Healthcare, Retail, Automotive, Government, and Others. Among these, Consumer Electronics held a dominant market position, capturing more than a 35.0% share. This sector’s substantial share can be attributed to the increasing integration of AI technologies in consumer devices like smartphones, home security systems, and personal assistants, where cameras play a crucial role in enhancing user interaction and functionality.

The BFSI sector also leveraged AI cameras extensively for security and customer service enhancements, such as facial recognition for secure transactions and customer identification. In the Healthcare sector, AI cameras are increasingly adopted for monitoring patient health and supporting diagnostic procedures with greater accuracy and efficiency.

Retail businesses utilize AI cameras for inventory management, customer behavior tracking, and enhancing the overall shopping experience through personalized customer interactions. The Automotive industry benefits from AI cameras by integrating them into advanced driver-assistance systems (ADAS) to improve vehicle safety and navigation capabilities.

Government initiatives to implement AI technology for public safety, traffic management, and surveillance have also supported the growth of this market segment. The 'Others' category, which includes sectors like logistics and education, is exploring the use of AI cameras to optimize operational efficiency and enhance learning experiences through augmented reality (AR) applications.

By Connectivity Analysis

In 2023, Wired held a dominant market position in the "By Connectivity" segment of the AI Camera Market, capturing more than a 55.0% share. This significant market presence can be attributed to the stability, reliability, and uninterrupted data transmission that wired AI camera systems offer, especially in industries requiring high-performance and consistent connectivity, such as surveillance, industrial automation, and healthcare. Wired AI cameras are often preferred in large-scale, fixed installations where uninterrupted data flow is critical, and latency or interference risks need to be minimized.

On the other hand, Wireless AI cameras are steadily gaining traction, driven by their flexibility, ease of installation, and cost-effectiveness in environments where mobility and scalability are essential. While the wireless segment accounted for a smaller market share in 2023, its adoption is expected to rise due to advancements in wireless technologies such as 5G and Wi-Fi 6, improving bandwidth, reducing latency, and supporting high-definition data transmission. This makes wireless AI cameras increasingly attractive for dynamic and decentralized applications, such as smart cities, retail, and home security solutions.

Looking ahead, the Wired segment is expected to maintain a stronghold in specific industries, particularly where high data integrity and security are non-negotiable. However, the Wireless segment is poised for accelerated growth, driven by the increasing demand for flexible, scalable, and cost-efficient AI camera systems across various sectors.

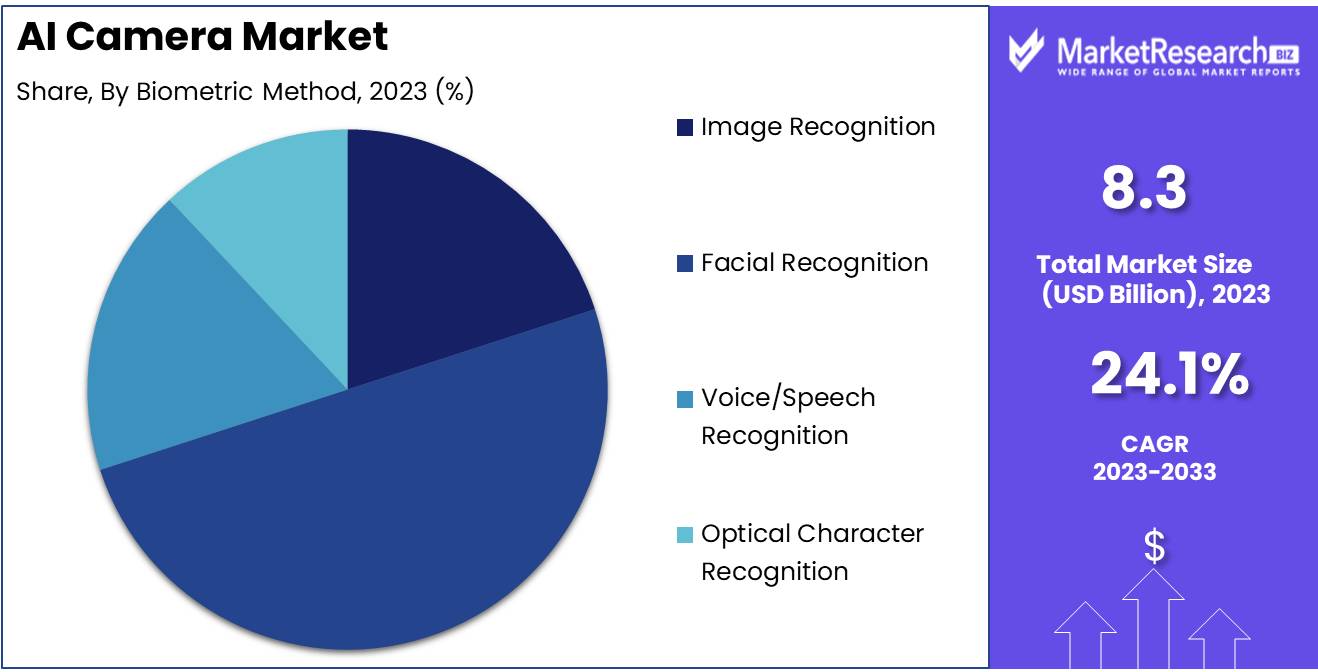

By Biometric Method Analysis

In 2023, Facial Recognition held a dominant market position in the By Biometric Method segment of the AI Camera Market, capturing more than a 50.0% share. The growth of this technology can be attributed to its widespread adoption across industries such as security, retail, healthcare, and public surveillance, where its ability to quickly and accurately identify individuals offers significant advantages in enhancing security protocols and improving customer experience.

Image Recognition, another key component in AI camera systems, accounted for a notable market share, driven by its use in sectors like automotive, where it plays a critical role in autonomous driving systems, and in retail, where it supports inventory management and product recommendations. Its rapid growth trajectory is supported by advancements in deep learning and computer vision technologies.

Voice/Speech Recognition made substantial inroads, particularly in smart home devices, automotive infotainment systems, and personal assistants, though it captured a smaller share compared to facial and image recognition. The integration of voice-based controls in cameras and devices that interact with AI assistants underscores the increasing consumer demand for hands-free functionality and improved user interfaces.

Lastly, Optical Character Recognition (OCR), while more niche compared to the other biometric methods, has demonstrated consistent growth due to its crucial role in digitizing documents and improving workflow automation in sectors such as banking, legal, and logistics. The ability of OCR to extract text from images enhances data management efficiency, contributing to its adoption across industries requiring high-volume data processing.

Key Market Segments

By Type

- Surveillance Cameras

- Smartphone Cameras

- Digital Cameras

- Industrial Cameras

- Others

By Technology

- Computer Vision

- Deep learning

- Context-Aware Computing

- Natural Language Processing

By End-user

- Consumer Electronics

- BFSI

- Healthcare

- Retail

- Automotive

- Government

- Others

By Connectivity

- Wired

- Wireless

By Biometric Method

- Image Recognition

- Facial Recognition

- Voice/Speech Recognition

- Optical Character Recognition

Growth Opportunity

Leveraging AI and Machine Learning Innovations

The AI Camera Market is set for substantial expansion in 2024, primarily driven by continuous breakthroughs in artificial intelligence (AI) and machine learning technologies. These innovations are transforming camera functionalities, enabling more sophisticated image processing and analytics. As AI algorithms evolve, AI cameras are equipped with enhanced features such as real-time object detection, facial recognition, and automated decision-making. These capabilities are crucial in areas ranging from security surveillance to consumer electronics, where the demand for intelligent and autonomous systems is rapidly increasing. The advancement of AI not only boosts the accuracy of these devices but also broadens their application scope, ensuring wider market adoption.

Integration with Smart Home and IoT Devices

Another pivotal growth avenue for the AI Camera Market in 2024 stems from its integration with smart home systems and Internet of Things (IoT) devices. With the proliferation of smart homes, AI cameras are increasingly becoming essential to home automation systems. These cameras enhance home security and energy management by seamlessly interacting with other IoT devices. For example, an AI camera can detect unusual activities and automatically adjust lighting or notify homeowners, thus providing convenience and enhanced security. This integration is anticipated to drive further innovations in the market, as developers strive to forge more interconnected and intelligent systems.

Latest Trends

Enhanced Surveillance Capabilities

The AI camera market is set to undergo transformative shifts by 2024, driven by significant advancements in surveillance technology. A key trend is the increased integration of AI features in network cameras. By 2025, an estimated 64% of all network cameras will be equipped with AI functionalities. This development is pivotal as it enhances object detection capabilities, markedly reduces false positives, and improves overall image clarity. The transition to AI-enhanced surveillance is rapidly gaining traction, with approximately 70% of businesses indicating plans to escalate their investments in AI video surveillance systems within the next year. This trend underscores the sector’s move towards more efficient and sophisticated surveillance solutions.

AI Cameras in Smart City Development

AI technology, particularly facial recognition, is becoming indispensable in the realm of smart city initiatives. These technologies are crucial for enhancing public safety, optimizing transportation systems, and improving urban infrastructure management. By 2026, AI applications in smart cities are expected to yield a substantial economic impact, contributing to a global value of $20 trillion. The European Union’s commitment, exemplified by its investment of over $1 billion in smart city projects, emphasizes the significant role that AI-powered cameras will play in future urban development. This focus on smart cities represents a major opportunity for growth in the AI camera market, as governments and municipalities push for technological integration that promises to redefine urban living and operational efficiencies.

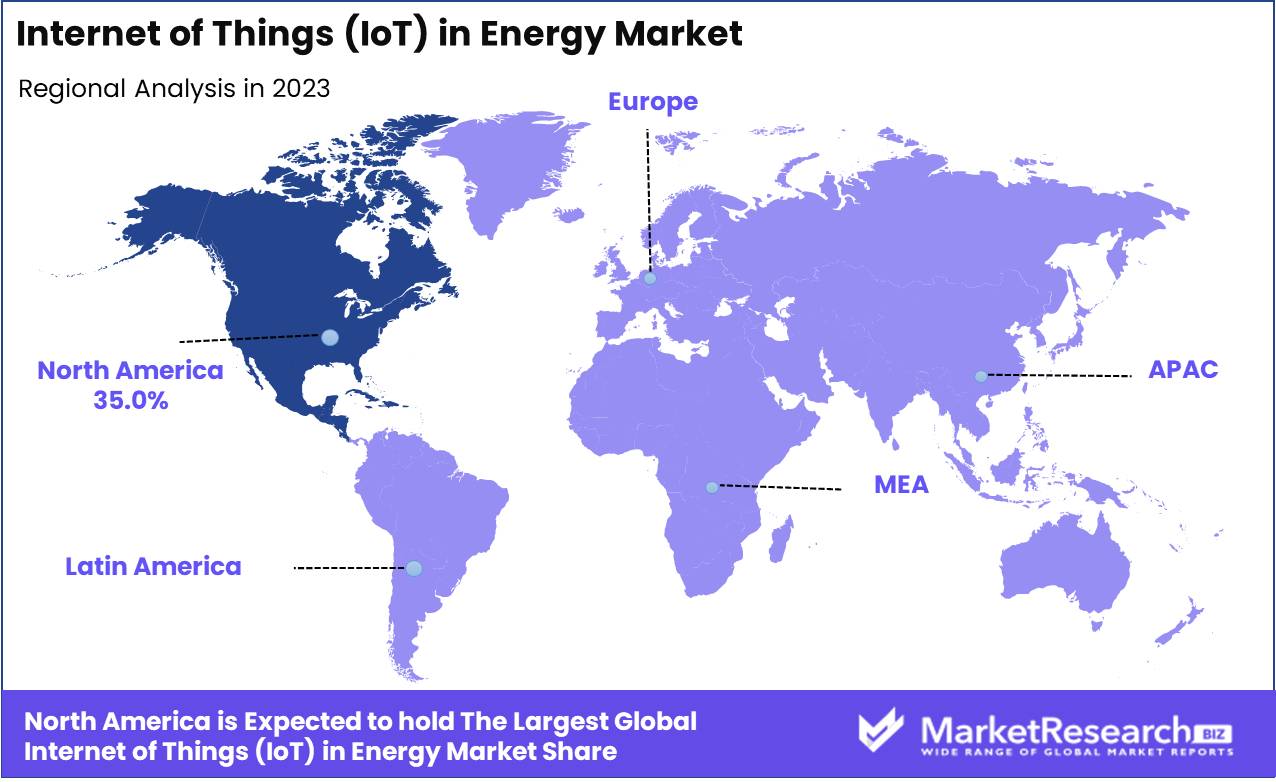

Regional Analysis

AI Camera Market North America Leads with 37.4% Largest Market Share

In the global AI camera market, North America stands as the dominant region, accounting for a substantial 37.4% of the market share. This leadership is driven by robust adoption of advanced AI technologies, a strong presence of major industry players, and a well-developed infrastructure conducive to technological innovation. The U.S., in particular, is a key contributor within North America, supported by high investments in AI research and development, as well as increasing demand for AI-enabled cameras in sectors such as security, automotive, and consumer electronics. Canada also plays a significant role, although at a smaller scale, with increasing deployments of AI camera systems in public safety and commercial sectors. The rest of North America continues to experience steady growth, benefiting from spillover effects from the U.S. market.

Europe follows closely, with Germany, France, and the UK leading the charge. The region is characterized by rapid advancements in AI technology integration across various sectors, such as automotive and retail, contributing to strong demand for AI cameras. Germany, known for its prowess in automotive manufacturing, is a key hub for AI camera adoption in autonomous vehicles. The UK and France are also emerging as important markets due to growing smart city initiatives and enhanced surveillance requirements. The rest of Europe, including Spain, Italy, the Netherlands, and Russia, is gradually catching up as governments and private enterprises increasingly invest in AI-driven security solutions.

Asia-Pacific is another fast-growing region, spearheaded by China, Japan, and South Korea. China, with its massive investment in AI infrastructure, especially in facial recognition and surveillance technology, is a dominant force within the region. Japan and South Korea, recognized for their leadership in consumer electronics and robotics, are driving AI camera demand through innovations in smart home devices and industrial automation. Emerging markets like India, Vietnam, and Singapore are also witnessing rapid growth, supported by increasing urbanization and government initiatives aimed at enhancing security systems. Asia-Pacific is expected to exhibit the highest growth rate in the coming years due to the region's expanding technological capabilities and growing middle-class consumer base.

In Latin America, Mexico and Brazil lead the market, although the region as a whole remains in the early stages of AI camera adoption. Growth is mainly driven by the increasing need for security solutions in urban areas and rising investments in digital infrastructure. However, economic challenges in some countries may slow down broader regional adoption.

The Middle East & Africa is a nascent but promising market for AI cameras. Saudi Arabia and the UAE are at the forefront of adopting AI technology, driven by smart city projects and national security initiatives. South Africa also shows potential as governments and private sectors look to enhance public safety measures through AI-based surveillance systems. The rest of the region, however, faces infrastructural and economic challenges that may hinder rapid adoption in the near term.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global AI camera market is witnessing significant advancements, driven by key players across various sectors. Canon Inc. and Nikon Corporation, traditionally known for their imaging technology, are leveraging AI to enhance image processing and recognition capabilities, positioning themselves as frontrunners in professional photography and security applications.

Bosch Sicherheitssysteme GmbH and Honeywell International Inc., both prominent in the security and safety sectors, continue to integrate AI-driven cameras into smart surveillance systems, enhancing real-time analytics, facial recognition, and predictive threat detection. Similarly, Johnson Controls and Robert Bosch GmbH are increasingly focused on AI for smart building solutions, incorporating advanced cameras for automated monitoring and facility management.

Sony Corporation, Panasonic Holdings Corporation, and Samsung Electronics Co. remain at the forefront of innovation, integrating AI technologies into consumer electronics, including smartphones, autonomous vehicles, and smart home devices, ensuring robust market competitiveness. These companies benefit from their strong R&D capabilities and broad consumer reach, positioning them well in both the consumer and industrial segments of the AI camera market.

Chinese firms, including Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., and VIVOTEK Inc., continue to dominate the video surveillance market with AI-powered solutions that offer advanced video analytics and data processing. Their expansive product portfolios and cost-effective solutions enable them to capture significant market share, particularly in Asia-Pacific and emerging markets.

Axis Communications AB, known for its expertise in network cameras, is likely to see continued growth through AI integration, as the demand for intelligent video surveillance increases globally. This competitive landscape underscores the AI camera market's rapid evolution and potential for continued expansion across industries.

Market Key Players

- Canon Inc.

- Bosch Sicherheitssysteme GmbH

- Honeywell International Inc.

- Sony Corporation

- Panasonic Holdings Corporation

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Nikon Corporation

- Johnson Controls

- Samsung Electronics Co.

- Axis Communications AB

- VIVOTEK Inc

- Dahua Technology Co., Ltd.

- Robert Bosch GmbH

- Other Key Players

Recent Development

- In 2024, Cisco: Cisco launched a $1 billion global investment fund to develop AI infrastructure and form partnerships with companies like Cohere and Mistral AI. Their innovations include AI-powered security and networking, with AI cameras enhancing cybersecurity and digital resilience.

- In 2024, Accenture: Accenture committed $3 billion to accelerate AI integration across industries. This includes AI-powered solutions for security, retail analytics, and healthcare monitoring, supported by partnerships and acquisitions aimed at improving business efficiency through AI.

- In 2024, Advantech: Advantech introduced the ICAM-520/500 series Industrial AI Camera, featuring SONY image sensors, ARM processors, and an NVIDIA AI module. This camera supports AI-driven cloud-to-edge vision applications with development tools like CAMNavi SDK and NVIDIA Deepstream SDK.

- In 2024, Resideo: Resideo expanded its VX Series with the First Alert VX5 Indoor Camera, an AI-powered device offering advanced event detection, high-quality video/audio, and a privacy mode for enhanced security.

- In 2024, DNEG Group: DNEG Group received a $200 million investment from United Al Saqer Group to launch Prime Focus Studios and Brahma AI, an AI-driven platform for content creation and technological innovation in visual effects and animation.

Report Scope

Report Features Description Market Value (2023) USD 8.3 Bn Forecast Revenue (2033) USD 68.1 Bn CAGR (2024-2032) 24.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Surveillance Cameras, Smartphone Cameras, Digital Cameras, Industrial Cameras, Others), By Technology (Deep learning, Natural Language Processing, Computer Vision, Context-Aware Computing), By End-user (BFSI, Healthcare, Automotive, Consumer Electronics, Retail, Government, Others), By connectivity (Wired, Wireless), By biometric method (Image Recognition, Facial Recognition, Voice/Speech Recognition, Optical Character Recognition) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Canon Inc., Bosch Sicherheitssysteme GmbH, Honeywell International Inc., Sony Corporation, Panasonic Holdings Corporation, Hangzhou Hikvision Digital Technology Co., Ltd., Nikon Corporation, Johnson Controls, Samsung Electronics Co., Axis Communications AB, VIVOTEK Inc, Dahua Technology Co., Ltd., Robert Bosch GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global AI Camera Market Overview

- 2.1. AI Camera Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. AI Camera Market Dynamics

- 3. Global AI Camera Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global AI Camera Market Analysis, 2016-2021

- 3.2. Global AI Camera Market Opportunity and Forecast, 2023-2032

- 3.3. Global AI Camera Market Analysis, Opportunity and Forecast, By By Type , 2016-2032

- 3.3.1. Global AI Camera Market Analysis by By Type : Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type , 2016-2032

- 3.3.3. Surveillance Cameras

- 3.3.4. Smartphone Cameras

- 3.3.5. Digital Cameras

- 3.3.6. Industrial Cameras

- 3.3.7. Others

- 3.4. Global AI Camera Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 3.4.1. Global AI Camera Market Analysis by By Technology: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 3.4.3. Deep learning

- 3.4.4. Natural Language Processing

- 3.4.5. Computer Vision

- 3.4.6. Context-Aware Computing

- 3.5. Global AI Camera Market Analysis, Opportunity and Forecast, By By End-user , 2016-2032

- 3.5.1. Global AI Camera Market Analysis by By End-user : Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user , 2016-2032

- 3.5.3. BFSI

- 3.5.4. Healthcare

- 3.5.5. Automotive

- 3.5.6. Consumer Electronics

- 3.5.7. Retail

- 3.5.8. Government

- 3.5.9. Others

- 3.6. Global AI Camera Market Analysis, Opportunity and Forecast, By By Connectivity, 2016-2032

- 3.6.1. Global AI Camera Market Analysis by By Connectivity: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Connectivity, 2016-2032

- 3.6.3. Wired

- 3.6.4. Wireless

- 3.7. Global AI Camera Market Analysis, Opportunity and Forecast, By By Biometric Method, 2016-2032

- 3.7.1. Global AI Camera Market Analysis by By Biometric Method: Introduction

- 3.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Biometric Method, 2016-2032

- 3.7.3. Image Recognition

- 3.7.4. Facial Recognition

- 3.7.5. Voice/Speech Recognition

- 3.7.6. Optical Character Recognition

- 4. North America AI Camera Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America AI Camera Market Analysis, 2016-2021

- 4.2. North America AI Camera Market Opportunity and Forecast, 2023-2032

- 4.3. North America AI Camera Market Analysis, Opportunity and Forecast, By By Type , 2016-2032

- 4.3.1. North America AI Camera Market Analysis by By Type : Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type , 2016-2032

- 4.3.3. Surveillance Cameras

- 4.3.4. Smartphone Cameras

- 4.3.5. Digital Cameras

- 4.3.6. Industrial Cameras

- 4.3.7. Others

- 4.4. North America AI Camera Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 4.4.1. North America AI Camera Market Analysis by By Technology: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 4.4.3. Deep learning

- 4.4.4. Natural Language Processing

- 4.4.5. Computer Vision

- 4.4.6. Context-Aware Computing

- 4.5. North America AI Camera Market Analysis, Opportunity and Forecast, By By End-user , 2016-2032

- 4.5.1. North America AI Camera Market Analysis by By End-user : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user , 2016-2032

- 4.5.3. BFSI

- 4.5.4. Healthcare

- 4.5.5. Automotive

- 4.5.6. Consumer Electronics

- 4.5.7. Retail

- 4.5.8. Government

- 4.5.9. Others

- 4.6. North America AI Camera Market Analysis, Opportunity and Forecast, By By Connectivity, 2016-2032

- 4.6.1. North America AI Camera Market Analysis by By Connectivity: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Connectivity, 2016-2032

- 4.6.3. Wired

- 4.6.4. Wireless

- 4.7. North America AI Camera Market Analysis, Opportunity and Forecast, By By Biometric Method, 2016-2032

- 4.7.1. North America AI Camera Market Analysis by By Biometric Method: Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Biometric Method, 2016-2032

- 4.7.3. Image Recognition

- 4.7.4. Facial Recognition

- 4.7.5. Voice/Speech Recognition

- 4.7.6. Optical Character Recognition

- 4.8. North America AI Camera Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.8.1. North America AI Camera Market Analysis by Country : Introduction

- 4.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.8.2.1. The US

- 4.8.2.2. Canada

- 4.8.2.3. Mexico

- 5. Western Europe AI Camera Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe AI Camera Market Analysis, 2016-2021

- 5.2. Western Europe AI Camera Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe AI Camera Market Analysis, Opportunity and Forecast, By By Type , 2016-2032

- 5.3.1. Western Europe AI Camera Market Analysis by By Type : Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type , 2016-2032

- 5.3.3. Surveillance Cameras

- 5.3.4. Smartphone Cameras

- 5.3.5. Digital Cameras

- 5.3.6. Industrial Cameras

- 5.3.7. Others

- 5.4. Western Europe AI Camera Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 5.4.1. Western Europe AI Camera Market Analysis by By Technology: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 5.4.3. Deep learning

- 5.4.4. Natural Language Processing

- 5.4.5. Computer Vision

- 5.4.6. Context-Aware Computing

- 5.5. Western Europe AI Camera Market Analysis, Opportunity and Forecast, By By End-user , 2016-2032

- 5.5.1. Western Europe AI Camera Market Analysis by By End-user : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user , 2016-2032

- 5.5.3. BFSI

- 5.5.4. Healthcare

- 5.5.5. Automotive

- 5.5.6. Consumer Electronics

- 5.5.7. Retail

- 5.5.8. Government

- 5.5.9. Others

- 5.6. Western Europe AI Camera Market Analysis, Opportunity and Forecast, By By Connectivity, 2016-2032

- 5.6.1. Western Europe AI Camera Market Analysis by By Connectivity: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Connectivity, 2016-2032

- 5.6.3. Wired

- 5.6.4. Wireless

- 5.7. Western Europe AI Camera Market Analysis, Opportunity and Forecast, By By Biometric Method, 2016-2032

- 5.7.1. Western Europe AI Camera Market Analysis by By Biometric Method: Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Biometric Method, 2016-2032

- 5.7.3. Image Recognition

- 5.7.4. Facial Recognition

- 5.7.5. Voice/Speech Recognition

- 5.7.6. Optical Character Recognition

- 5.8. Western Europe AI Camera Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.8.1. Western Europe AI Camera Market Analysis by Country : Introduction

- 5.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.8.2.1. Germany

- 5.8.2.2. France

- 5.8.2.3. The UK

- 5.8.2.4. Spain

- 5.8.2.5. Italy

- 5.8.2.6. Portugal

- 5.8.2.7. Ireland

- 5.8.2.8. Austria

- 5.8.2.9. Switzerland

- 5.8.2.10. Benelux

- 5.8.2.11. Nordic

- 5.8.2.12. Rest of Western Europe

- 6. Eastern Europe AI Camera Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe AI Camera Market Analysis, 2016-2021

- 6.2. Eastern Europe AI Camera Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe AI Camera Market Analysis, Opportunity and Forecast, By By Type , 2016-2032

- 6.3.1. Eastern Europe AI Camera Market Analysis by By Type : Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type , 2016-2032

- 6.3.3. Surveillance Cameras

- 6.3.4. Smartphone Cameras

- 6.3.5. Digital Cameras

- 6.3.6. Industrial Cameras

- 6.3.7. Others

- 6.4. Eastern Europe AI Camera Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 6.4.1. Eastern Europe AI Camera Market Analysis by By Technology: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 6.4.3. Deep learning

- 6.4.4. Natural Language Processing

- 6.4.5. Computer Vision

- 6.4.6. Context-Aware Computing

- 6.5. Eastern Europe AI Camera Market Analysis, Opportunity and Forecast, By By End-user , 2016-2032

- 6.5.1. Eastern Europe AI Camera Market Analysis by By End-user : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user , 2016-2032

- 6.5.3. BFSI

- 6.5.4. Healthcare

- 6.5.5. Automotive

- 6.5.6. Consumer Electronics

- 6.5.7. Retail

- 6.5.8. Government

- 6.5.9. Others

- 6.6. Eastern Europe AI Camera Market Analysis, Opportunity and Forecast, By By Connectivity, 2016-2032

- 6.6.1. Eastern Europe AI Camera Market Analysis by By Connectivity: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Connectivity, 2016-2032

- 6.6.3. Wired

- 6.6.4. Wireless

- 6.7. Eastern Europe AI Camera Market Analysis, Opportunity and Forecast, By By Biometric Method, 2016-2032

- 6.7.1. Eastern Europe AI Camera Market Analysis by By Biometric Method: Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Biometric Method, 2016-2032

- 6.7.3. Image Recognition

- 6.7.4. Facial Recognition

- 6.7.5. Voice/Speech Recognition

- 6.7.6. Optical Character Recognition

- 6.8. Eastern Europe AI Camera Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.8.1. Eastern Europe AI Camera Market Analysis by Country : Introduction

- 6.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.8.2.1. Russia

- 6.8.2.2. Poland

- 6.8.2.3. The Czech Republic

- 6.8.2.4. Greece

- 6.8.2.5. Rest of Eastern Europe

- 7. APAC AI Camera Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC AI Camera Market Analysis, 2016-2021

- 7.2. APAC AI Camera Market Opportunity and Forecast, 2023-2032

- 7.3. APAC AI Camera Market Analysis, Opportunity and Forecast, By By Type , 2016-2032

- 7.3.1. APAC AI Camera Market Analysis by By Type : Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type , 2016-2032

- 7.3.3. Surveillance Cameras

- 7.3.4. Smartphone Cameras

- 7.3.5. Digital Cameras

- 7.3.6. Industrial Cameras

- 7.3.7. Others

- 7.4. APAC AI Camera Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 7.4.1. APAC AI Camera Market Analysis by By Technology: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 7.4.3. Deep learning

- 7.4.4. Natural Language Processing

- 7.4.5. Computer Vision

- 7.4.6. Context-Aware Computing

- 7.5. APAC AI Camera Market Analysis, Opportunity and Forecast, By By End-user , 2016-2032

- 7.5.1. APAC AI Camera Market Analysis by By End-user : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user , 2016-2032

- 7.5.3. BFSI

- 7.5.4. Healthcare

- 7.5.5. Automotive

- 7.5.6. Consumer Electronics

- 7.5.7. Retail

- 7.5.8. Government

- 7.5.9. Others

- 7.6. APAC AI Camera Market Analysis, Opportunity and Forecast, By By Connectivity, 2016-2032

- 7.6.1. APAC AI Camera Market Analysis by By Connectivity: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Connectivity, 2016-2032

- 7.6.3. Wired

- 7.6.4. Wireless

- 7.7. APAC AI Camera Market Analysis, Opportunity and Forecast, By By Biometric Method, 2016-2032

- 7.7.1. APAC AI Camera Market Analysis by By Biometric Method: Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Biometric Method, 2016-2032

- 7.7.3. Image Recognition

- 7.7.4. Facial Recognition

- 7.7.5. Voice/Speech Recognition

- 7.7.6. Optical Character Recognition

- 7.8. APAC AI Camera Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.8.1. APAC AI Camera Market Analysis by Country : Introduction

- 7.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.8.2.1. China

- 7.8.2.2. Japan

- 7.8.2.3. South Korea

- 7.8.2.4. India

- 7.8.2.5. Australia & New Zeland

- 7.8.2.6. Indonesia

- 7.8.2.7. Malaysia

- 7.8.2.8. Philippines

- 7.8.2.9. Singapore

- 7.8.2.10. Thailand

- 7.8.2.11. Vietnam

- 7.8.2.12. Rest of APAC

- 8. Latin America AI Camera Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America AI Camera Market Analysis, 2016-2021

- 8.2. Latin America AI Camera Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America AI Camera Market Analysis, Opportunity and Forecast, By By Type , 2016-2032

- 8.3.1. Latin America AI Camera Market Analysis by By Type : Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type , 2016-2032

- 8.3.3. Surveillance Cameras

- 8.3.4. Smartphone Cameras

- 8.3.5. Digital Cameras

- 8.3.6. Industrial Cameras

- 8.3.7. Others

- 8.4. Latin America AI Camera Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 8.4.1. Latin America AI Camera Market Analysis by By Technology: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 8.4.3. Deep learning

- 8.4.4. Natural Language Processing

- 8.4.5. Computer Vision

- 8.4.6. Context-Aware Computing

- 8.5. Latin America AI Camera Market Analysis, Opportunity and Forecast, By By End-user , 2016-2032

- 8.5.1. Latin America AI Camera Market Analysis by By End-user : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user , 2016-2032

- 8.5.3. BFSI

- 8.5.4. Healthcare

- 8.5.5. Automotive

- 8.5.6. Consumer Electronics

- 8.5.7. Retail

- 8.5.8. Government

- 8.5.9. Others

- 8.6. Latin America AI Camera Market Analysis, Opportunity and Forecast, By By Connectivity, 2016-2032

- 8.6.1. Latin America AI Camera Market Analysis by By Connectivity: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Connectivity, 2016-2032

- 8.6.3. Wired

- 8.6.4. Wireless

- 8.7. Latin America AI Camera Market Analysis, Opportunity and Forecast, By By Biometric Method, 2016-2032

- 8.7.1. Latin America AI Camera Market Analysis by By Biometric Method: Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Biometric Method, 2016-2032

- 8.7.3. Image Recognition

- 8.7.4. Facial Recognition

- 8.7.5. Voice/Speech Recognition

- 8.7.6. Optical Character Recognition

- 8.8. Latin America AI Camera Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.8.1. Latin America AI Camera Market Analysis by Country : Introduction

- 8.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.8.2.1. Brazil

- 8.8.2.2. Colombia

- 8.8.2.3. Chile

- 8.8.2.4. Argentina

- 8.8.2.5. Costa Rica

- 8.8.2.6. Rest of Latin America

- 9. Middle East & Africa AI Camera Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa AI Camera Market Analysis, 2016-2021

- 9.2. Middle East & Africa AI Camera Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa AI Camera Market Analysis, Opportunity and Forecast, By By Type , 2016-2032

- 9.3.1. Middle East & Africa AI Camera Market Analysis by By Type : Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type , 2016-2032

- 9.3.3. Surveillance Cameras

- 9.3.4. Smartphone Cameras

- 9.3.5. Digital Cameras

- 9.3.6. Industrial Cameras

- 9.3.7. Others

- 9.4. Middle East & Africa AI Camera Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 9.4.1. Middle East & Africa AI Camera Market Analysis by By Technology: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 9.4.3. Deep learning

- 9.4.4. Natural Language Processing

- 9.4.5. Computer Vision

- 9.4.6. Context-Aware Computing

- 9.5. Middle East & Africa AI Camera Market Analysis, Opportunity and Forecast, By By End-user , 2016-2032

- 9.5.1. Middle East & Africa AI Camera Market Analysis by By End-user : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-user , 2016-2032

- 9.5.3. BFSI

- 9.5.4. Healthcare

- 9.5.5. Automotive

- 9.5.6. Consumer Electronics

- 9.5.7. Retail

- 9.5.8. Government

- 9.5.9. Others

- 9.6. Middle East & Africa AI Camera Market Analysis, Opportunity and Forecast, By By Connectivity, 2016-2032

- 9.6.1. Middle East & Africa AI Camera Market Analysis by By Connectivity: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Connectivity, 2016-2032

- 9.6.3. Wired

- 9.6.4. Wireless

- 9.7. Middle East & Africa AI Camera Market Analysis, Opportunity and Forecast, By By Biometric Method, 2016-2032

- 9.7.1. Middle East & Africa AI Camera Market Analysis by By Biometric Method: Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Biometric Method, 2016-2032

- 9.7.3. Image Recognition

- 9.7.4. Facial Recognition

- 9.7.5. Voice/Speech Recognition

- 9.7.6. Optical Character Recognition

- 9.8. Middle East & Africa AI Camera Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.8.1. Middle East & Africa AI Camera Market Analysis by Country : Introduction

- 9.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.8.2.1. Algeria

- 9.8.2.2. Egypt

- 9.8.2.3. Israel

- 9.8.2.4. Kuwait

- 9.8.2.5. Nigeria

- 9.8.2.6. Saudi Arabia

- 9.8.2.7. South Africa

- 9.8.2.8. Turkey

- 9.8.2.9. The UAE

- 9.8.2.10. Rest of MEA

- 10. Global AI Camera Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global AI Camera Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global AI Camera Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Canon Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Bosch Sicherheitssysteme GmbH

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Honeywell International Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Sony Corporation

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Panasonic Holdings Corporation

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Hangzhou Hikvision Digital Technology Co., Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Nikon Corporation

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Johnson Controls

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Samsung Electronics Co.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Axis Communications AB

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. VIVOTEK Inc

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Robert Bosch GmbH

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Other Key Players

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global AI Camera Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 2: Global AI Camera Market Market Attractiveness Analysis by By Type , 2016-2032

- Figure 3: Global AI Camera Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 4: Global AI Camera Market Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 5: Global AI Camera Market Revenue (US$ Mn) Market Share by By End-user in 2022

- Figure 6: Global AI Camera Market Market Attractiveness Analysis by By End-user , 2016-2032

- Figure 7: Global AI Camera Market Revenue (US$ Mn) Market Share by By Connectivityin 2022

- Figure 8: Global AI Camera Market Market Attractiveness Analysis by By Connectivity, 2016-2032

- Figure 9: Global AI Camera Market Revenue (US$ Mn) Market Share by By Biometric Methodin 2022

- Figure 10: Global AI Camera Market Market Attractiveness Analysis by By Biometric Method, 2016-2032

- Figure 11: Global AI Camera Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 12: Global AI Camera Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 13: Global AI Camera Market Market Revenue (US$ Mn) (2016-2032)

- Figure 14: Global AI Camera Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 15: Global AI Camera Market Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 16: Global AI Camera Market Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 17: Global AI Camera Market Market Revenue (US$ Mn) Comparison by By End-user (2016-2032)

- Figure 18: Global AI Camera Market Market Revenue (US$ Mn) Comparison by By Connectivity (2016-2032)

- Figure 19: Global AI Camera Market Market Revenue (US$ Mn) Comparison by By Biometric Method (2016-2032)

- Figure 20: Global AI Camera Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 21: Global AI Camera Market Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 22: Global AI Camera Market Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 23: Global AI Camera Market Market Y-o-Y Growth Rate Comparison by By End-user (2016-2032)

- Figure 24: Global AI Camera Market Market Y-o-Y Growth Rate Comparison by By Connectivity (2016-2032)

- Figure 25: Global AI Camera Market Market Y-o-Y Growth Rate Comparison by By Biometric Method (2016-2032)

- Figure 26: Global AI Camera Market Market Share Comparison by Region (2016-2032)

- Figure 27: Global AI Camera Market Market Share Comparison by By Type (2016-2032)

- Figure 28: Global AI Camera Market Market Share Comparison by By Technology (2016-2032)

- Figure 29: Global AI Camera Market Market Share Comparison by By End-user (2016-2032)

- Figure 30: Global AI Camera Market Market Share Comparison by By Connectivity (2016-2032)

- Figure 31: Global AI Camera Market Market Share Comparison by By Biometric Method (2016-2032)

- Figure 32: North America AI Camera Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 33: North America AI Camera Market Market Attractiveness Analysis by By Type , 2016-2032

- Figure 34: North America AI Camera Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 35: North America AI Camera Market Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 36: North America AI Camera Market Revenue (US$ Mn) Market Share by By End-user in 2022

- Figure 37: North America AI Camera Market Market Attractiveness Analysis by By End-user , 2016-2032

- Figure 38: North America AI Camera Market Revenue (US$ Mn) Market Share by By Connectivityin 2022

- Figure 39: North America AI Camera Market Market Attractiveness Analysis by By Connectivity, 2016-2032

- Figure 40: North America AI Camera Market Revenue (US$ Mn) Market Share by By Biometric Methodin 2022

- Figure 41: North America AI Camera Market Market Attractiveness Analysis by By Biometric Method, 2016-2032

- Figure 42: North America AI Camera Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 43: North America AI Camera Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 44: North America AI Camera Market Market Revenue (US$ Mn) (2016-2032)

- Figure 45: North America AI Camera Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 46: North America AI Camera Market Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 47: North America AI Camera Market Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 48: North America AI Camera Market Market Revenue (US$ Mn) Comparison by By End-user (2016-2032)

- Figure 49: North America AI Camera Market Market Revenue (US$ Mn) Comparison by By Connectivity (2016-2032)

- Figure 50: North America AI Camera Market Market Revenue (US$ Mn) Comparison by By Biometric Method (2016-2032)

- Figure 51: North America AI Camera Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 52: North America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 53: North America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 54: North America AI Camera Market Market Y-o-Y Growth Rate Comparison by By End-user (2016-2032)

- Figure 55: North America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Connectivity (2016-2032)

- Figure 56: North America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Biometric Method (2016-2032)

- Figure 57: North America AI Camera Market Market Share Comparison by Country (2016-2032)

- Figure 58: North America AI Camera Market Market Share Comparison by By Type (2016-2032)

- Figure 59: North America AI Camera Market Market Share Comparison by By Technology (2016-2032)

- Figure 60: North America AI Camera Market Market Share Comparison by By End-user (2016-2032)

- Figure 61: North America AI Camera Market Market Share Comparison by By Connectivity (2016-2032)

- Figure 62: North America AI Camera Market Market Share Comparison by By Biometric Method (2016-2032)

- Figure 63: Western Europe AI Camera Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 64: Western Europe AI Camera Market Market Attractiveness Analysis by By Type , 2016-2032

- Figure 65: Western Europe AI Camera Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 66: Western Europe AI Camera Market Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 67: Western Europe AI Camera Market Revenue (US$ Mn) Market Share by By End-user in 2022

- Figure 68: Western Europe AI Camera Market Market Attractiveness Analysis by By End-user , 2016-2032

- Figure 69: Western Europe AI Camera Market Revenue (US$ Mn) Market Share by By Connectivityin 2022

- Figure 70: Western Europe AI Camera Market Market Attractiveness Analysis by By Connectivity, 2016-2032

- Figure 71: Western Europe AI Camera Market Revenue (US$ Mn) Market Share by By Biometric Methodin 2022

- Figure 72: Western Europe AI Camera Market Market Attractiveness Analysis by By Biometric Method, 2016-2032

- Figure 73: Western Europe AI Camera Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 74: Western Europe AI Camera Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 75: Western Europe AI Camera Market Market Revenue (US$ Mn) (2016-2032)

- Figure 76: Western Europe AI Camera Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 77: Western Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 78: Western Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 79: Western Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By End-user (2016-2032)

- Figure 80: Western Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Connectivity (2016-2032)

- Figure 81: Western Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Biometric Method (2016-2032)

- Figure 82: Western Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 83: Western Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 84: Western Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 85: Western Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By End-user (2016-2032)

- Figure 86: Western Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Connectivity (2016-2032)

- Figure 87: Western Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Biometric Method (2016-2032)

- Figure 88: Western Europe AI Camera Market Market Share Comparison by Country (2016-2032)

- Figure 89: Western Europe AI Camera Market Market Share Comparison by By Type (2016-2032)

- Figure 90: Western Europe AI Camera Market Market Share Comparison by By Technology (2016-2032)

- Figure 91: Western Europe AI Camera Market Market Share Comparison by By End-user (2016-2032)

- Figure 92: Western Europe AI Camera Market Market Share Comparison by By Connectivity (2016-2032)

- Figure 93: Western Europe AI Camera Market Market Share Comparison by By Biometric Method (2016-2032)

- Figure 94: Eastern Europe AI Camera Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 95: Eastern Europe AI Camera Market Market Attractiveness Analysis by By Type , 2016-2032

- Figure 96: Eastern Europe AI Camera Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 97: Eastern Europe AI Camera Market Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 98: Eastern Europe AI Camera Market Revenue (US$ Mn) Market Share by By End-user in 2022

- Figure 99: Eastern Europe AI Camera Market Market Attractiveness Analysis by By End-user , 2016-2032

- Figure 100: Eastern Europe AI Camera Market Revenue (US$ Mn) Market Share by By Connectivityin 2022

- Figure 101: Eastern Europe AI Camera Market Market Attractiveness Analysis by By Connectivity, 2016-2032

- Figure 102: Eastern Europe AI Camera Market Revenue (US$ Mn) Market Share by By Biometric Methodin 2022

- Figure 103: Eastern Europe AI Camera Market Market Attractiveness Analysis by By Biometric Method, 2016-2032

- Figure 104: Eastern Europe AI Camera Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 105: Eastern Europe AI Camera Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 106: Eastern Europe AI Camera Market Market Revenue (US$ Mn) (2016-2032)

- Figure 107: Eastern Europe AI Camera Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 108: Eastern Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 109: Eastern Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 110: Eastern Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By End-user (2016-2032)

- Figure 111: Eastern Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Connectivity (2016-2032)

- Figure 112: Eastern Europe AI Camera Market Market Revenue (US$ Mn) Comparison by By Biometric Method (2016-2032)

- Figure 113: Eastern Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 114: Eastern Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 115: Eastern Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 116: Eastern Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By End-user (2016-2032)

- Figure 117: Eastern Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Connectivity (2016-2032)

- Figure 118: Eastern Europe AI Camera Market Market Y-o-Y Growth Rate Comparison by By Biometric Method (2016-2032)

- Figure 119: Eastern Europe AI Camera Market Market Share Comparison by Country (2016-2032)

- Figure 120: Eastern Europe AI Camera Market Market Share Comparison by By Type (2016-2032)

- Figure 121: Eastern Europe AI Camera Market Market Share Comparison by By Technology (2016-2032)

- Figure 122: Eastern Europe AI Camera Market Market Share Comparison by By End-user (2016-2032)

- Figure 123: Eastern Europe AI Camera Market Market Share Comparison by By Connectivity (2016-2032)

- Figure 124: Eastern Europe AI Camera Market Market Share Comparison by By Biometric Method (2016-2032)

- Figure 125: APAC AI Camera Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 126: APAC AI Camera Market Market Attractiveness Analysis by By Type , 2016-2032

- Figure 127: APAC AI Camera Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 128: APAC AI Camera Market Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 129: APAC AI Camera Market Revenue (US$ Mn) Market Share by By End-user in 2022

- Figure 130: APAC AI Camera Market Market Attractiveness Analysis by By End-user , 2016-2032

- Figure 131: APAC AI Camera Market Revenue (US$ Mn) Market Share by By Connectivityin 2022

- Figure 132: APAC AI Camera Market Market Attractiveness Analysis by By Connectivity, 2016-2032

- Figure 133: APAC AI Camera Market Revenue (US$ Mn) Market Share by By Biometric Methodin 2022

- Figure 134: APAC AI Camera Market Market Attractiveness Analysis by By Biometric Method, 2016-2032

- Figure 135: APAC AI Camera Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 136: APAC AI Camera Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 137: APAC AI Camera Market Market Revenue (US$ Mn) (2016-2032)

- Figure 138: APAC AI Camera Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 139: APAC AI Camera Market Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 140: APAC AI Camera Market Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 141: APAC AI Camera Market Market Revenue (US$ Mn) Comparison by By End-user (2016-2032)

- Figure 142: APAC AI Camera Market Market Revenue (US$ Mn) Comparison by By Connectivity (2016-2032)

- Figure 143: APAC AI Camera Market Market Revenue (US$ Mn) Comparison by By Biometric Method (2016-2032)

- Figure 144: APAC AI Camera Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 145: APAC AI Camera Market Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 146: APAC AI Camera Market Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 147: APAC AI Camera Market Market Y-o-Y Growth Rate Comparison by By End-user (2016-2032)

- Figure 148: APAC AI Camera Market Market Y-o-Y Growth Rate Comparison by By Connectivity (2016-2032)

- Figure 149: APAC AI Camera Market Market Y-o-Y Growth Rate Comparison by By Biometric Method (2016-2032)

- Figure 150: APAC AI Camera Market Market Share Comparison by Country (2016-2032)

- Figure 151: APAC AI Camera Market Market Share Comparison by By Type (2016-2032)

- Figure 152: APAC AI Camera Market Market Share Comparison by By Technology (2016-2032)

- Figure 153: APAC AI Camera Market Market Share Comparison by By End-user (2016-2032)

- Figure 154: APAC AI Camera Market Market Share Comparison by By Connectivity (2016-2032)

- Figure 155: APAC AI Camera Market Market Share Comparison by By Biometric Method (2016-2032)

- Figure 156: Latin America AI Camera Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 157: Latin America AI Camera Market Market Attractiveness Analysis by By Type , 2016-2032

- Figure 158: Latin America AI Camera Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 159: Latin America AI Camera Market Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 160: Latin America AI Camera Market Revenue (US$ Mn) Market Share by By End-user in 2022

- Figure 161: Latin America AI Camera Market Market Attractiveness Analysis by By End-user , 2016-2032

- Figure 162: Latin America AI Camera Market Revenue (US$ Mn) Market Share by By Connectivityin 2022

- Figure 163: Latin America AI Camera Market Market Attractiveness Analysis by By Connectivity, 2016-2032

- Figure 164: Latin America AI Camera Market Revenue (US$ Mn) Market Share by By Biometric Methodin 2022

- Figure 165: Latin America AI Camera Market Market Attractiveness Analysis by By Biometric Method, 2016-2032

- Figure 166: Latin America AI Camera Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 167: Latin America AI Camera Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 168: Latin America AI Camera Market Market Revenue (US$ Mn) (2016-2032)

- Figure 169: Latin America AI Camera Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 170: Latin America AI Camera Market Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 171: Latin America AI Camera Market Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 172: Latin America AI Camera Market Market Revenue (US$ Mn) Comparison by By End-user (2016-2032)

- Figure 173: Latin America AI Camera Market Market Revenue (US$ Mn) Comparison by By Connectivity (2016-2032)

- Figure 174: Latin America AI Camera Market Market Revenue (US$ Mn) Comparison by By Biometric Method (2016-2032)

- Figure 175: Latin America AI Camera Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 176: Latin America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 177: Latin America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 178: Latin America AI Camera Market Market Y-o-Y Growth Rate Comparison by By End-user (2016-2032)

- Figure 179: Latin America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Connectivity (2016-2032)

- Figure 180: Latin America AI Camera Market Market Y-o-Y Growth Rate Comparison by By Biometric Method (2016-2032)

- Figure 181: Latin America AI Camera Market Market Share Comparison by Country (2016-2032)

- Figure 182: Latin America AI Camera Market Market Share Comparison by By Type (2016-2032)

- Figure 183: Latin America AI Camera Market Market Share Comparison by By Technology (2016-2032)

- Figure 184: Latin America AI Camera Market Market Share Comparison by By End-user (2016-2032)

- Figure 185: Latin America AI Camera Market Market Share Comparison by By Connectivity (2016-2032)

- Figure 186: Latin America AI Camera Market Market Share Comparison by By Biometric Method (2016-2032)

- Figure 187: Middle East & Africa AI Camera Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 188: Middle East & Africa AI Camera Market Market Attractiveness Analysis by By Type , 2016-2032

- Figure 189: Middle East & Africa AI Camera Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 190: Middle East & Africa AI Camera Market Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 191: Middle East & Africa AI Camera Market Revenue (US$ Mn) Market Share by By End-user in 2022

- Figure 192: Middle East & Africa AI Camera Market Market Attractiveness Analysis by By End-user , 2016-2032

- Figure 193: Middle East & Africa AI Camera Market Revenue (US$ Mn) Market Share by By Connectivityin 2022

- Figure 194: Middle East & Africa AI Camera Market Market Attractiveness Analysis by By Connectivity, 2016-2032

- Figure 195: Middle East & Africa AI Camera Market Revenue (US$ Mn) Market Share by By Biometric Methodin 2022